Enlarge image

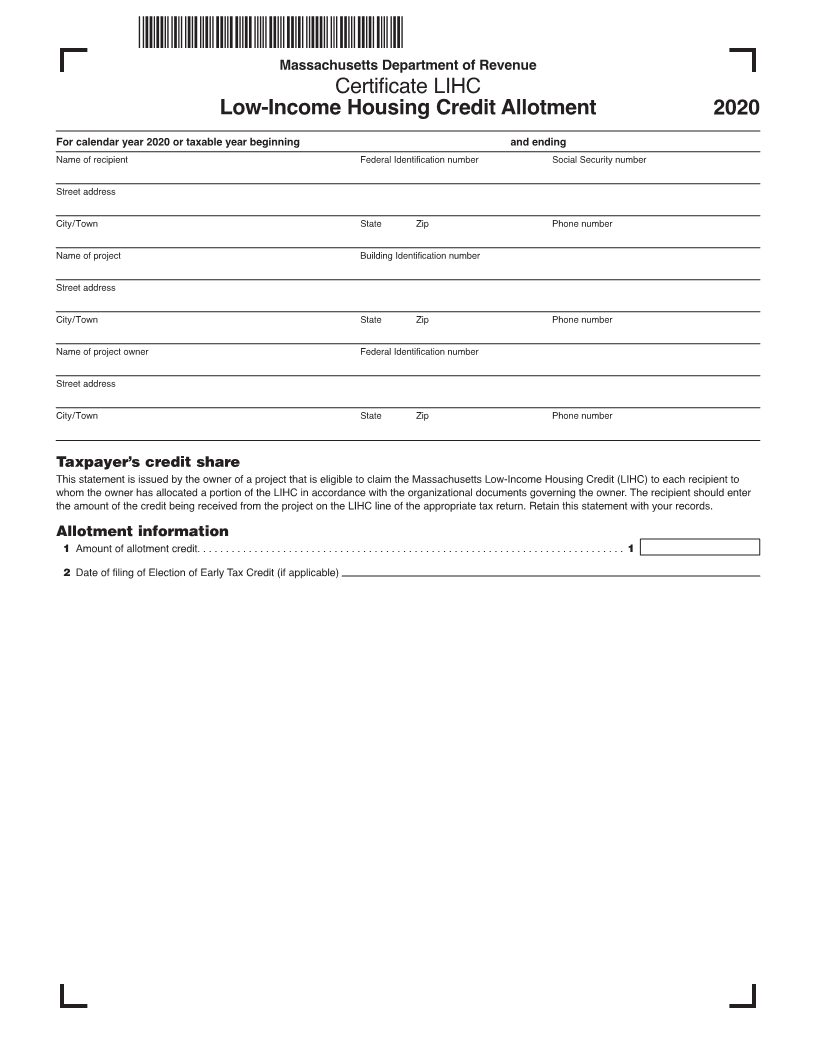

Massachusetts Department of Revenue

Certificate LIHC

Low-Income Housing Credit Allotment 2020

For calendar year 2020 or taxable year beginning and ending

Name of recipient Federal Identification number Social Security number

Street address

City/Town State Zip Phone number

Name of project Building Identification number

Street address

City/Town State Zip Phone number

Name of project owner Federal Identification number

Street address

City/Town State Zip Phone number

Taxpayer’s credit share

This statement is issued by the owner of a project that is eligible to claim the Massachusetts Low-Income Housing Credit (LIHC) to each recipient to

whom the owner has allocated a portion of the LIHC in accordance with the organizational documents governing the owner. The recipient should enter

the amount of the credit being received from the project on the LIHC line of the appropriate tax return. Retain this statement with your records.

Allotment information

11 Amount of allotment credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Date of filing of Election of Early Tax Credit (if applicable)