Enlarge image

Massachusetts Department of Revenue

Form M-990T

Unrelated Business Income Tax Return 2020

For calendar year 2020 or taxable year beginning 2020 and ending

Most corporate excise taxpayers, including tax-exempt corporations and trusts, are subject to the electronic filing requirements. See Technical

Information Release 16-9.

Name Federal Identification number

Mailing address

City/Town State Zip Phone number

Name of treasurer Fill in if a Taxpayer Disclosure Statement is enclosed

●

Fill in if

● Amended return (see instructions) ● Federal amendment ● Federal audit ● Final return ● Enclosing Schedule FCI

Fill in if

● 501 ● 408(e) ● 408A ● 529(a) ● 220(e) ● 530(a)

Fill in if

● 501(c) corporation ● 501(c) trust ● 401(a) trust ● Other

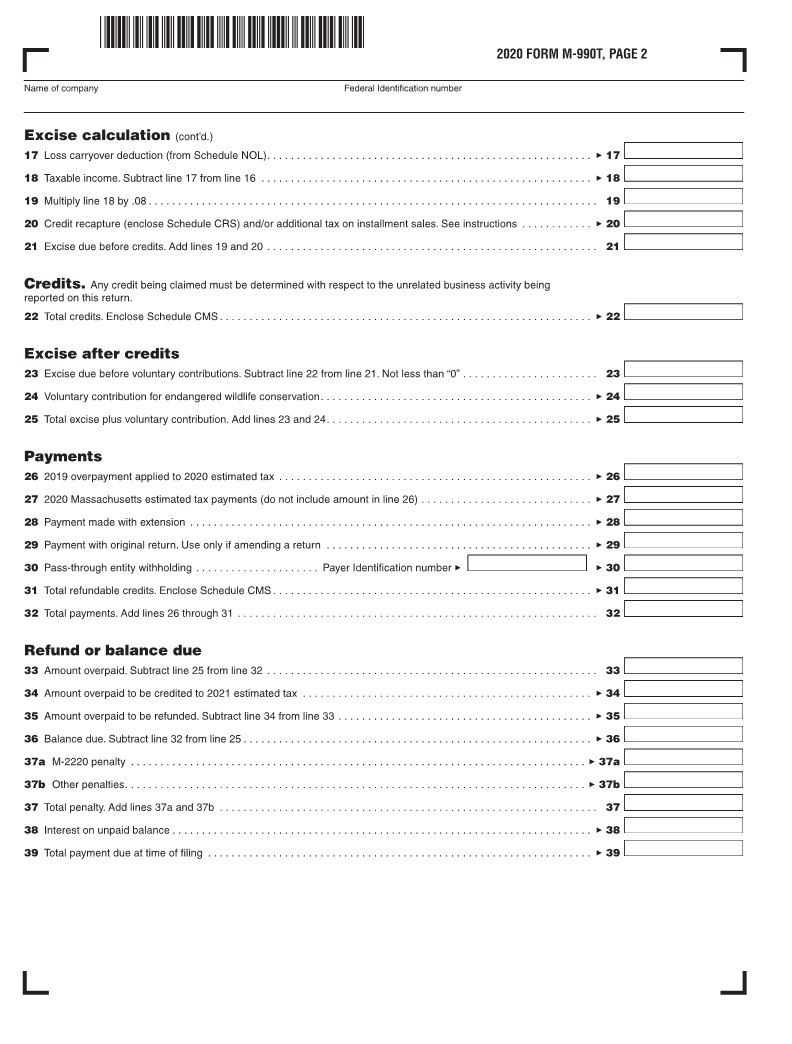

Excise calculation. Use whole dollar method.

1 Unrelated business taxable income (from U.S. Form 990T, Schedule A, line 18) See instructions ................. 3 1

2 Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income ............. 3 2

3 Section 168(k) “bonus” depreciation adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Section 31I and 31K intangible expense add back adjustment. ............................................ 3 4

5 Federal NOL add back adjustment (from U.S. Form 990T, Schedule A, line 17) See instructions .................. 3 5

6 Section 31J and 31K interest expense add back adjustment .............................................. 3 6

7 Reserved for future use .......................................................................... 3 7

8 Abandoned Building Renovation deduction........................ Total cost × .10 = 3 8

9 Other adjustments, including research and development expenses (enclose explanation) ....................... 3 9

10 Income subject to apportionment. See instructions .................................................... 3 10

11 Income apportionment percentage (from Schedule F, line 5 or 1.0, whichever applies). ........................ 3 11

12 Multiply line 10 by line 11 ........................................................................ 3 12

13 Income not subject to apportionment ............................................................... 3 13

14 Add lines 12 and 13 ............................................................................ 3 14

15 Certified Massachusetts solar or wind power deduction ................................................. 3 15

16 Taxable income before net operating loss deduction .................................................... 16

Declaration

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate corporate officer (see instructions) Date Phone

Signature of paid preparer Date Employer Identification number Address

If you are signing as an authorized delegate of the appropriate corporate officer, fill in oval ● and enclose Massachusetts Form M-2848, Power of

Attorney. The Privacy Act Notice is available upon request. Mail to Massachusetts Department of Revenue, PO Box 7067, Boston, MA 02204.