Enlarge image

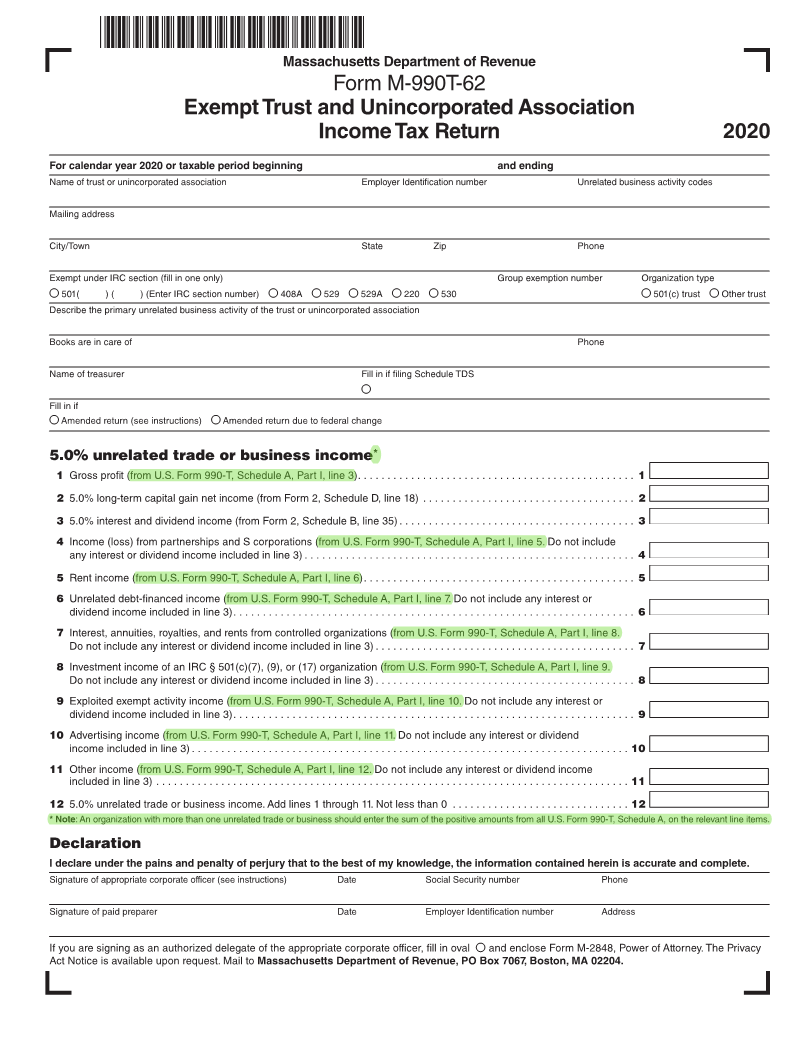

Massachusetts Department of Revenue

Form M-990T-62

Exempt Trust and Unincorporated Association

Income Tax Return 2020

For calendar year 2020 or taxable period beginning and ending

Name of trust or unincorporated association Employer Identification number Unrelated business activity codes

Mailing address

City/Town State Zip Phone

Exempt under IRC section (fill in one only) Group exemption number Organization type

● 501( ) ( ) (Enter IRC section number) ● 408A ● 529 ● 529A ● 220 ● 530 ● 501(c) trust ● Other trust

Describe the primary unrelated business activity of the trust or unincorporated association

