Enlarge image

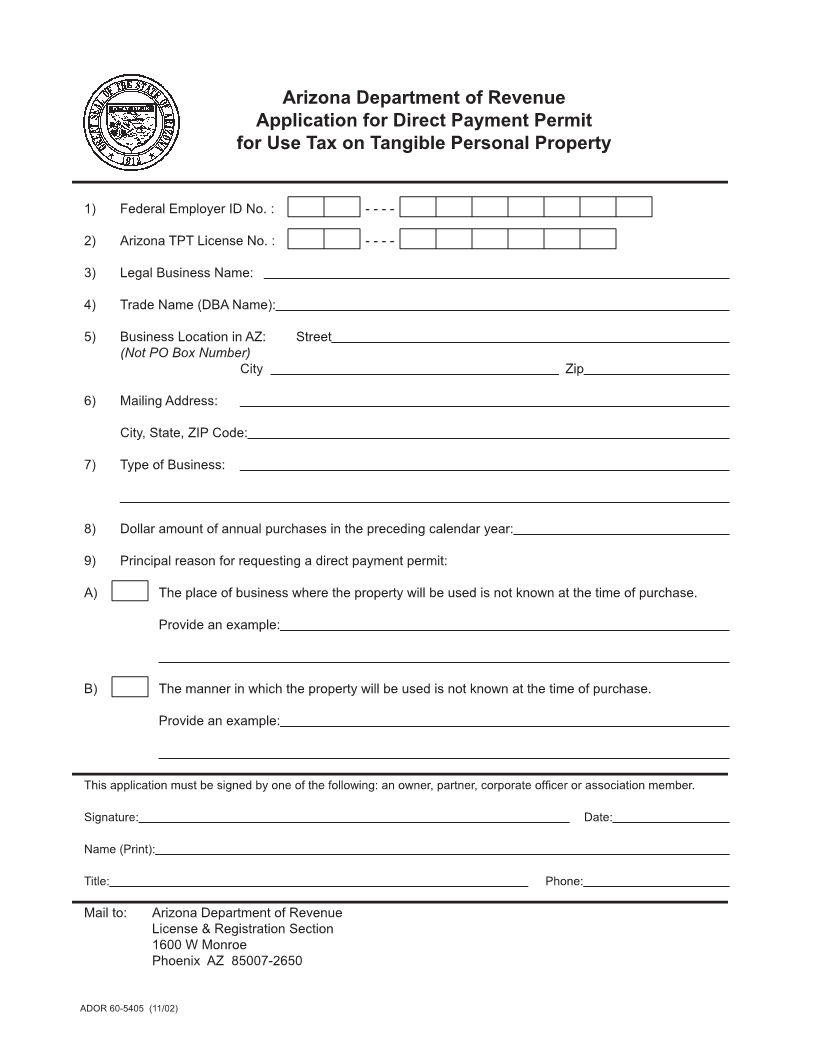

Arizona Department of Revenue

Application for Direct Payment Permit

for Use Tax on Tangible Personal Property

1) Federal Employer ID No. : - - - -

2) Arizona TPT License No. : - - - -

3) Legal Business Name:

4) Trade Name (DBA Name):

5) Business Location in AZ: Street

(Not PO Box Number)

City Zip

6) Mailing Address:

City, State, ZIP Code:

7) Type of Business:

8) Dollar amount of annual purchases in the preceding calendar year:

9) Principal reason for requesting a direct payment permit:

A) The place of business where the property will be used is not known at the time of purchase.

Provide an example:

B) The manner in which the property will be used is not known at the time of purchase.

Provide an example:

This application must be signed by one of the following: an owner, partner, corporate offi cer or association member.

Signature: Date:

Name (Print):

Title: Phone:

Mail to: Arizona Department of Revenue

License & Registration Section

1600 W Monroe

Phoenix AZ 85007-2650

ADOR 60-5405 (11/02)

60-5405.indd 1 5/12/2006 11:34:12 AM