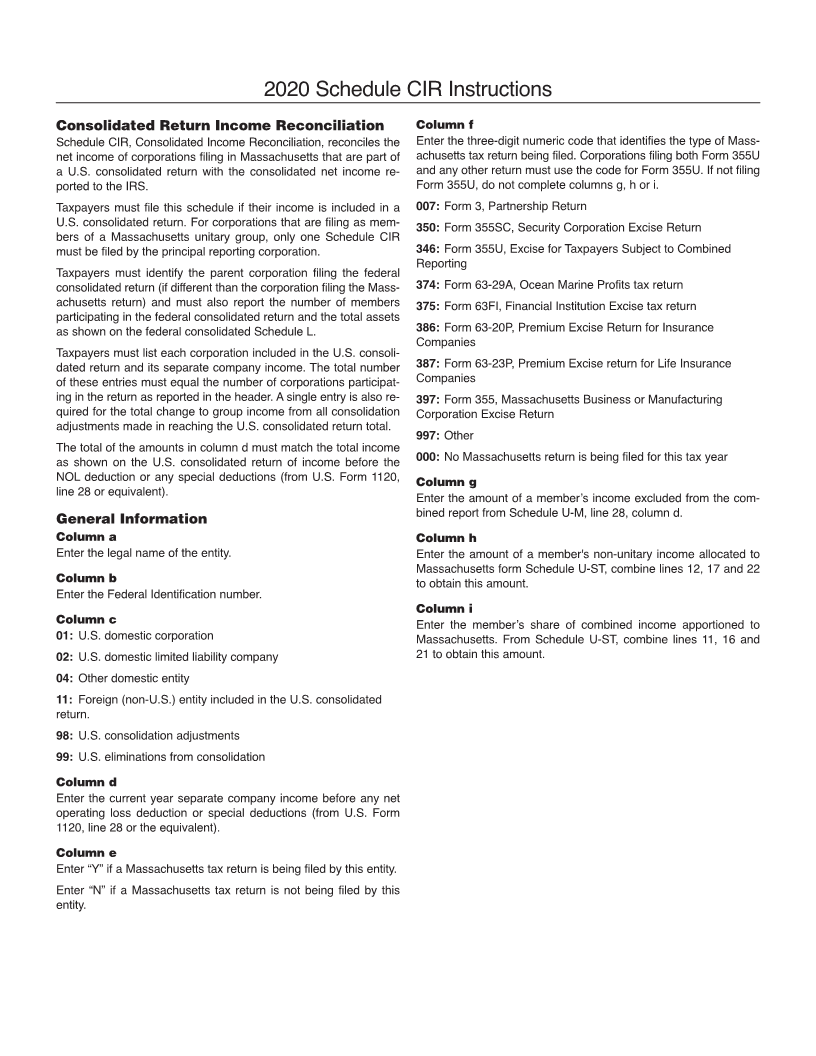

Enlarge image

2020 Schedule CIR Instructions

Consolidated Return Income Reconciliation Column f

Schedule CIR, Consolidated Income Reconciliation, reconciles the Enter the three-digit numeric code that identifies the type of Mass-

net income of corporations filing in Massachusetts that are part of achusetts tax return being filed. Corporations filing both Form 355U

a U.S. consolidated return with the consolidated net income re- and any other return must use the code for Form 355U. If not filing

ported to the IRS. Form 355U, do not complete columns g, h or i.

Taxpayers must file this schedule if their income is included in a 007: Form 3, Partnership Return

U.S. consolidated return. For corporations that are filing as mem- Form 355SC, Security Corporation Excise Return

350:

bers of a Massachusetts unitary group, only one Schedule CIR

must be filed by the principal reporting corporation. 346: Form 355U, Excise for Taxpayers Subject to Combined

Reporting

Taxpayers must identify the parent corporation filing the federal

consolidated return (if different than the corporation filing the Mass- 374: Form 63-29A, Ocean Marine Profits tax return

achusetts return) and must also report the number of members 375: Form 63FI, Financial Institution Excise tax return

participating in the federal consolidated return and the total assets

as shown on the federal consolidated Schedule L. 386: Form 63-20P, Premium Excise Return for Insurance

Companies

Taxpayers must list each corporation included in the U.S. consoli-

dated return and its separate company income. The total number 387: Form 63-23P, Premium Excise return for Life Insurance

of these entries must equal the number of corporations participat- Companies

ing in the return as reported in the header. A single entry is also re- 397: Form 355, Massachusetts Business or Manufacturing

quired for the total change to group income from all consolidation Corporation Excise Return

adjustments made in reaching the U.S. consolidated return total.

997: Other

The total of the amounts in column d must match the total income

as shown on the U.S. consolidated return of income before the 000: No Massachusetts return is being filed for this tax year

NOL deduction or any special deductions (from U.S. Form 1120, Column g

line 28 or equivalent). Enter the amount of a member’s income excluded from the com-

General Information bined report from Schedule U-M, line 28, column d.

Column a Column h

Enter the legal name of the entity. Enter the amount of a member's non-unitary income allocated to

Massachusetts form Schedule U-ST, combine lines 12, 17 and 22

Column b to obtain this amount.

Enter the Federal Identification number.

Column i

Column c Enter the member’s share of combined income apportioned to

01: U.S. domestic corporation Massachusetts. From Schedule U-ST, combine lines 11, 16 and

02: U.S. domestic limited liability company 21 to obtain this amount.

04: Other domestic entity

11: Foreign (non-U.S.) entity included in the U.S. consolidated

return.

98: U.S. consolidation adjustments

99: U.S. eliminations from consolidation

Column d

Enter the current year separate company income before any net

operating loss deduction or special deductions (from U.S. Form

1120, line 28 or the equivalent).

Column e

Enter “Y” if a Massachusetts tax return is being filed by this entity.

Enter “N” if a Massachusetts tax return is not being filed by this

entity.