Enlarge image

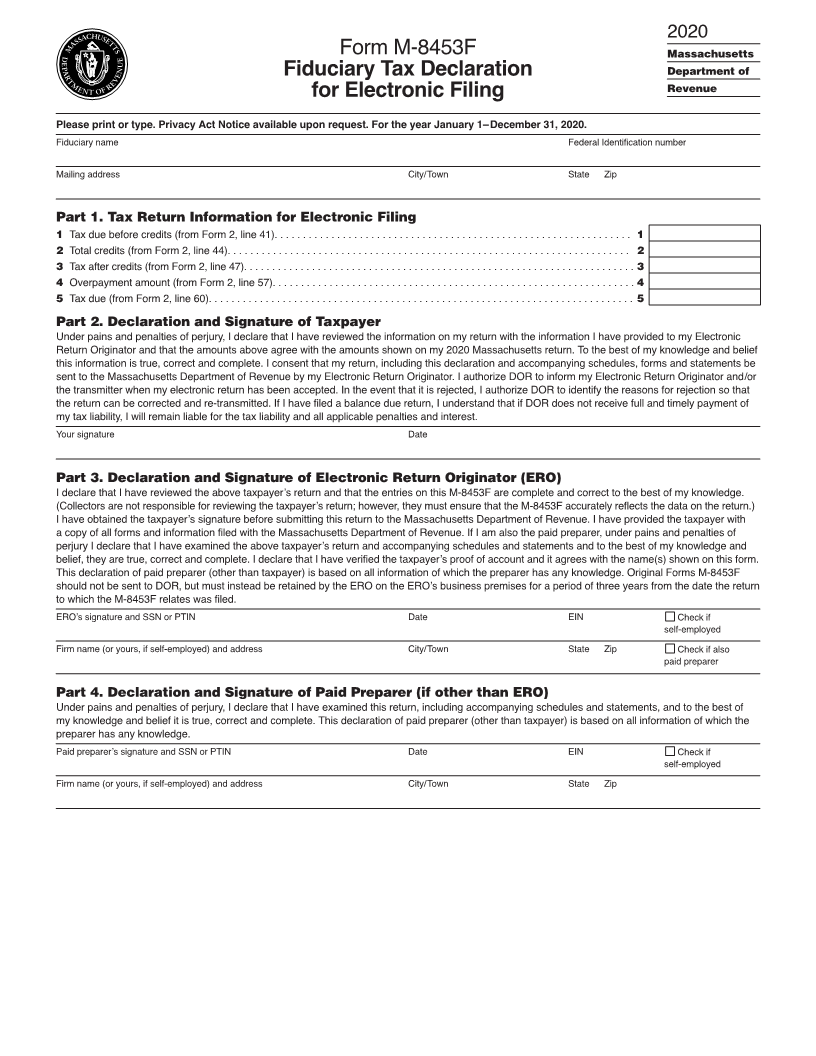

2020

Form M-8453F Massachusetts

Fiduciary Tax Declaration Department of

Revenue

for Electronic Filing

Please print or type. Privacy Act Notice available upon request. For the year January 1–December 31, 2020.

Fiduciary name Federal Identification number

Mailing address City/Town State Zip

Part 1. Tax Return Information for Electronic Filing

1 Tax due before credits (from Form 2, line 41). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total credits (from Form 2, line 44). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax after credits (from Form 2, line 47). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Overpayment amount (from Form 2, line 57). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Tax due (from Form 2, line 60). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Part 2. Declaration and Signature of Taxpayer

Under pains and penalties of perjury, I declare that I have reviewed the information on my return with the information I have provided to my Electronic

Re turn Originator and that the amounts above agree with the amounts shown on my 2020 Massachusetts return. To the best of my knowledge and belief

this information is true, correct and complete. I consent that my return, including this declaration and accompanying schedules, forms and statements be

sent to the Massachusetts Department of Revenue by my Electronic Return Originator. I authorize DOR to inform my Electronic Return Originator and/or

the transmitter when my electronic return has been accepted. In the event that it is rejected, I authorize DOR to identify the reasons for rejection so that

the return can be corrected and re-transmitted. If I have filed a balance due return, I understand that if DOR does not receive full and timely payment of

my tax liability, I will remain liable for the tax liability and all applicable penalties and interest.

Your signature Date

Part 3. Declaration and Signature of Electronic Return Originator (ERO)

I declare that I have reviewed the above taxpayer’s return and that the entries on this M-8453F are complete and correct to the best of my knowledge.

(Collectors are not responsible for reviewing the taxpayer’s return; however, they must ensure that the M-8453F accurately reflects the data on the return.)

I have obtained the taxpayer’s signature before submitting this return to the Massachusetts Department of Revenue. I have provided the taxpayer with

a copy of all forms and information filed with the Massachusetts Department of Revenue. If I am also the paid preparer, under pains and penalties of

perjury I declare that I have examined the above taxpayer’s return and accompanying schedules and statements and to the best of my knowledge and

belief, they are true, correct and complete. I declare that I have verified the taxpayer’s proof of account and it agrees with the name(s) shown on this form.

This declaration of paid preparer (other than taxpayer) is based on all information of which the preparer has any knowledge. Original Forms M-8453F

should not be sent to DOR, but must instead be retained by the ERO on the ERO’s business premises for a period of three years from the date the return

to which the M-8453F relates was filed.

ERO’s signature and SSN or PTIN Date EIN Check if

self-employed

Firm name (or yours, if self-employed) and address City/Town State Zip Check if also

paid preparer

Part 4. Declaration and Signature of Paid Preparer (if other than ERO)

Under pains and penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of

my knowledge and belief it is true, correct and complete. This declaration of paid preparer (other than taxpayer) is based on all information of which the

preparer has any knowledge.

Paid preparer’s signature and SSN or PTIN Date EIN Check if

self-employed

Firm name (or yours, if self-employed) and address City/Town State Zip