Enlarge image

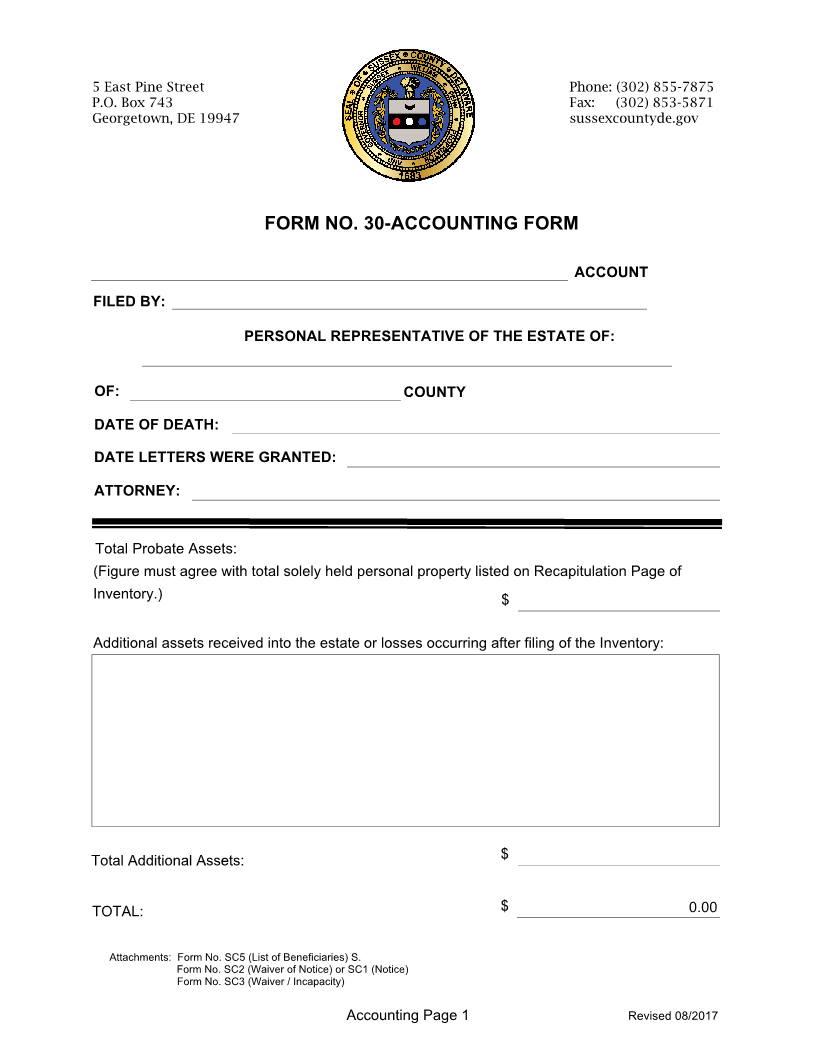

5 East Pine Street Phone: (302) 855-7875

P.O. Box 743 Fax: (302) 853-5871

Georgetown, DE 19947 sussexcountyde.gov

Register of Wills

PROBATE PACK INSTRUCTIONS

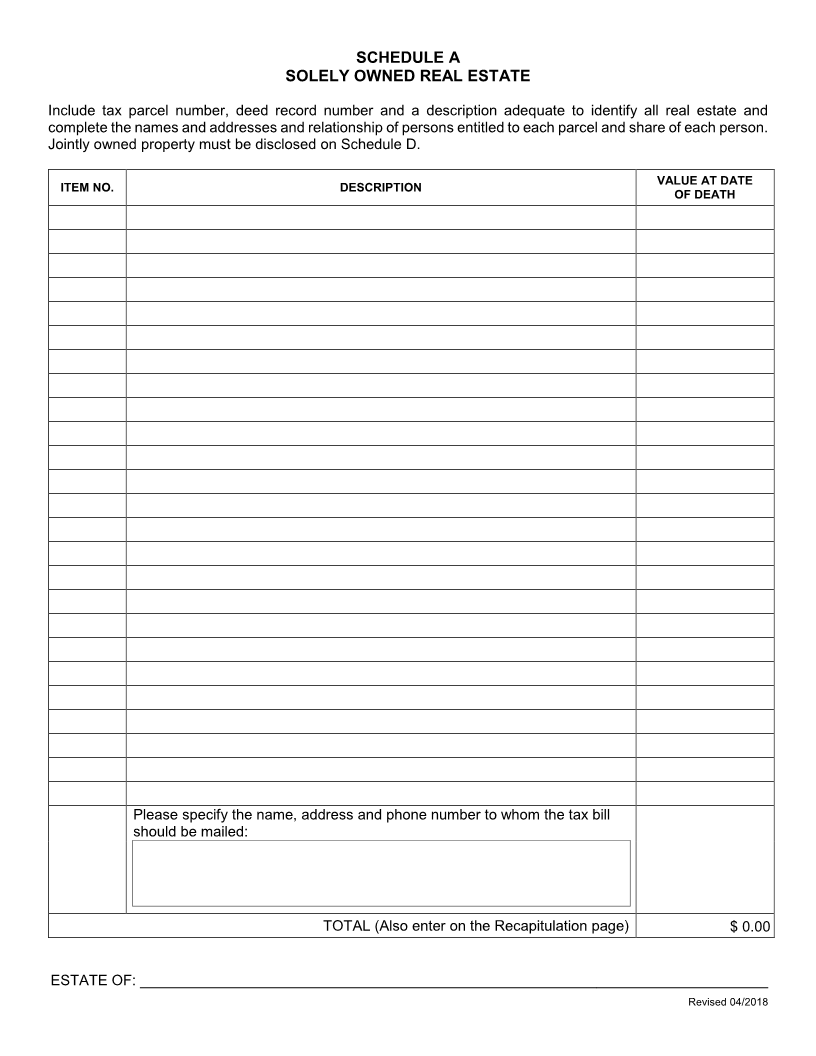

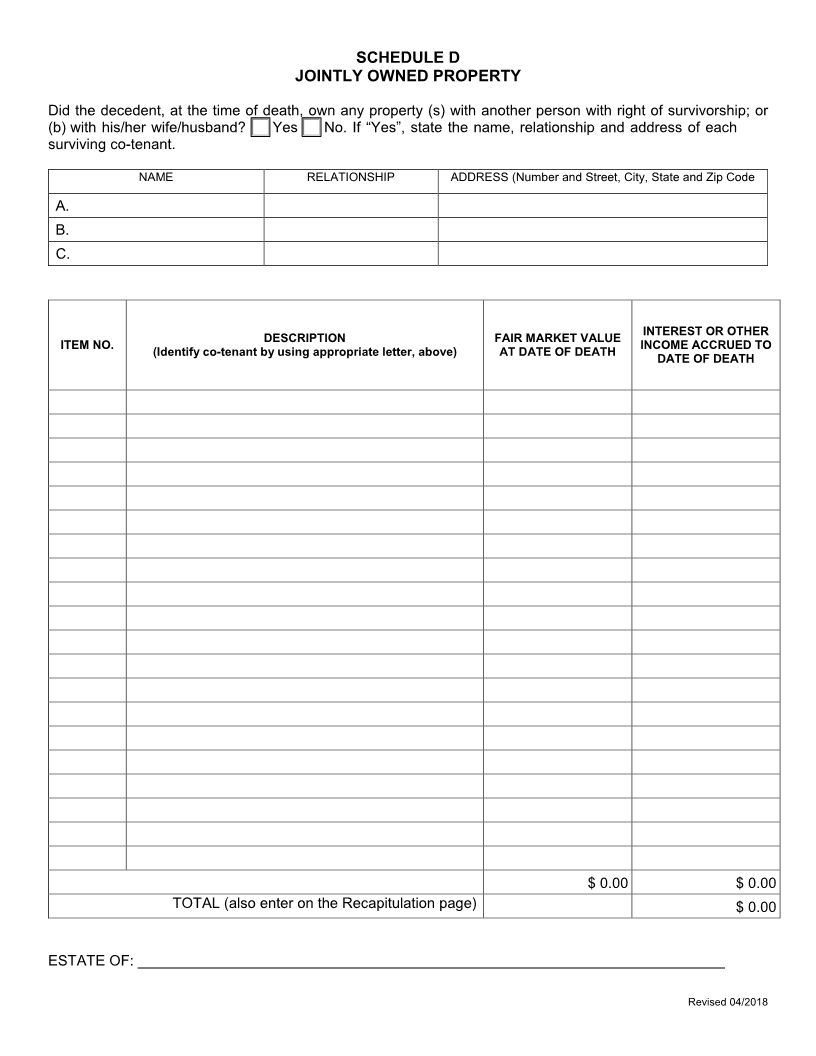

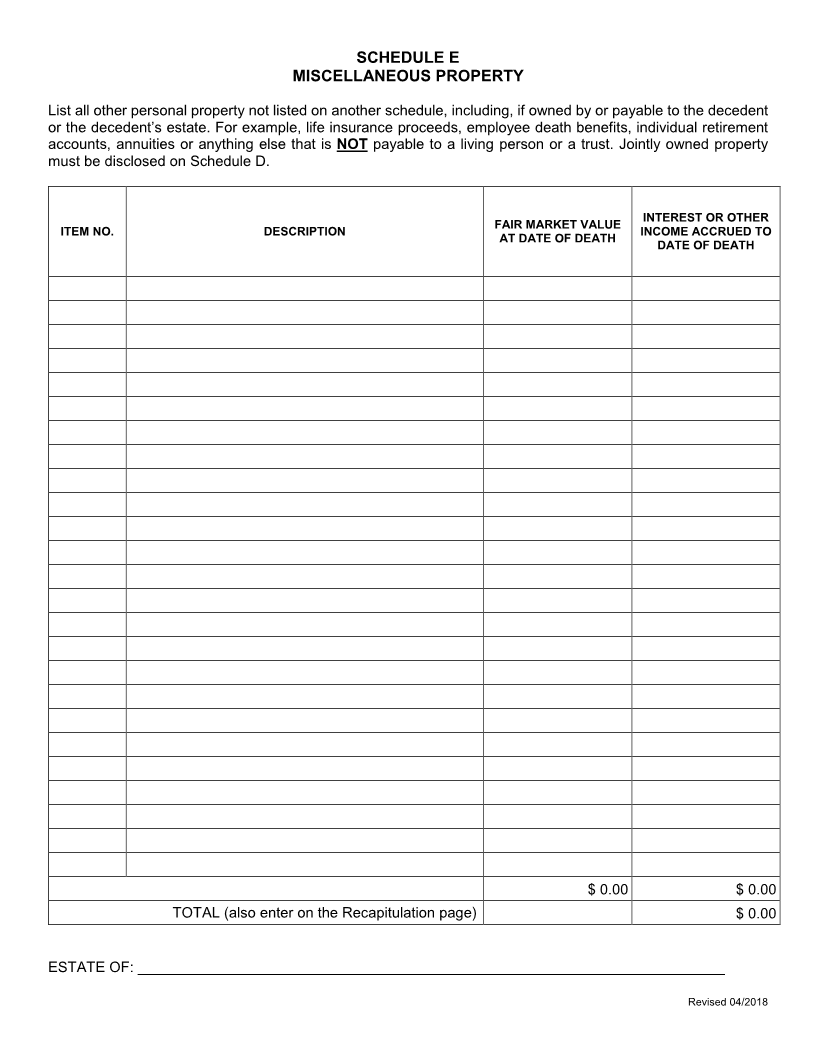

