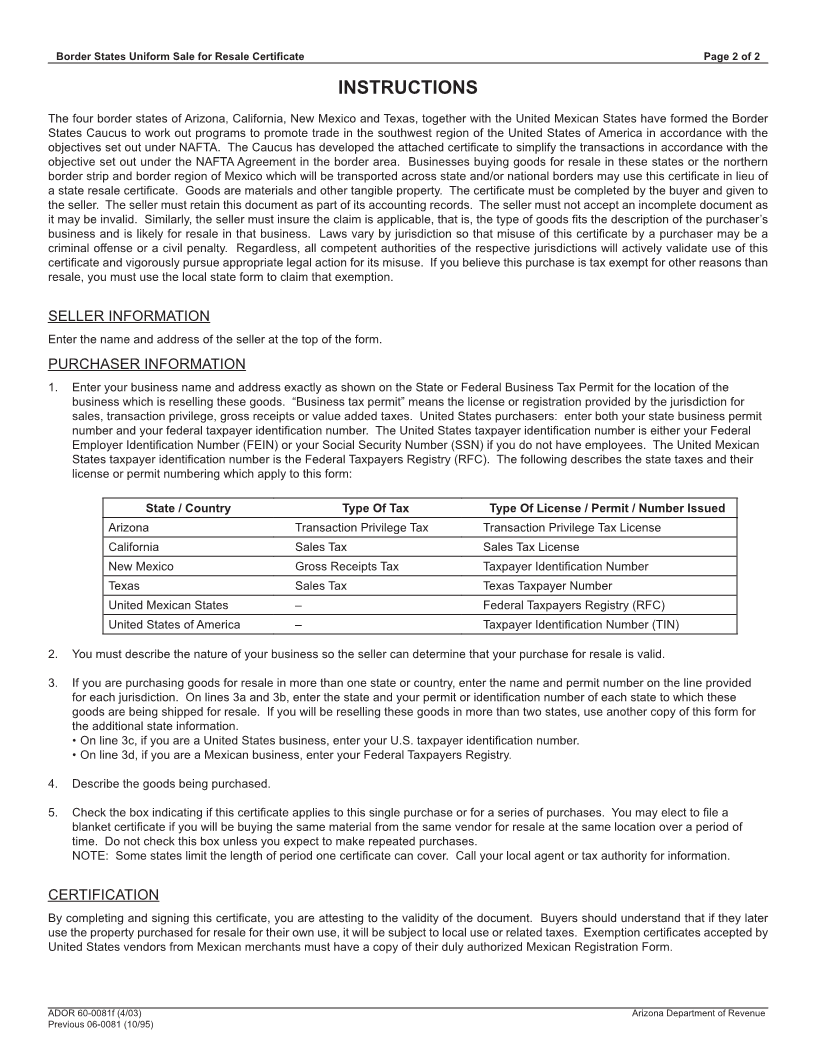

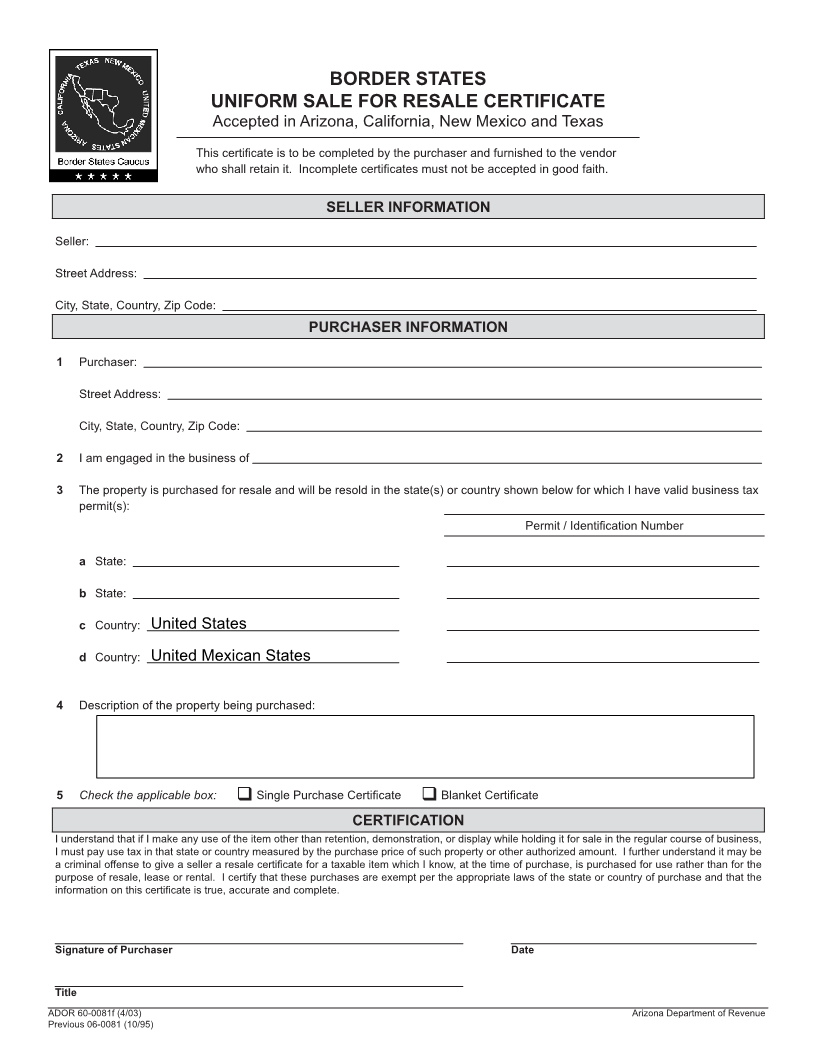

Enlarge image

BORDER STATES

UNIFORM SALE FOR RESALE CERTIFICATE

Accepted in Arizona, California, New Mexico and Texas

This certifi cate is to be completed by the purchaser and furnished to the vendor

who shall retain it. Incomplete certifi cates must not be accepted in good faith.

SELLER INFORMATION

Seller:

Street Address:

City, State, Country, Zip Code:

PURCHASER INFORMATION

1 Purchaser:

Street Address:

City, State, Country, Zip Code:

2 I am engaged in the business of

3 The property is purchased for resale and will be resold in the state(s) or country shown below for which I have valid business tax

permit(s):

Permit / Identifi cation Number

a State:

b State:

c Country: United States

d Country: United Mexican States

4 Description of the property being purchased:

5 Check the applicable box: Single Purchase Certifi cate Blanket Certifi cate

CERTIFICATION

I understand that if I make any use of the item other than retention, demonstration, or display while holding it for sale in the regular course of business,

I must pay use tax in that state or country measured by the purchase price of such property or other authorized amount. I further understand it may be

a criminal offense to give a seller a resale certifi cate for a taxable item which I know, at the time of purchase, is purchased for use rather than for the

purpose of resale, lease or rental. I certify that these purchases are exempt per the appropriate laws of the state or country of purchase and that the

information on this certifi cate is true, accurate and complete.

Signature of Purchaser Date

Title

ADOR 60-0081f (4/03) Arizona Department of Revenue

Previous 06-0081 (10/95)