Enlarge image

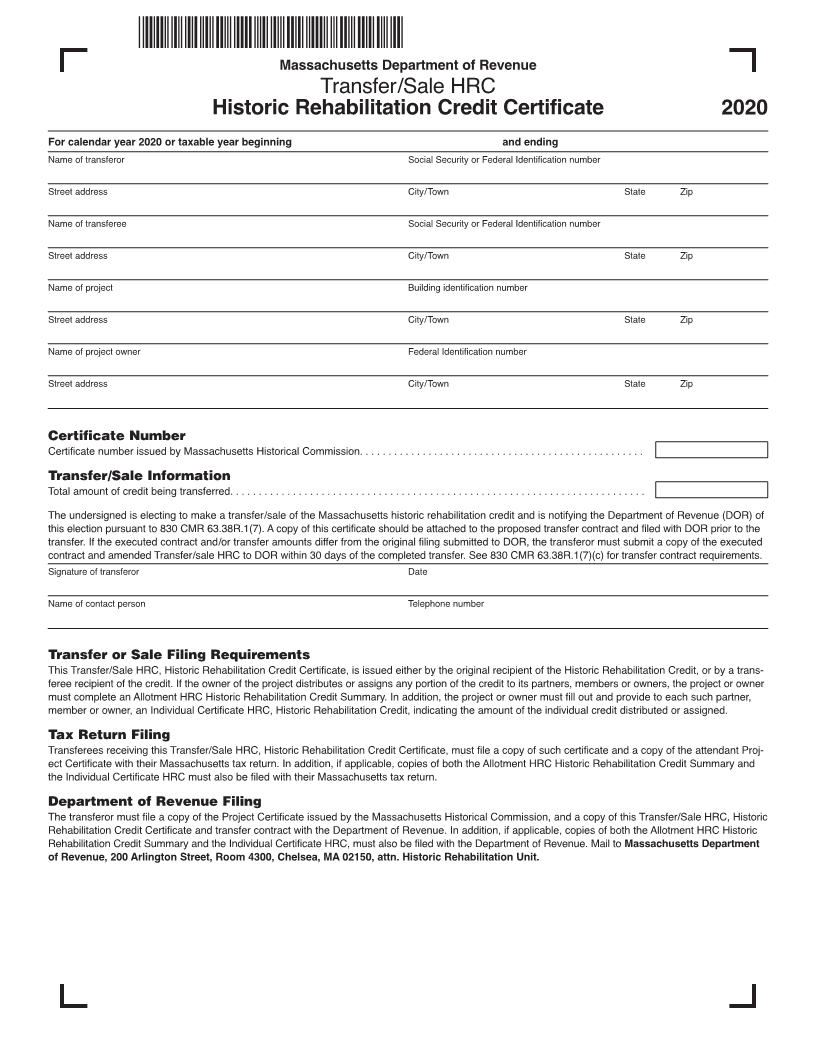

Massachusetts Department of Revenue

Transfer/Sale HRC

Historic Rehabilitation Credit Certificate 2020

For calendar year 2020 or taxable year beginning and ending

Name of transferor Social Security or Federal Identification number

Street address City/Town State Zip

Name of transferee Social Security or Federal Identification number

Street address City/Town State Zip

Name of project Building identification number

Street address City/Town State Zip

Name of project owner Federal Identification number

Street address City/Town State Zip

Certificate Number

Certificate number issued by Massachusetts Historical Commission. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Transfer/Sale Information

Total amount of credit being transferred. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The undersigned is electing to make a transfer/sale of the Massachusetts historic rehabilitation credit and is notifying the Department of Revenue (DOR) of

this election pursuant to 830 CMR 63.38R.1(7). A copy of this certificate should be attached to the proposed transfer contract and filed with DOR prior to the

transfer. If the executed contract and/or transfer amounts differ from the original filing submitted to DOR, the transferor must submit a copy of the executed

contract and amended Transfer/sale HRC to DOR within 30 days of the completed transfer. See 830 CMR 63.38R.1(7)(c) for transfer contract requirements.

Signature of transferor Date

Name of contact person Telephone number

Transfer or Sale Filing Requirements

This Transfer/Sale HRC, Historic Rehabilitation Credit Certificate, is issued either by the original recipient of the Historic Rehabilitation Credit, or by a trans-

feree recipient of the credit. If the owner of the project distributes or assigns any portion of the credit to its partners, members or owners, the project or owner

must complete an Allotment HRC Historic Rehabilitation Credit Summary. In addition, the project or owner must fill out and provide to each such partner,

member or owner, an Individual Certificate HRC, Historic Rehabilitation Credit, indicating the amount of the individual credit distributed or assigned.

Tax Return Filing

Transferees receiving this Transfer/Sale HRC, Historic Rehabilitation Credit Certificate, must file a copy of such certificate and a copy of the attendant Proj -

ect Certificate with their Massachusetts tax return. In addition, if applicable, copies of both the Allotment HRC Historic Rehabilitation Credit Summary and

the Individual Certificate HRC must also be filed with their Massachusetts tax return.

Department of Revenue Filing

The transferor must file a copy of the Project Certificate issued by the Massachusetts Historical Commission, and a copy of this Transfer/Sale HRC, Historic

Rehabilitation Credit Certificate and transfer contract with the Department of Revenue. In addition, if applicable, copies of both the Allotment HRC Historic

Rehabilitation Credit Summary and the Individual Certificate HRC, must also be filed with the Department of Revenue. Mail to Massachusetts Department

of Revenue, 200 Arlington Street, Room 4300, Chelsea, MA 02150, attn. Historic Rehabilitation Unit.