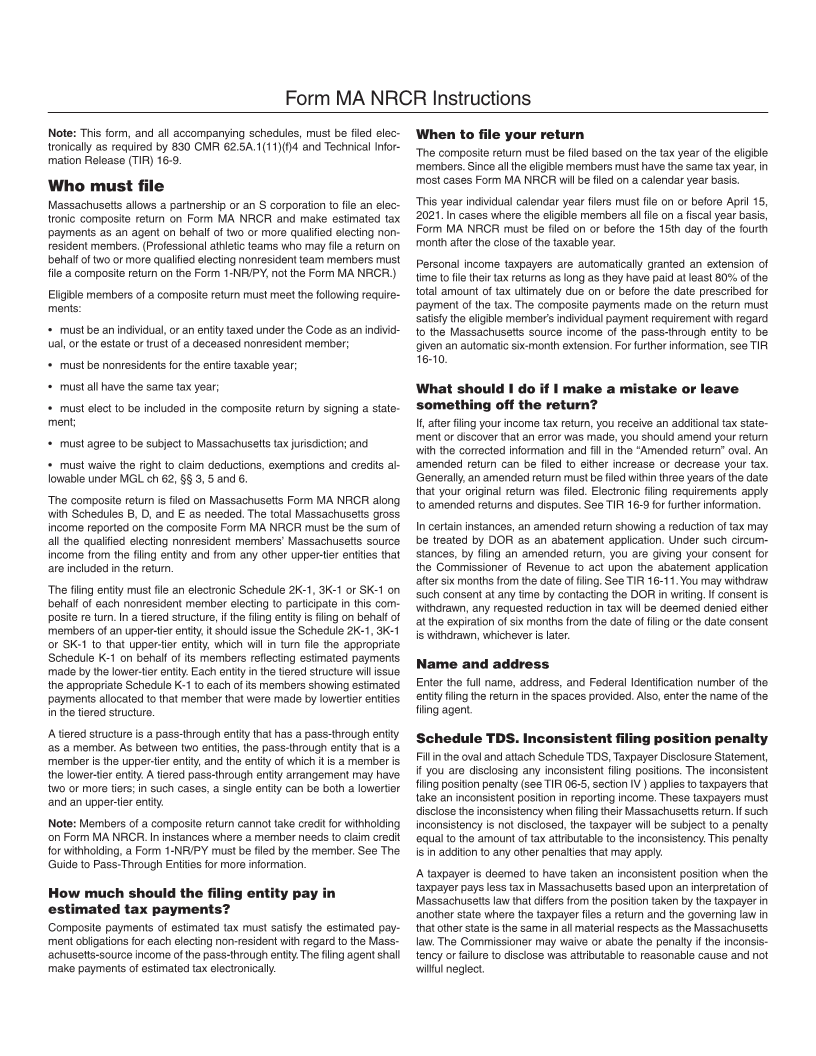

Enlarge image

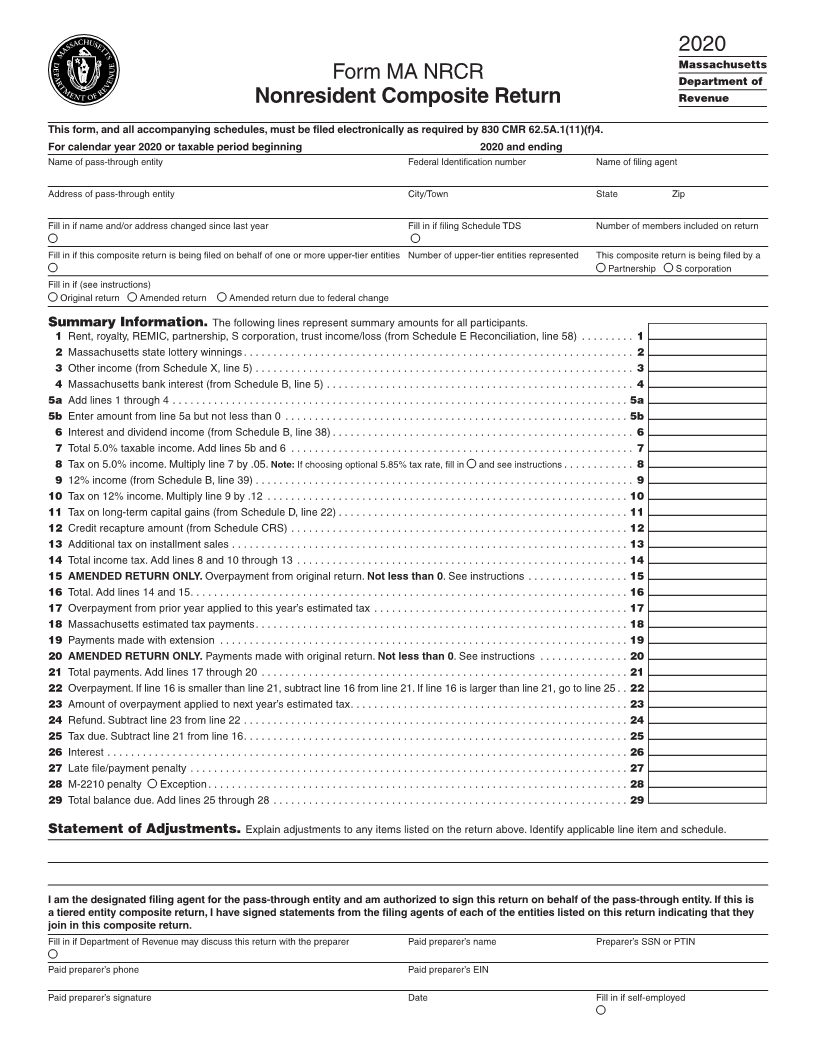

2020

Massachusetts

Form MA NRCR Department of

Nonresident Composite Return Revenue

This form, and all accompanying schedules, must be filed electronically as required by 830 CMR 62.5A.1(11)(f)4.

For calendar year 2020 or taxable period beginning 2020 and ending

Name of pass-through entity Federal Identification number Name of filing agent

Address of pass-through entity City/Town State Zip

