Enlarge image

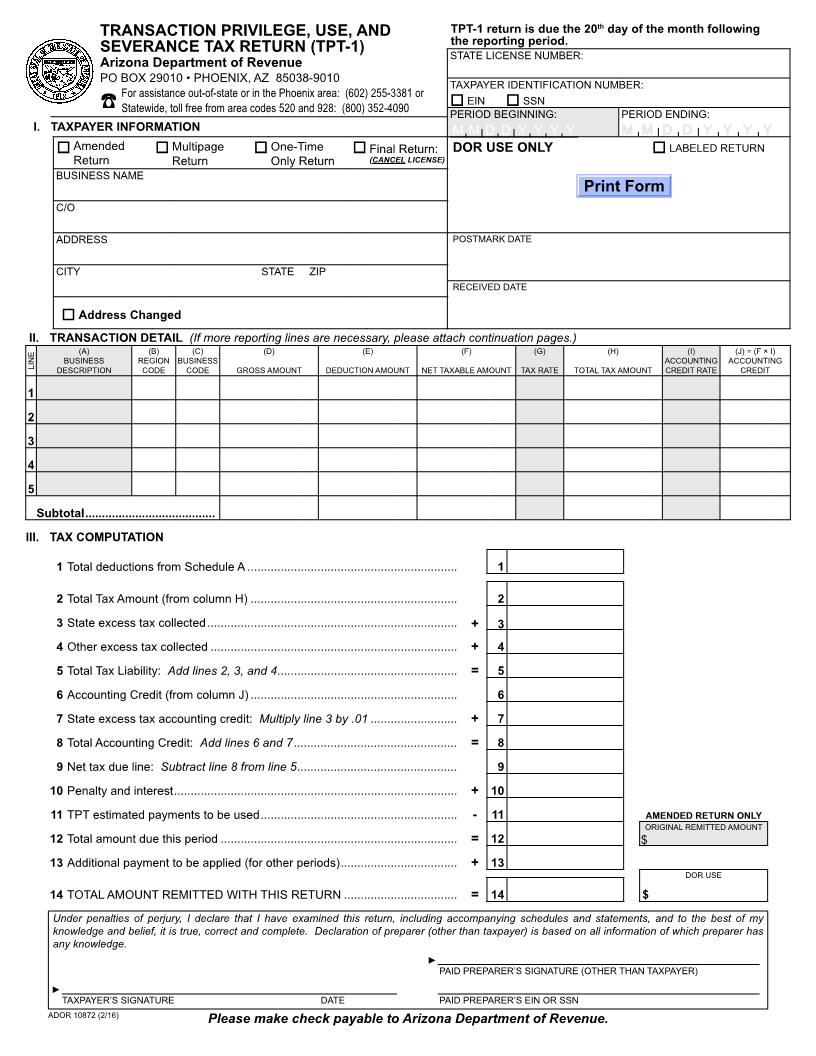

TPT-1 return is due the 20 daythof the month following

TRANSACTION PRIVILEGE, USE, AND

the reporting period.

SEVERANCE TAX RETURN (TPT-1) STATE LICENSE NUMBER:

Arizona Department of Revenue

PO BOX 29010 • PHOENIX, AZ 85038-9010 TAXPAYER IDENTIFICATION NUMBER:

For assistance out-of-state or in the Phoenix area: (602) 255-3381 or

Statewide, toll free from area codes 520 and 928: (800) 352-4090 EIN SSN

PERIOD BEGINNING: PERIOD ENDING:

I. TAXPAYER INFORMATION M M D D Y Y Y Y M M D D Y Y Y Y

Amended Multipage One-Time Final Return: DOR USE ONLY LABELED RETURN

Return Return Only Return (CANCEL LICENSE)

BUSINESS NAME

Print Form

C/O

ADDRESS POSTMARK DATE

CITY STATE ZIP

RECEIVED DATE

Address Changed

II. TRANSACTION DETAIL (If more reporting lines are necessary, please attach continuation pages.)

(A) (B) (C) (D) (E) (F) (G) (H) (I) (J) = (F × I)

LINE BUSINESS REGION BUSINESS ACCOUNTING ACCOUNTING

DESCRIPTION CODE CODE GROSS AMOUNT DEDUCTION AMOUNT NET TAXABLE AMOUNT TAX RATE TOTAL TAX AMOUNT CREDIT RATE CREDIT

1

2

3

4

5

Subtotal .......................................

III. TAX COMPUTATION

1 Total deductions from Schedule A ............................................................... 1

2 Total Tax Amount (from column H) .............................................................. 2

3 State excess tax collected ........................................................................... + 3

4 Other excess tax collected .......................................................................... + 4

5 Total Tax Liability: Add lines 2, 3, and 4 ...................................................... = 5

6 Accounting Credit (from column J) .............................................................. 6

7 State excess tax accounting credit: Multiply line 3 by .01 .......................... + 7

8 Total Accounting Credit: Add lines 6 and 7 ................................................. = 8

9 Net tax due line: Subtract line 8 from line 5 ................................................ 9

10 Penalty and interest ..................................................................................... + 10

11 TPT estimated payments to be used ........................................................... - 11 AMENDED RETURN ONLY

ORIGINAL REMITTED AMOUNT

12 Total amount due this period ....................................................................... = 12 $

13 Additional payment to be applied (for other periods) ................................... + 13

DOR USE

14 TOTAL AMOUNT REMITTED WITH THIS RETURN .................................. = 14 $

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has

any knowledge.

►

PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

►

TAXPAYER’S SIGNATURE DATE PAID PREPARER’S EIN OR SSN

ADOR 10872 (2/16)

Please make check payable to Arizona Department of Revenue.