Enlarge image

2020 Schedule CG Instructions

Combined Reporting Allocation Schedule Part 4. Additional Payments Made Separately

Schedule CG must be completed and submitted with each com- by Individual Members

bined report (Form 355U). It records all payments made by all A member is required to submit a Part 4 record only if payments

members of the group towards either the income measure of ex- were made by the individual member that are not listed in Part 3.

cise under MGL ch 63 or any non-income measure of excise which It is possible for Schedule CG to contain no Part 4 records.

may be due from individual group members with the same taxable

For each Part 4 record submitted, enter the member’s name and

year for which the combined report is filed. For contact informa-

Federal Identification number. Enter on line 1 the period end date

tion, provide the name and telephone number the Department of

shown on the member’s prior year separate return. If the member

Revenue (DOR) should use to inquire regarding discrepancies

did not file a separate return for the prior year, leave this blank.

between the payments reported on the schedule and DOR

Enter on lines 2 through 7 any amounts paid by the member for

records.

each installment. Do not include any amounts paid on behalf of the

Schedule CG reconciles all payments made by all members of the group by the principal reporting corporation and shown in Part 3.

group towards the excise shown on the combined report, which for

taxable years beginning on or after January 1, 2012, includes any Fiscalized Taxpayers

non-income measure of excise due from corporations taxable If any member of the group has a separate taxable year ending

under MGL ch 63 § 39 with the same taxable year for which the after the end of the combined group’s taxable year, the non-in-

combined report is filed. Payments made by the principal reporting come measure of excise due from that member must be paid sep-

corporation on behalf of the group are reported in Part 3. Payments arately. In such circumstances, the member should file a Part 4

made separately by individual members (e.g., overpayments car- record only for the purpose of having one or more payments cred-

ried forward from prior years and estimated payments made before ited against that separate non-income measure applied to the

they determined they were to be included in the combined report) total excise shown on Form 355U.

are shown in Part 4.