Fill in if name and/or address changed since last year Fill in if filing Schedule TDS Number of members included on return

● ●

Fill in if this composite return is being filed on behalf of one or more upper-tier entities Number of upper-tier entities represented This composite return is being filed by a

● ● Partnership ● S corporation

Fill in if (see instructions)

● Original return ● Amended return ● Amended return due to federal change

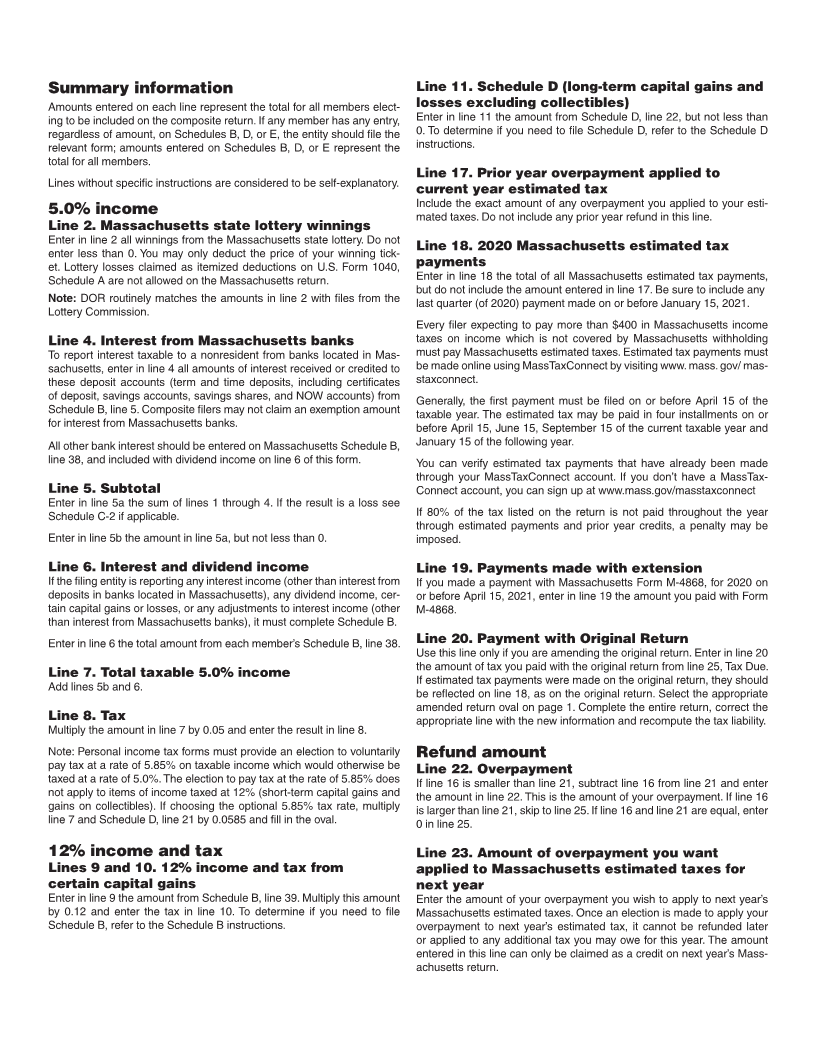

Summary Information. The following lines represent summary amounts for all participants.

