Enlarge image

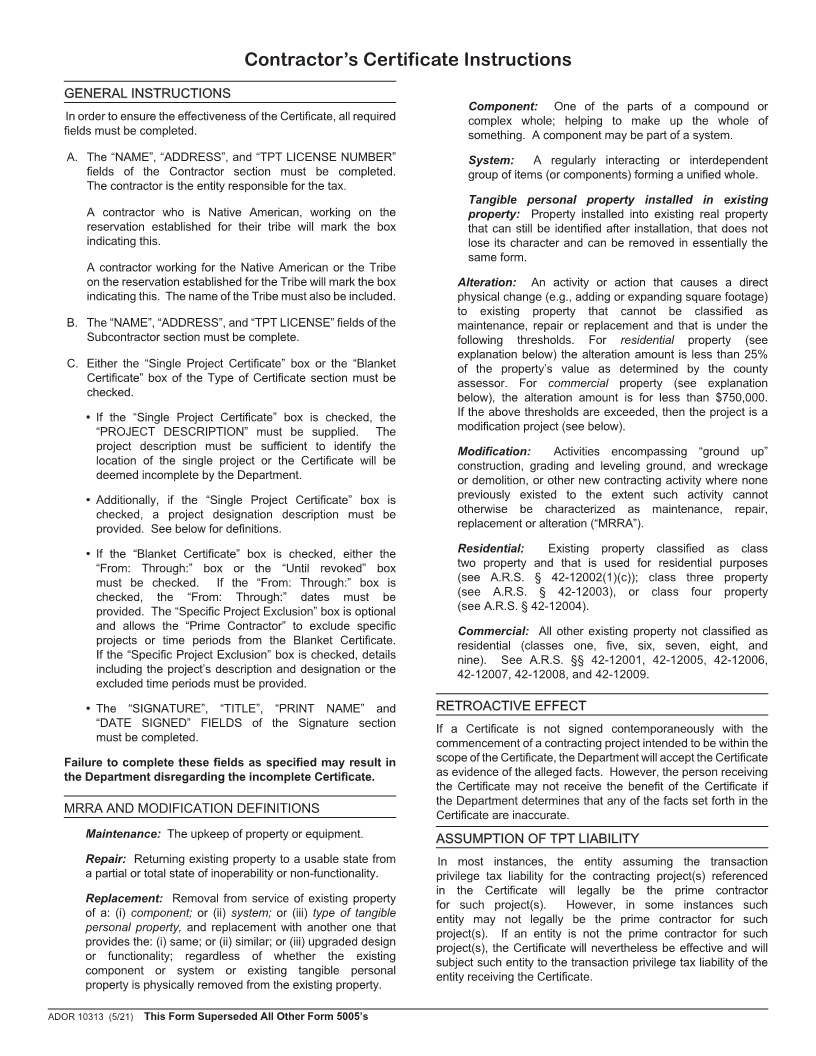

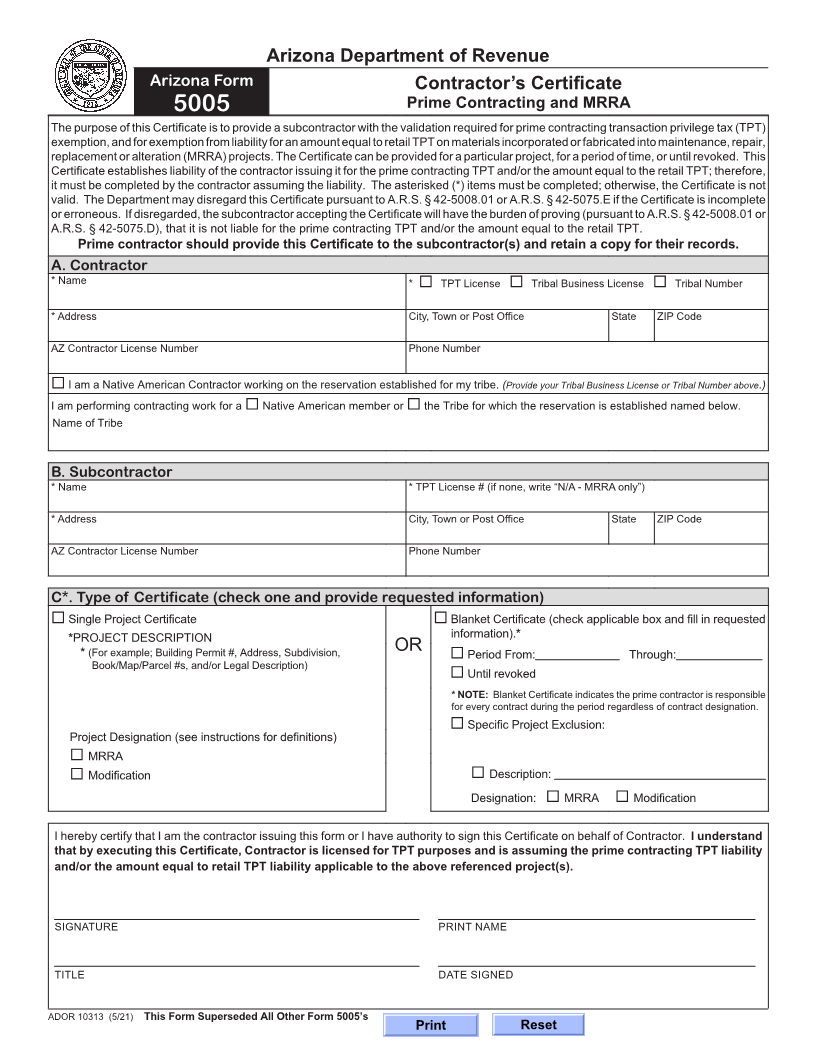

Arizona Department of Revenue

Arizona Form Contractor’s Certificate

5005 Prime Contracting and MRRA

The purpose of this Certificate is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (TPT)

exemption, and for exemption from liability for an amount equal to retail TPT on materials incorporated or fabricated into maintenance, repair,

replacement or alteration (MRRA) projects. The Certificate can be provided for a particular project, for a period of time, or until revoked. This

Certificate establishes liability of the contractor issuing it for the prime contracting TPT and/or the amount equal to the retail TPT; therefore,

it must be completed by the contractor assuming the liability. The asterisked (*) items must be completed; otherwise, the Certificate is not

valid. The Department may disregard this Certificate pursuant to A.R.S. § 42-5008.01 or A.R.S. § 42-5075.E if the Certificate is incomplete

or erroneous. If disregarded, the subcontractor accepting the Certificate will have the burden of proving (pursuant to A.R.S. § 42-5008.01 or

A.R.S. § 42-5075.D), that it is not liable for the prime contracting TPT and/or the amount equal to the retail TPT.

Prime contractor should provide this Certificate to the subcontractor(s) and retain a copy for their records.

A. Contractor

* Name * TPT License Tribal Business License Tribal Number

* Address City, Town or Post Office State ZIP Code

AZ Contractor License Number Phone Number

