Enlarge image

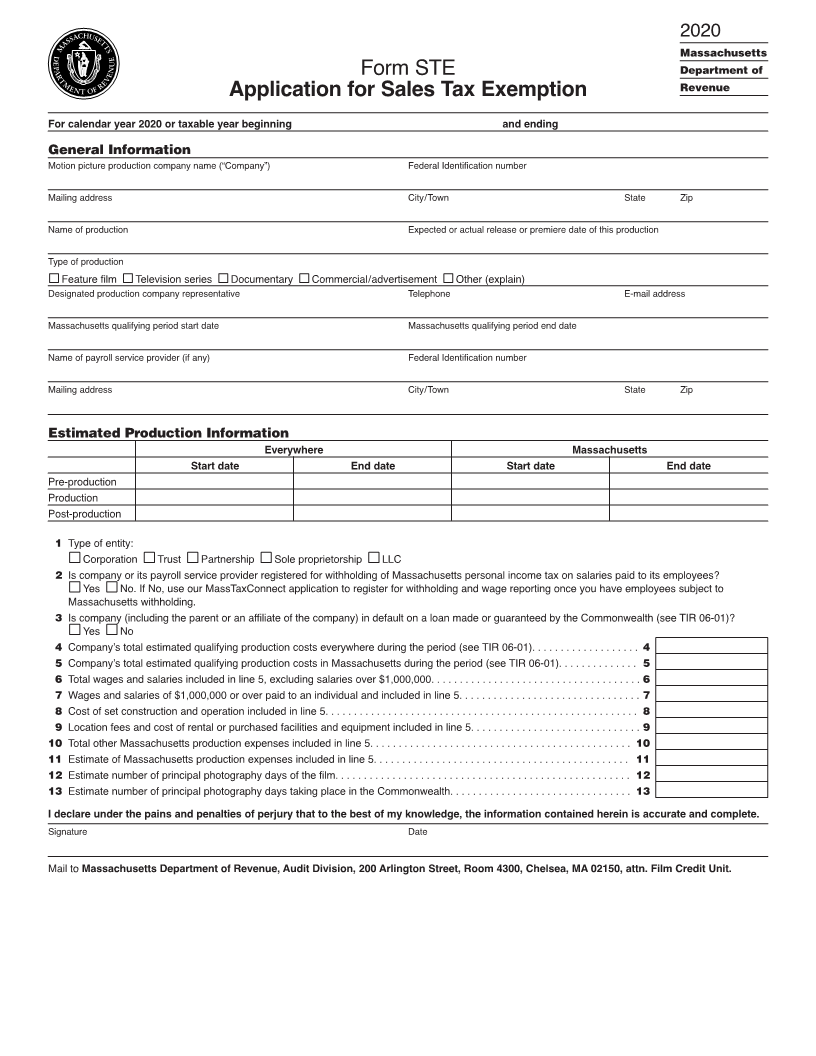

2020

Massachusetts

Form STE Department of

Revenue

Application for Sales Tax Exemption

For calendar year 2020 or taxable year beginning and ending

General Information

Motion picture production company name (“Company”) Federal Identification number

Mailing address City/Town State Zip

Name of production Expected or actual release or premiere date of this production

Type of production

Feature film Television series Documentary Commercial/advertisement Other (explain)

Designated production company representative Telephone E-mail address

Massachusetts qualifying period start date Massachusetts qualifying period end date

Name of payroll service provider (if any) Federal Identification number

Mailing address City/Town State Zip

Estimated Production Information

Everywhere Massachusetts

Start date End date Start date End date

Pre-production

Production

Post-production

01 Type of entity:

Corporation Trust Partnership Sole proprietorship LLC

02 Is company or its payroll service provider registered for withholding of Massachusetts personal income tax on salaries paid to its employees?

Yes No. If No, use our MassTaxConnect application to register for withholding and wage reporting once you have employees subject to

Massachusetts withholding.

03 Is company (including the parent or an affiliate of the company) in default on a loan made or guaranteed by the Commonwealth (see TIR 06-01)?

Yes No

04 Company’s total estimated qualifying production costs everywhere during the period (see TIR 06-01). . . . . . . . . . . . . . . . . . . 4

05 Company’s total estimated qualifying production costs in Massachusetts during the period (see TIR 06-01). . . . . . . . . . . . . . 5

06 Total wages and salaries included in line 5, excluding salaries over $1,000,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

07 Wages and salaries of $1,000,000 or over paid to an individual and included in line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

08 Cost of set construction and operation included in line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

09 Location fees and cost of rental or purchased facilities and equipment included in line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total other Massachusetts production expenses included in line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Estimate of Massachusetts production expenses included in line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Estimate number of principal photography days of the film. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Estimate number of principal photography days taking place in the Commonwealth. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

I declare under the pains and penalties of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature Date

Mail to Massachusetts Department of Revenue, Audit Division, 200 Arlington Street, Room 4300, Chelsea, MA 02150, attn. Film Credit Unit.