1 Rent, royalty, REMIC, partnership, S corporation, trust income/loss (from Schedule E Reconciliation, line 58) ......... 1

2 Massachusetts state lottery winnings .................................................................. 2

3 Other income (from Schedule X, line 5) ................................................................ 3

4 Massachusetts bank interest (from Schedule B, line 5) .................................................... 4

5a Add lines 1 through 4 ............................................................................. 5a

5b Enter amount from line 5a but not less than 0 .......................................................... 5b

6 Interest and dividend income (from Schedule B, line 38) ................................................... 6

7 Total 5.0% taxable income. Add lines 5b and 6 .......................................................... 7

8 Tax on 5.0% income. Multiply line 7 by .05. Note: If choosing optional 5.85% tax rate, fill in ● and see instructions ............ 8

9 12% income (from Schedule B, line 39) ................................................................ 9

10 Tax on 12% income. Multiply line 9 by .12 ............................................................. 10

11 Tax on long-term capital gains (from Schedule D, line 22) ................................................. 11

12 Credit recapture amount (from Schedule CRS) ......................................................... 12

13 Additional tax on installment sales ................................................................... 13

14 Total income tax. Add lines 8 and 10 through 13 ........................................................ 14

15 AMENDED RETURN ONLY. Overpayment from original return. Not less than 0. See instructions ................. 15

16 Total. Add lines 14 and 15 .......................................................................... 16

17 Overpayment from prior year applied to this year’s estimated tax ........................................... 17

18 Massachusetts estimated tax payments ............................................................... 18

19 Payments made with extension ..................................................................... 19

20 AMENDED RETURN ONLY. Payments made with original return. Not less than 0. See instructions ............... 20

21 Total payments. Add lines 17 through 20 .............................................................. 21

22 Overpayment. If line 16 is smaller than line 21, subtract line 16 from line 21. If line 16 is larger than line 21, go to line 25 .. 22

23 Amount of overpayment applied to next year’s estimated tax ............................................... 23

24 Refund. Subtract line 23 from line 22 ................................................................. 24

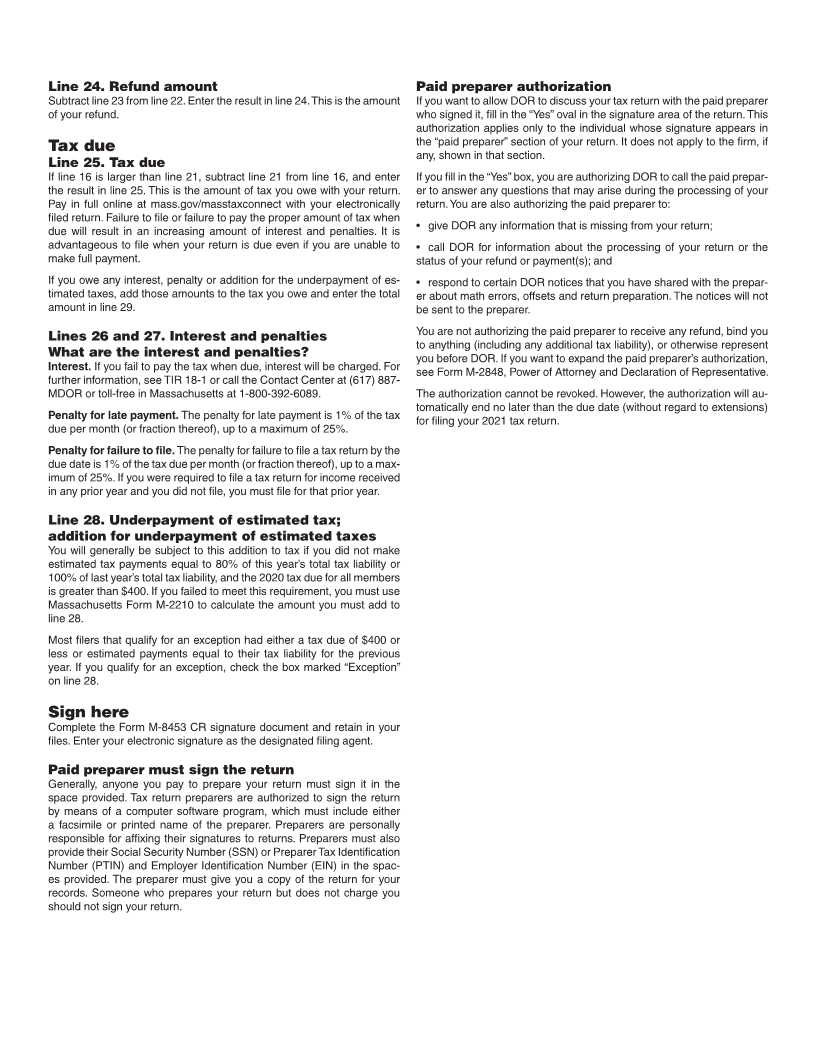

25 Tax due. Subtract line 21 from line 16 ................................................................. 25

26 Interest ........................................................................................ 26

27 Late file/payment penalty .......................................................................... 27

28 M-2210 penalty ● Exception ....................................................................... 28

29 Total balance due. Add lines 25 through 28 ............................................................ 29

Statement of Adjustments. Explain adjustments to any items listed on the return above. Identify applicable line item and schedule.

I am the designated filing agent for the pass-through entity and am authorized to sign this return on behalf of the pass-through entity. If this is

a tiered entity composite return, I have signed statements from the filing agents of each of the entities listed on this return indicating that they

join in this composite return.

Fill in if Department of Revenue may discuss this return with the preparer Paid preparer’s name Preparer’s SSN or PTIN

●

Paid preparer’s phone Paid preparer’s EIN

Paid preparer’s signature Date Fill in if self-employed

●