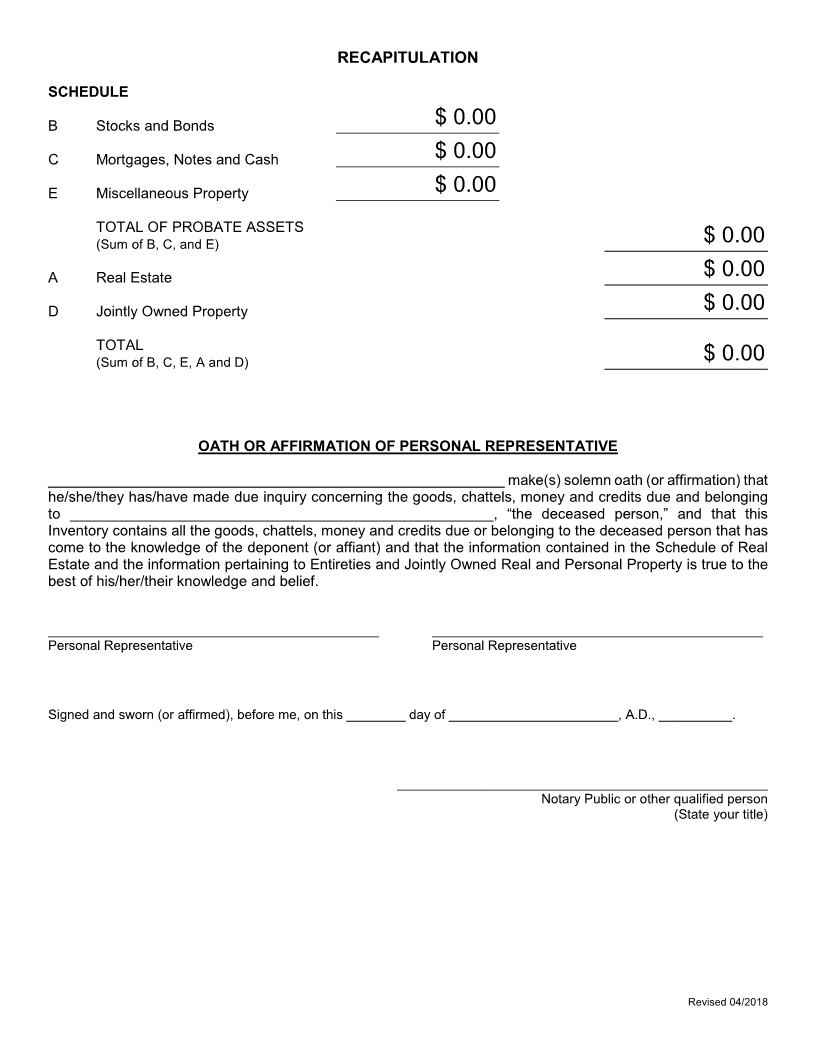

1. File Inventory (Form 600 RW ) with the Register of Wills within three (3) months from the

date letters were granted. Any pages added will cost $1.00 per page to file.

§ 1905. Inventory and appraisal; filing requirements, form, contents and

supporting affidavits; notice of action affecting title.

(a) Every executor or administrator shall, within 3 months after the granting of letters

testamentary or of administration, file in the office of the Register of Wills of the county

in which the letters have been granted, an nventoryI and appraisal.

§1 06.9Failure to file inventory; civil and criminal penalties.

(b)Any executor or administrator who fails to file the nventory,I list and statement with

the Register of Wills within 3 months after the granting of letters

testamentary or of administration shall be subject, personally and individually, to

a penalty of $1 per day for each day delinquent. This penalty shall not apply until 1

monthafter notice by the Register of Wills of such delinquency.