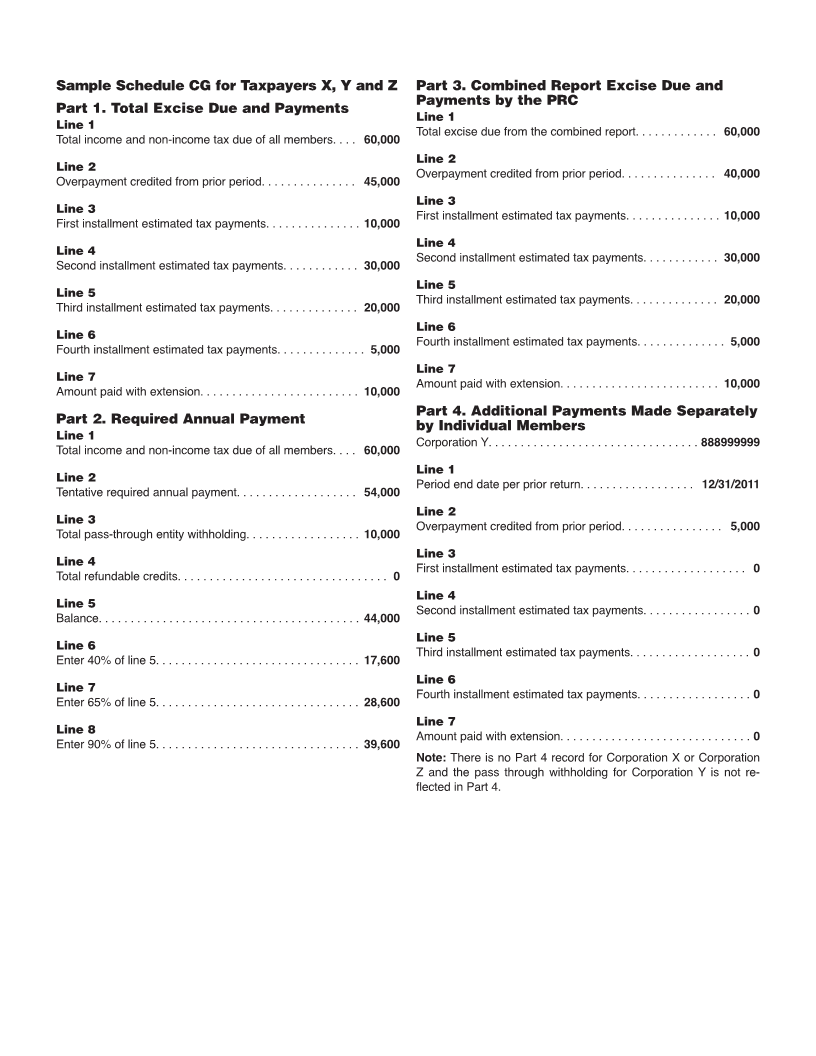

Example

Part 1. Total Excise Tax Due and Payments Taxpayers X, Y and Z are members of a group filing a combined re-

This section reports the total of the income and non-income mea- port for the 2012 calendar year. Taxpayers X and Y are taxable in

sures for all members as shown on the combined report and the Massachusetts, taxpayer Z is a non-taxable member. Taxpayer X

total of all payments made by all group members. For line 1, enter is the principal reporting corporation and files Form 355U on behalf

the amount from Form 355U, line 27. For each line 2 through 7, the of the group. The excise before voluntary contribution on line 27 of

total shown in Part 1 must match the totals shown for all records Form 355U is $60,000. This includes the non-income measures of

in Part 3 and 4 for the same line. excise calculated by taxpayers X and Y for the year.

Schedule CG, Part 1, line 2 (overpayment credited from prior pe- Taxpayer X filed a 2011 form 355U and applied $40,000 of its re-

riod) is entered on Form 355U, line 30. fund from that taxable year to the combined group’s 2012 estimated

taxes. Beginning in March of 2012, taxpayer X made estimated

The total of the amounts from Schedule CG, Part 1, lines 3 through payments on behalf of the group in the amounts of $10,000,

6 (the estimated tax payments made by all members of the group) $30,000, $20,000 and $5,000 respectively. Taxpayer X filed a re-

is entered on Form 355U, line 31. quest for extension on behalf of the combined group on March 15,

Schedule CG, Part 1, line 7 (amount paid with extension) is entered 2013 and made a payment of $10,000 at that time. Taxpayer Y was

on Form 355U, line 32. not a member of the group in prior years and, it had an overpay-

ment of $5,000 from its last separate return that it chose to apply to

Part 2. Required Annual Payment its 2012 estimated taxes. Taxpayer Y also had income from a part-

This section calculates the required annual payment for the com- nership that withheld $10,000 from taxpayer Y’s share of the part-

bined group as provided in TIR 09-05 and the cumulative amounts nership income. Taxpayer Y made no other estimated tax payments

required for the various installments in a taxable year of 12 months. as its projected tax liability for both its income and non-income

For example, if the amount shown on Part 2, line 6 is greater than measures of excise was combined with that of the other members

the total of the amounts shown on Part 1, line 2 and line 3, the tax- and included in the payments made by taxpayer X for each install-

able members of the combined group may be liable for an addition ment as provided in TIR 09-05. Taxpayer Z did not make any pay-

to tax under MGL ch 63B. The amount of any such addition is cal- ments. As a group, taxpayers X, Y and Z had a total tax liability of

culated on Form M-2220, which is also used to claim certain ex- $60,000, made $120,000 in payments and had $10,000 withheld.

ceptions. See 830 CMR 63B.2.2 for further information. They request a refund of $30,000 and apply $40,000 to estimated

taxes for 2013.

Part 3. Combined Report Excise Due and

Payments by the PRC

The group must file a single Part 3 record showing the payments

made by the principal reporting corporation for the excise due on

the combined report. Enter on line 1, the period end date of the

prior year combined report. If a combined report was not filed for

the prior year, leave this blank. Enter on lines 2 through 7 any

amounts paid or credited by the principal reporting corporation on

behalf of the group.