Books are in care of Phone

Name of treasurer Fill in if filing Schedule TDS

●

Fill in if

● Amended return (see instructions) ● Amended return due to federal change

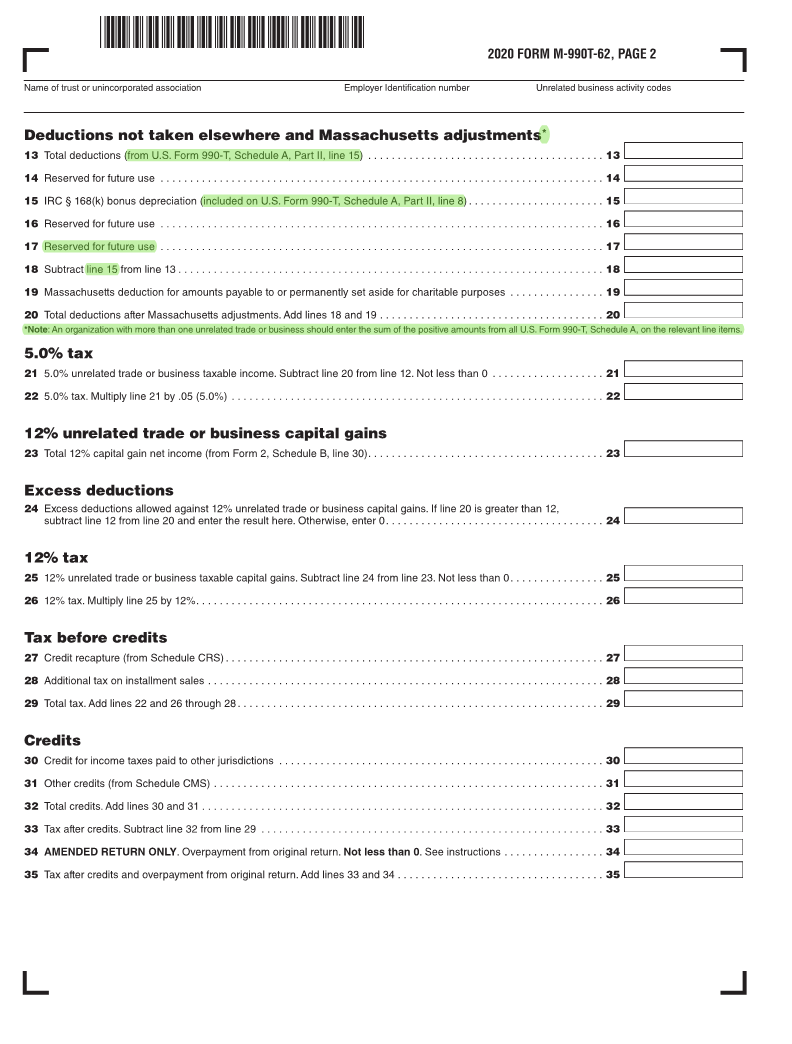

5.0% unrelated trade or business income*

1 Gross profit (from U.S. Form 990-T, Schedule A, Part I, line 3) ............................................... 1

2 5.0% long-term capital gain net income (from Form 2, Schedule D, line 18) .................................... 2

3 5.0% interest and dividend income (from Form 2, Schedule B, line 35) ........................................ 3

4 Income (loss) from partnerships and S corporations (from U.S. Form 990-T, Schedule A, Part I, line 5. Do not include

any interest or dividend income included in line 3) ........................................................ 4

5 Rent income (from U.S. Form 990-T, Schedule A, Part I, line 6) .............................................. 5

6 Unrelated debt-financed income (from U.S. Form 990-T, Schedule A, Part I, line 7. Do not include any interest or

dividend income included in line 3) .................................................................... 6

7 Interest, annuities, royalties, and rents from controlled organizations (from U.S. Form 990-T, Schedule A, Part I, line 8.

Do not include any interest or dividend income included in line 3) ............................................ 7

8 Investment income of an IRC § 501(c)(7), (9), or (17) organization (from U.S. Form 990-T, Schedule A, Part I, line 9.

Do not include any interest or dividend income included in line 3) ............................................ 8

9 Exploited exempt activity income (from U.S. Form 990-T, Schedule A, Part I, line 10. Do not include any interest or

dividend income included in line 3) .................................................................... 9

10 Advertising income (from U.S. Form 990-T, Schedule A, Part I, line 11. Do not include any interest or dividend

income included in line 3) .......................................................................... 10

11 Other income (from U.S. Form 990-T, Schedule A, Part I, line 12. Do not include any interest or dividend income

included in line 3) ................................................................................ 11

12 5.0% unrelated trade or business income. Add lines 1 through 11. Not less than 0 .............................. 12

* Note: An organization with more than one unrelated trade or business should enter the sum of the positive amounts from all U.S. Form 990-T, Schedule A, on the relevant line items.

Declaration

I declare under the pains and penalty of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature of appropriate corporate officer (see instructions) Date Social Security number Phone

Signature of paid preparer Date Employer Identification number Address

If you are signing as an authorized delegate of the appropriate corporate officer, fill in oval ● and enclose Form M-2848, Power of Attorney. The Privacy

Act Notice is available upon request. Mail to Massachusetts Department of Revenue, PO Box 7067, Boston, MA 02204.