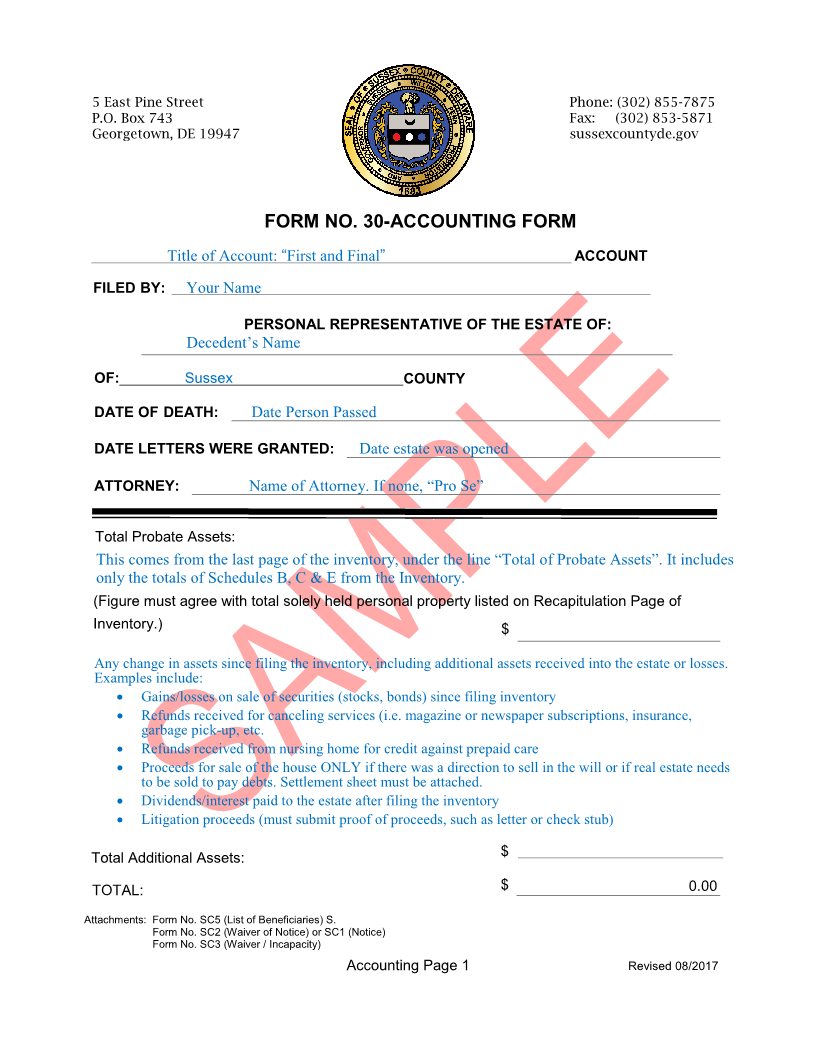

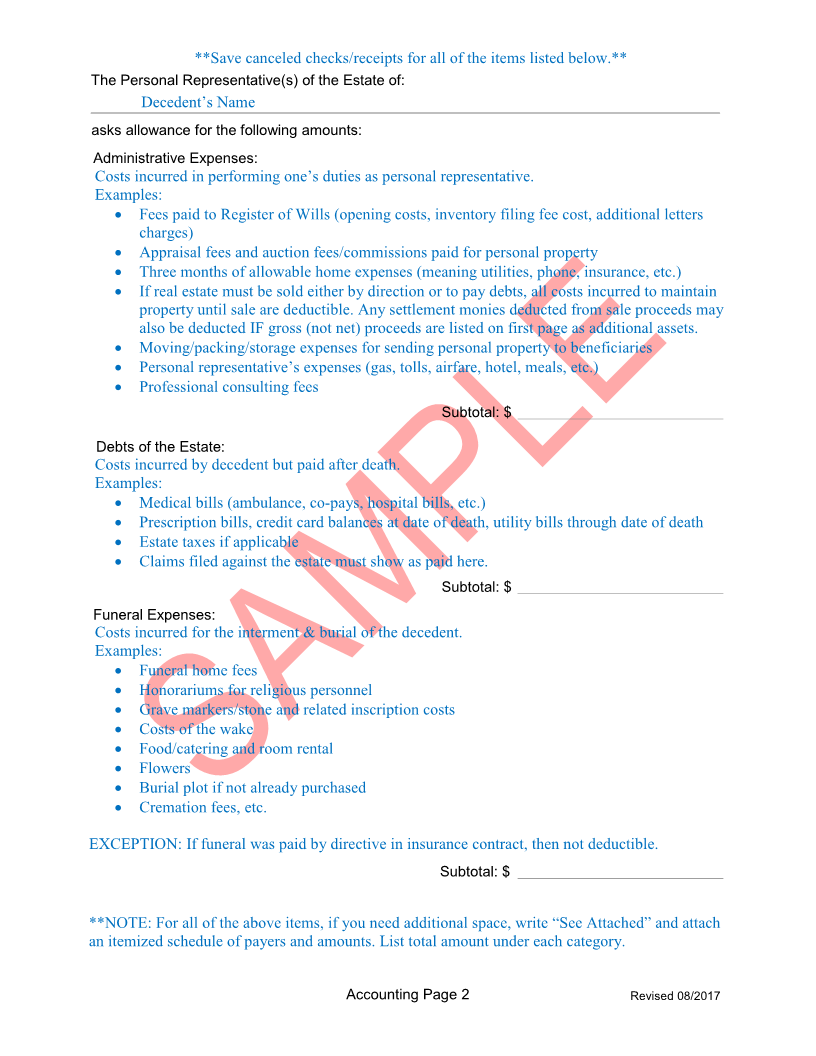

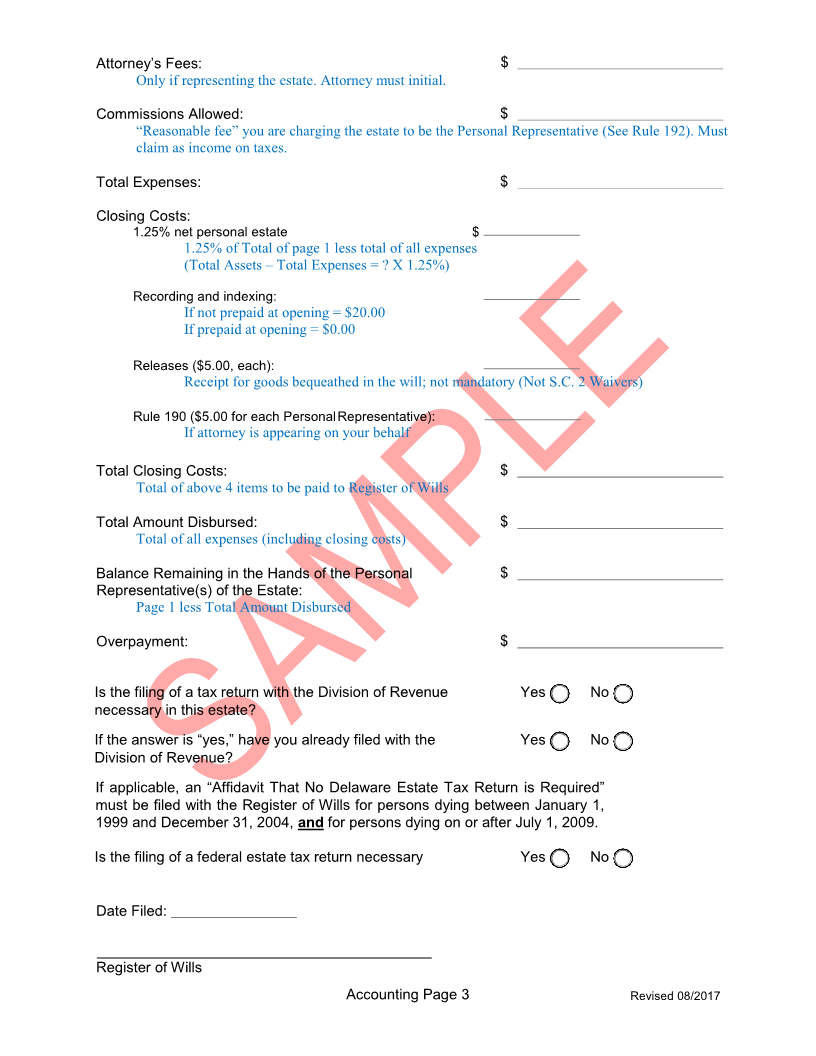

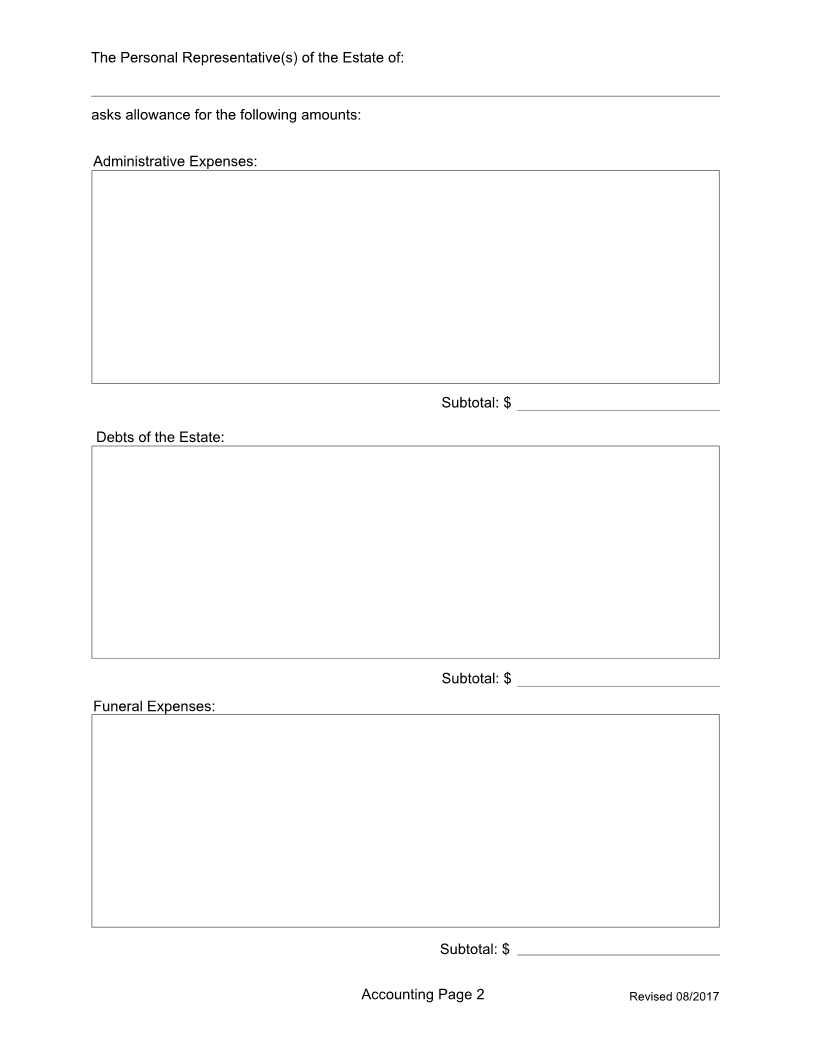

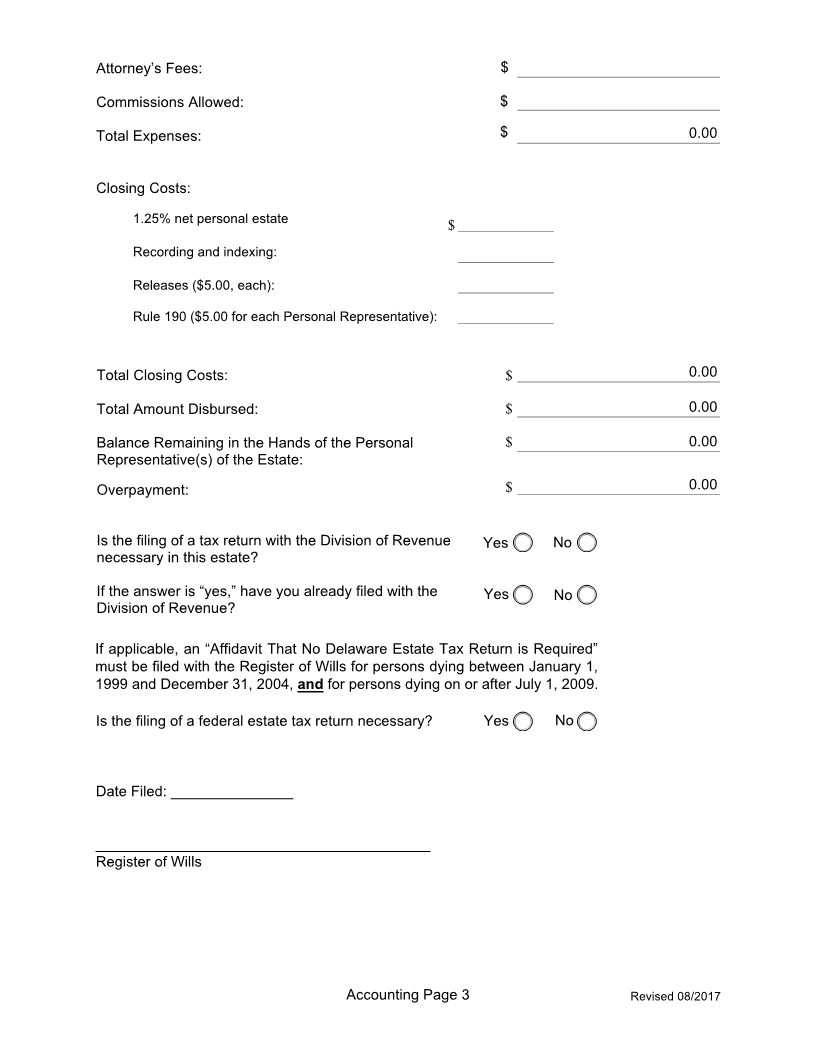

2. File First & Final Account with the Register of Wills within one (1) year from the date letters

were granted along with a eneficiary B istLand aivers W oticesorstamped,N (addressed

envelopes are required with all Notices). Verification of all payments listed on the

Account,being paid in full is, required with the ccount.A (Accounting forms are due every

year until a Final Account isfiled) .

THE ACCOUNT MAY NOT BE FILED BEFORE 8 MONTHS FROM THE DATE OF DEATH.

NOTE: #1 may be mailed or hand-delivered to the Register of Wills office. No appointment

is necessary.

NOTE: TO FILE #2, THIS OFFICE REQUIRES AN APPOINTMENT. Please call the phone

number above to schedule your appointment.

NOTE: #1 and #2 MUST be filed within the deadlines mentioned above. If additional time is

needed, please submit a written request for an extension.

NOTE: The Register of Wills has supplied one copy of the above-mentioned forms and

suggests that you make an additional copy to use as a scratch form.

Revised 4/2018