Enlarge image

Print All Pages

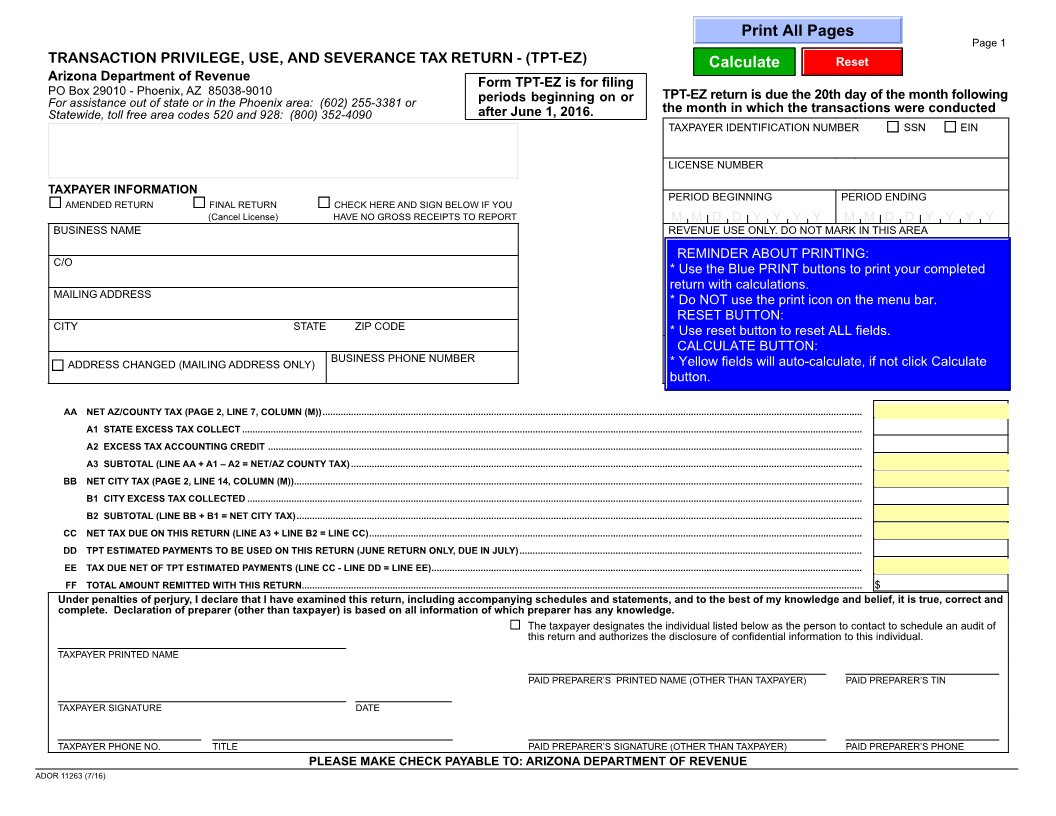

Page 1

TRANSACTION PRIVILEGE, USE, AND SEVERANCE TAX RETURN - (TPT-EZ) Calculate Reset

Arizona Department of Revenue Form TPT-EZ is for filing

PO Box 29010 - Phoenix, AZ 85038-9010 TPT-EZ return is due the 20th day of the month following

For assistance out of state or in the Phoenix area: (602) 255-3381 or periods beginning on or the month in which the transactions were conducted

Statewide, toll free area codes 520 and 928: (800) 352-4090 after June 1, 2016.

TAXPAYER IDENTIFICATION NUMBER SSN EIN

LICENSE NUMBER

TAXPAYER INFORMATION PERIOD BEGINNING PERIOD ENDING

AMENDED RETURN FINAL RETURN CHECK HERE AND SIGN BELOW IF YOU

(Cancel License) HAVE NO GROSS RECEIPTS TO REPORT M M D D Y Y Y Y M M D D Y Y Y Y

BUSINESS NAME REVENUE USE ONLY. DO NOT MARK IN THIS AREA

REMINDER ABOUT PRINTING:

C/O

* Use the Blue PRINT buttons to print your completed

return with calculations.

MAILING ADDRESS * Do NOT use the print icon on the menu bar.

RESET BUTTON:

CITY STATE ZIP CODE * Use reset button to reset ALL fields.

POSTMARK DATE CALCULATE BUTTON: RECEIVED DATE

ADDRESS CHANGED (MAILING ADDRESS ONLY) BUSINESS PHONE NUMBER * Yellow fields will auto-calculate, if not click Calculate

button.

AA NET AZ/COUNTY TAX (PAGE 2, LINE 7, COLUMN (M)) ................................................................................................................................................................................................................

A1 STATE EXCESS TAX COLLECT ...............................................................................................................................................................................................................................................

A2 EXCESS TAX ACCOUNTING CREDIT .....................................................................................................................................................................................................................................

A3 SUBTOTAL (LINE AA + A1 – A2 = NET/AZ COUNTY TAX) .....................................................................................................................................................................................................

BB NET CITY TAX (PAGE 2, LINE 14, COLUMN (M)) ...........................................................................................................................................................................................................................

B1 CITY EXCESS TAX COLLECTED .............................................................................................................................................................................................................................................

B2 SUBTOTAL (LINE BB + B1 = NET CITY TAX) ..........................................................................................................................................................................................................................

CC NET TAX DUE ON THIS RETURN (LINE A3 + LINE B2 = LINE CC) ..............................................................................................................................................................................................

DD TPT ESTIMATED PAYMENTS TO BE USED ON THIS RETURN (JUNE RETURN ONLY, DUE IN JULY) ....................................................................................................................................

EE TAX DUE NET OF TPT ESTIMATED PAYMENTS (LINE CC - LINE DD = LINE EE) ......................................................................................................................................................................

FF TOTAL AMOUNT REMITTED WITH THIS RETURN........................................................................................................................................................................................................................ $

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and

complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

The taxpayer designates the individual listed below as the person to contact to schedule an audit of

this return and authorizes the disclosure of confidential information to this individual.

TAXPAYER PRINTED NAME

PAID PREPARER’S PRINTED NAME (OTHER THAN TAXPAYER) PAID PREPARER’S TIN

TAXPAYER SIGNATURE DATE

TAXPAYER PHONE NO. TITLE PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER) PAID PREPARER’S PHONE

PLEASE MAKE CHECK PAYABLE TO: ARIZONA DEPARTMENT OF REVENUE

ADOR 11263 (7/16)