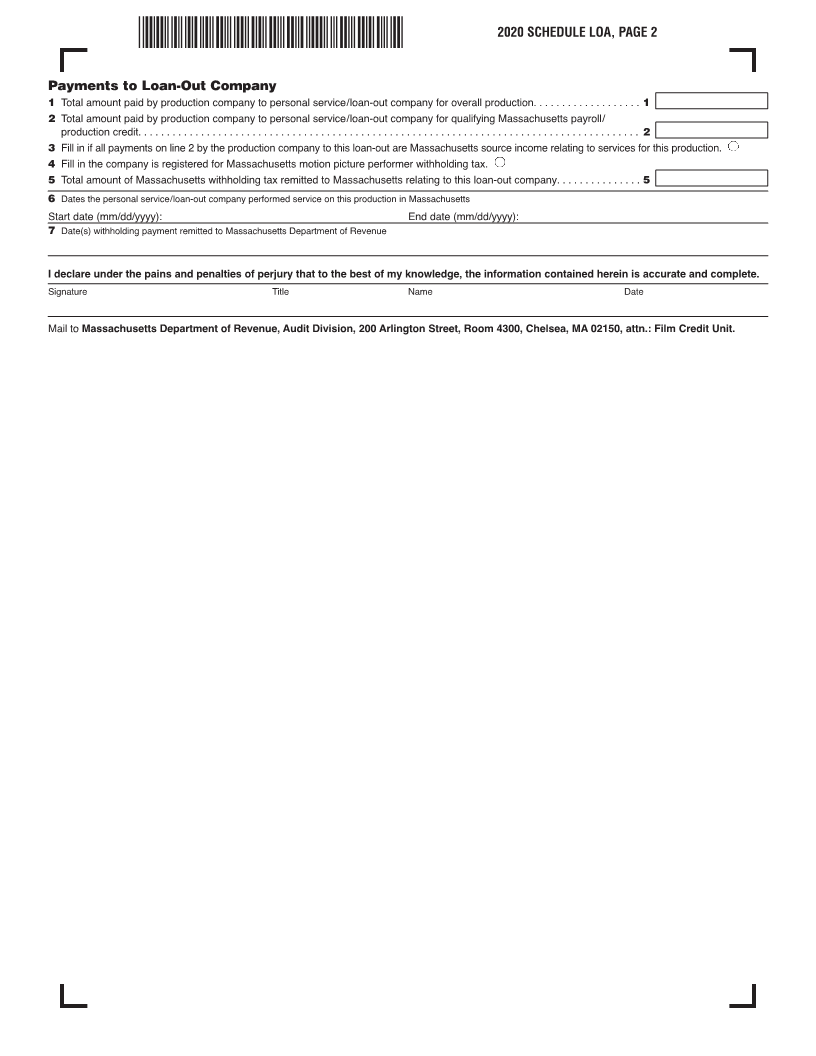

Enlarge image

Massachusetts Department of Revenue

Form LOA

Loan-Out Affidavit/Allocation 2020

Production company is required to complete and submit a separate loan-out affidavit for every personal service or loan-out company included on

the film credit application. Failure by production company to fully complete and submit a fully signed loan-out affidavit for a personal service or

loan-out company will result in disallowance of the credit claimed in relation to such personal service or loan-out company. To be valid and ac-

cepted, this form must be signed by an authorized representative from the loan-out company, the actor/performer and the production company.

General Information

Production company name Federal Identification number

Mailing address City/Town State Zip

Name of production

Massachusetts production start date (mm/dd/yyyy) Massachusetts production end date (mm/dd/yyyy)

Personal Service/Loan-Out Company Information

Company name Federal Identification number

Business address City/Town State Zip

Mailing address (if different) City/Town State Zip

Name of authorized representative Title Telephone E-mail

Massachusetts start date (mm/dd/yyyy) Massachusetts end date (mm/dd/yyyy)

Fill in if company is registered with Massachusetts Secretary of State to do business in Massachusetts.

Fill in if company is registered with Massachusetts Department of Revenue (DOR) to file and pay taxes.

If either of these are not filled in, the company will be required to register with Massachusetts Secretary of State and DOR.

I declare under the pains and penalties of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature Title Name Date

Actor/Performer Information. Attach additional sheets if more than one actor/performer is provided by this loan-out.

Name of actor/performer providing loan-out services Social Security number

Residential address City/Town State Zip

Mailing address (if different) City/Town State Zip

Massachusetts start date (mm/dd/yyyy) Massachusetts end date (mm/dd/yyyy)

Fill in if the actor/performer is registered with DOR to file and pay taxes.

If this is not filled in, the actor/performer will be required to register with DOR and file a personal tax return.

I declare under the pains and penalties of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

I also understand and agree to comply with the Motion Picture Production Company Withholding Regulation 830 CMR 62B.2.3 Sec. 5(b).

Signature Name Date

Be sure to complete page 2.