I am a Native American Contractor working on the reservation established for my tribe. (Provide your Tribal Business License or Tribal Number above.)

I am performing contracting work for a Native American member or the Tribe for which the reservation is established named below.

Name of Tribe

B. Subcontractor

* Name * TPT License # (if none, write “N/A - MRRA only”)

* Address City, Town or Post Office State ZIP Code

AZ Contractor License Number Phone Number

C*. Type of Certificate (check one and provide requested information)

Single Project Certificate Blanket Certificate (check applicable box and fill in requested

*PROJECT DESCRIPTION information).*

* (For example; Building Permit #, Address, Subdivision, OR Period From: Through:

Book/Map/Parcel #s, and/or Legal Description)

Until revoked

* NOTE: Blanket Certificate indicates the prime contractor is responsible

for every contract during the period regardless of contract designation.

Specific Project Exclusion:

Project Designation (see instructions for definitions)

MRRA

Modification Description:

Designation: MRRA Modification

I hereby certify that I am the contractor issuing this form or I have authority to sign this Certificate on behalf of Contractor. I understand

that by executing this Certificate, Contractor is licensed for TPT purposes and is assuming the prime contracting TPT liability

and/or the amount equal to retail TPT liability applicable to the above referenced project(s).

SIGNATURE PRINT NAME

TITLE DATE SIGNED

ADOR 10313 (5/21) This Form Superseded All Other Form 5005’s

Print Reset