Enlarge image

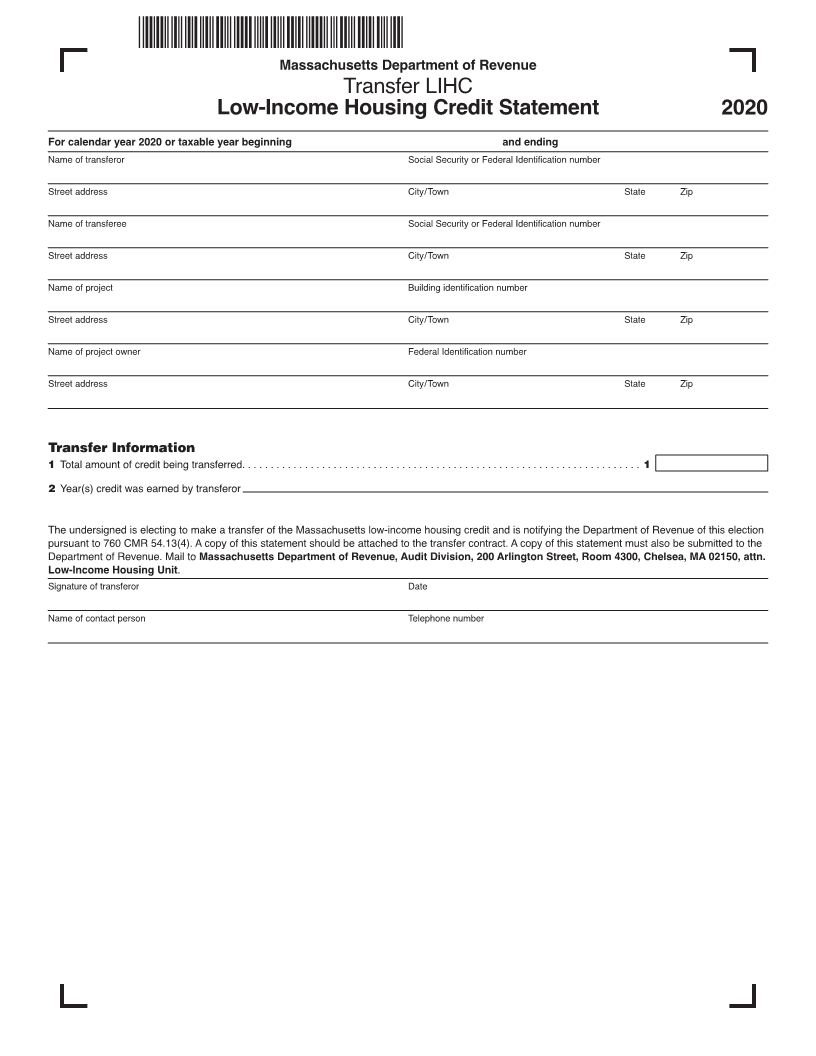

Massachusetts Department of Revenue

Transfer LIHC

Low-Income Housing Credit Statement 2020

For calendar year 2020 or taxable year beginning and ending

Name of transferor Social Security or Federal Identification number

Street address City/Town State Zip

Name of transferee Social Security or Federal Identification number

Street address City/Town State Zip

Name of project Building identification number

Street address City/Town State Zip

Name of project owner Federal Identification number

Street address City/Town State Zip

Transfer Information

1 Total amount of credit being transferred. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Year(s) credit was earned by transferor

The undersigned is electing to make a transfer of the Massachusetts low-income housing credit and is notifying the Department of Revenue of this election

pursuant to 760 CMR 54.13(4). A copy of this statement should be attached to the transfer contract. A copy of this statement must also be submitted to the

Department of Revenue. Mail to Massachusetts Department of Revenue, Audit Division, 200 Arlington Street, Room 4300, Chelsea, MA 02150, attn.

Low-Income Housing Unit.

Signature of transferor Date

Name of contact person Telephone number