Enlarge image

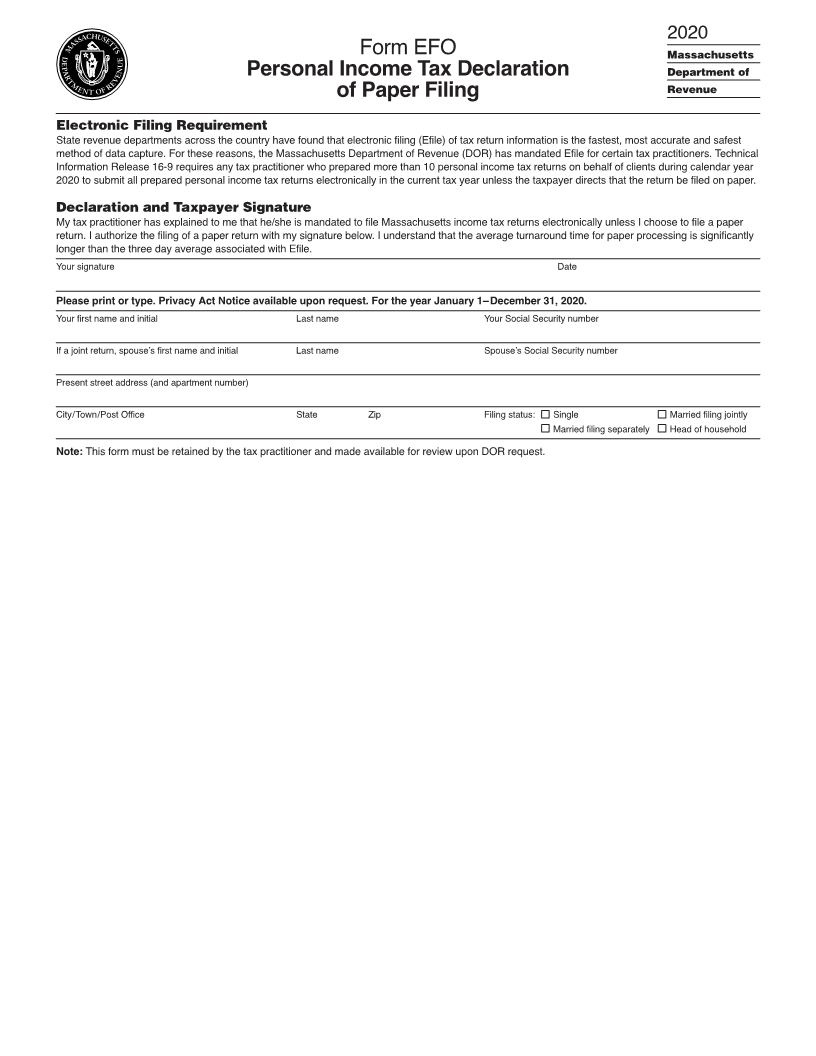

2020

Form EFO Massachusetts

Personal Income Tax Declaration Department of

of Paper Filing Revenue

Electronic Filing Requirement

State revenue departments across the country have found that electronic filing (Efile) of tax return information is the fastest, most accurate and safest

method of data capture. For these reasons, the Massachusetts Department of Revenue (DOR) has mandated Efile for certain tax practitioners. Technical

Information Release 16-9 requires any tax practitioner who prepared more than 10 personal income tax returns on behalf of clients during calendar year

2020 to submit all prepared personal income tax returns electronically in the current tax year unless the taxpayer directs that the return be filed on paper.

Declaration and Taxpayer Signature

My tax practitioner has explained to me that he/she is mandated to file Massachusetts income tax returns electronically unless I choose to file a paper

return. I authorize the filing of a paper return with my signature below. I understand that the average turnaround time for paper processing is significantly

longer than the three day average associated with Efile.

Your signature Date

Please print or type. Privacy Act Notice available upon request. For the year January 1–December 31, 2020.

Your first name and initial Last name Your Social Security number

If a joint return, spouse’s first name and initial Last name Spouse’s Social Security number

Present street address (and apartment number)

City/Town/Post Office State Zip Filing status: Single Married filing jointly

Married filing separately Head of household

Note: This form must be retained by the tax practitioner and made available for review upon DOR request.