Enlarge image

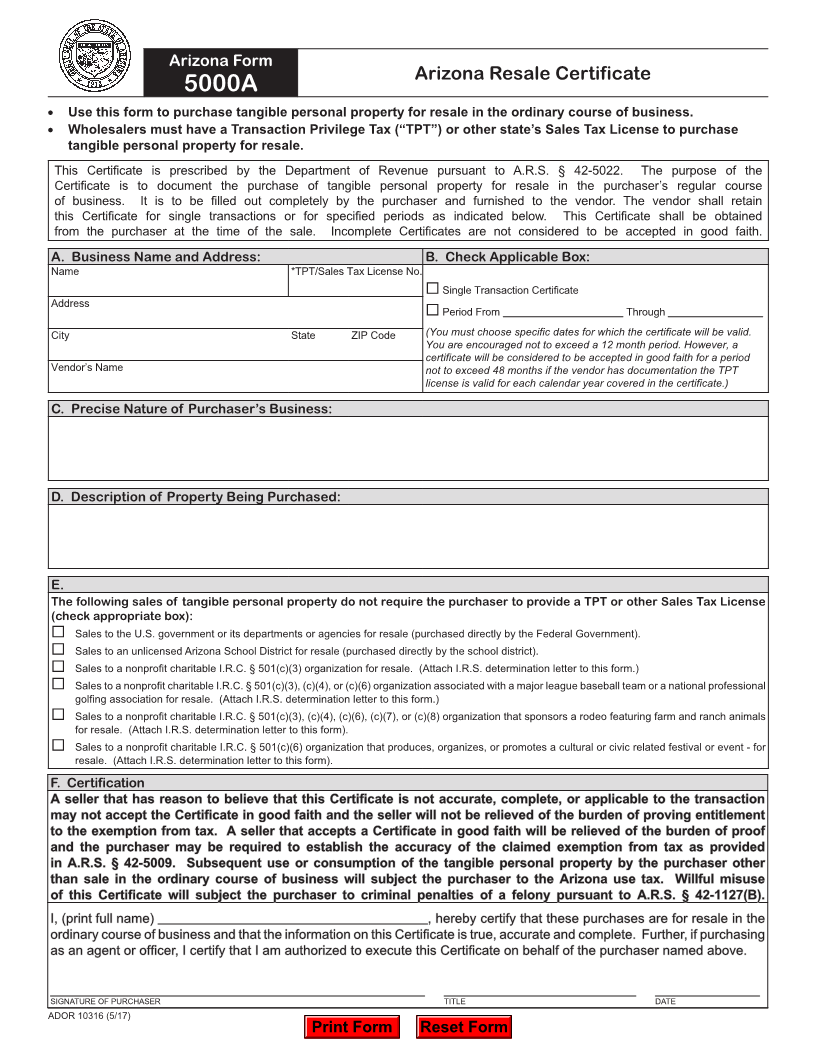

Arizona Form

Arizona Resale Certificate

5000A

• Use this form to purchase tangible personal property for resale in the ordinary course of business.

• Wholesalers must have a Transaction Privilege Tax (“TPT”) or other state’s Sales Tax License to purchase

tangible personal property for resale.

This Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § 42-5022. The purpose of the

Certificate is to document the purchase of tangible personal property for resale in the purchaser’s regular course

of business. It is to be filled out completely by the purchaser and furnished to the vendor. The vendor shall retain

this Certificate for single transactions or for specified periods as indicated below. This Certificate shall be obtained

from the purchaser at the time of the sale. Incomplete Certificates are not considered to be accepted in good faith.

A. Business Name and Address: B. Check Applicable Box:

Name *TPT/Sales Tax License No.

Single Transaction Certificate

Address

Period From Through

City State ZIP Code (You must choose specific dates for which the certificate will be valid.

You are encouraged not to exceed a 12 month period. However, a

certificate will be considered to be accepted in good faith for a period

Vendor’s Name not to exceed 48 months if the vendor has documentation the TPT

license is valid for each calendar year covered in the certificate.)

C. Precise Nature of Purchaser’s Business:

D. Description of Property Being Purchased:

E.

The following sales of tangible personal property do not require the purchaser to provide a TPT or other Sales Tax License

(check appropriate box):

Sales to the U.S. government or its departments or agencies for resale (purchased directly by the Federal Government).

Sales to an unlicensed Arizona School District for resale (purchased directly by the school district).

Sales to a nonprofit charitable I.R.C. § 501(c)(3) organization for resale. (Attach I.R.S. determination letter to this form.)

Sales to a nonprofit charitable I.R.C. § 501(c)(3), (c)(4), or (c)(6) organization associated with a major league baseball team or a national professional

golfing association for resale. (Attach I.R.S. determination letter to this form.)

Sales to a nonprofit charitable I.R.C. § 501(c)(3), (c)(4), (c)(6), (c)(7), or (c)(8) organization that sponsors a rodeo featuring farm and ranch animals

for resale. (Attach I.R.S. determination letter to this form).

Sales to a nonprofit charitable I.R.C. § 501(c)(6) organization that produces, organizes, or promotes a cultural or civic related festival or event - for

resale. (Attach I.R.S. determination letter to this form).

F. Certification

A seller that has reason to believe that this Certificate is not accurate, complete, or applicable to the transaction

may not accept the Certificate in good faith and the seller will not be relieved of the burden of proving entitlement

to the exemption from tax. A seller that accepts a Certificate in good faith will be relieved of the burden of proof

and the purchaser may be required to establish the accuracy of the claimed exemption from tax as provided

in A.R.S. § 42-5009. Subsequent use or consumption of the tangible personal property by the purchaser other

than sale in the ordinary course of business will subject the purchaser to the Arizona use tax. Willful misuse

of this Certificate will subject the purchaser to criminal penalties of a felony pursuant to A.R.S. § 42-1127(B).

I, (print full name) , hereby certify that these purchases are for resale in the

ordinary course of business and that the information on this Certificate is true, accurate and complete. Further, if purchasing

as an agent or officer, I certify that I am authorized to execute this Certificate on behalf of the purchaser named above.

SIGNATURE OF PURCHASER TITLE DATE

ADOR 10316 (5/17)

Print Form Reset Form