Enlarge image

2020

Schedule U-E Massachusetts

Massachusetts Unitary or Department of

Revenue

Affiliated Group Income

For calendar year 2020 or taxable period beginning 2020 and ending

Name of principal reporting corporation Federal Identification number

PBA code Unitary business identifier

Type of group (check one only): Financial Non-financial Mixed

Check if any of unitary or affiliated group income is taxable in another state

Financial institution groups and mixed groups only, check the method used by the group to allocate income from investment assets and trading assets to

Massachusetts Average value Gross income

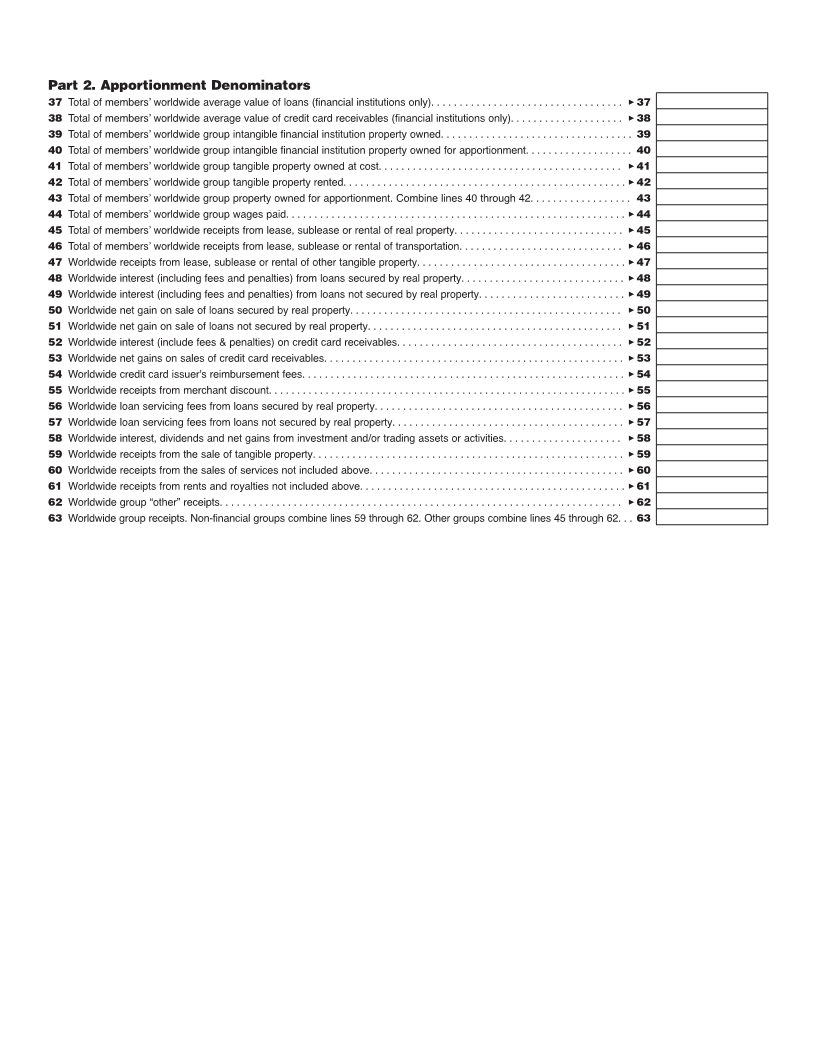

Part 1. Taxable Income

1 Net sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Cost of goods sold. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Gross profit. Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Gross rents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

7 Gross royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

8 Capital gains net income or loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

9 Net gain or (loss) from Form 4797. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Other income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Income. Combine lines 3 through 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Total deductions for this business group. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Total net income for the combined report before Massachusetts adjustments. Subtract line 12 from line 11. . . . . . . . . . . . . . 13

14 State and municipal bond interest not included in U.S. net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Foreign, state or local income taxes deducted from U.S. net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Section 168(k) "bonus" depreciation adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Sections 31I and 31K intangible expense add back adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Sections 31J and 31K interest expense add back adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Reserved for future use. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Research expense adjustment related to Massachusetts Research and Development Credit. . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Subtotal of Massachusetts income before additional deductions. Combine lines 13 through 20. . . . . . . . . . . . . . . . . . . . . . . 21

22 Reserved. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Abandoned building renovation deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 23

24 Reserved. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

25 95% deduction for certain other dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 25

26 Exceptions to the add back of intangible expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

27 Exceptions to the add back of interest expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 27

28 Adjustment for federally disallowed U.S. wage deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

29 Other adjustments to income or expenses (enter decreases to allowable deductions as a negative). . . . . . . . . . . . . . . . . . 3 29

30 Total Massachusetts income for the combined report. Subtract the total of lines 22 through 29 from line 21. . . . . . . . . . . . . 30

31 Net capital gain or (loss) included in line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 31

32 Net section 1231 gain or (loss) included in line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 32

33 Subtract the total of lines 31 and 32 from line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

34 Excess combined group capital loss. If line 31 is “0” or greater, enter “0” (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . 3 34

35 Combined taxable net income excluding excess capital loss. Add lines 30 and 34. Do not enter less than “0”. . . . . . . . . . 3 35

36 Enter 10% of one-third of line 35. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36