Enlarge image

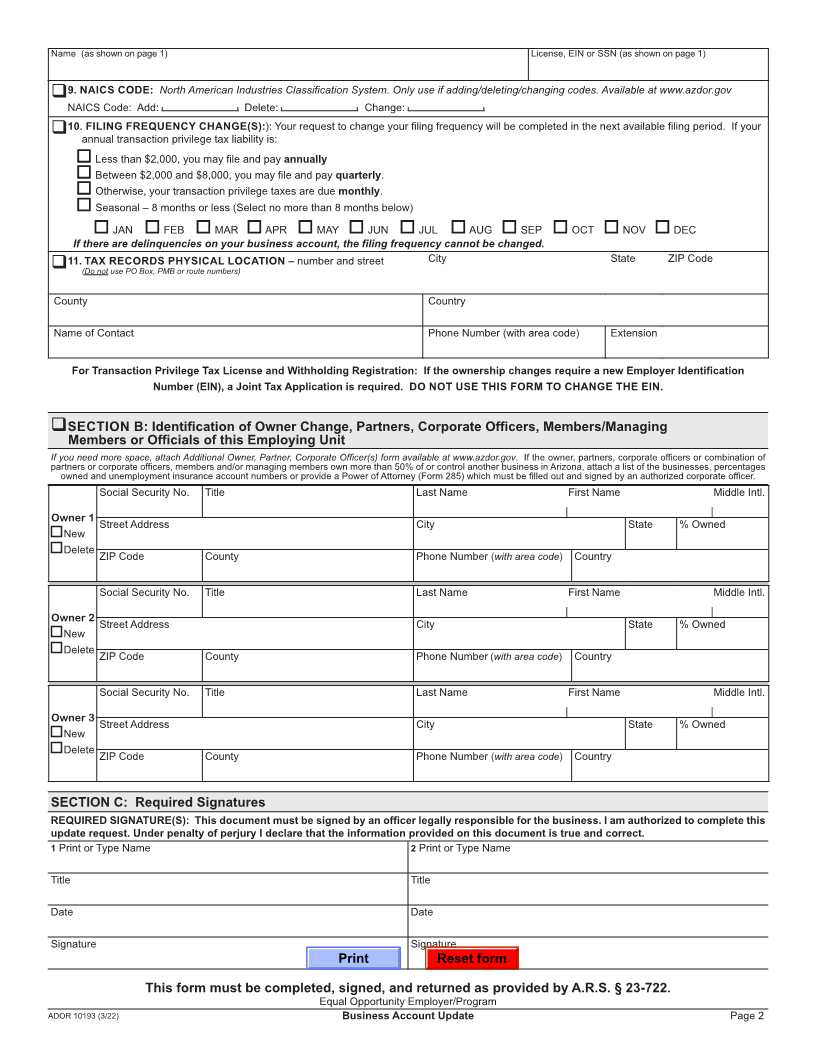

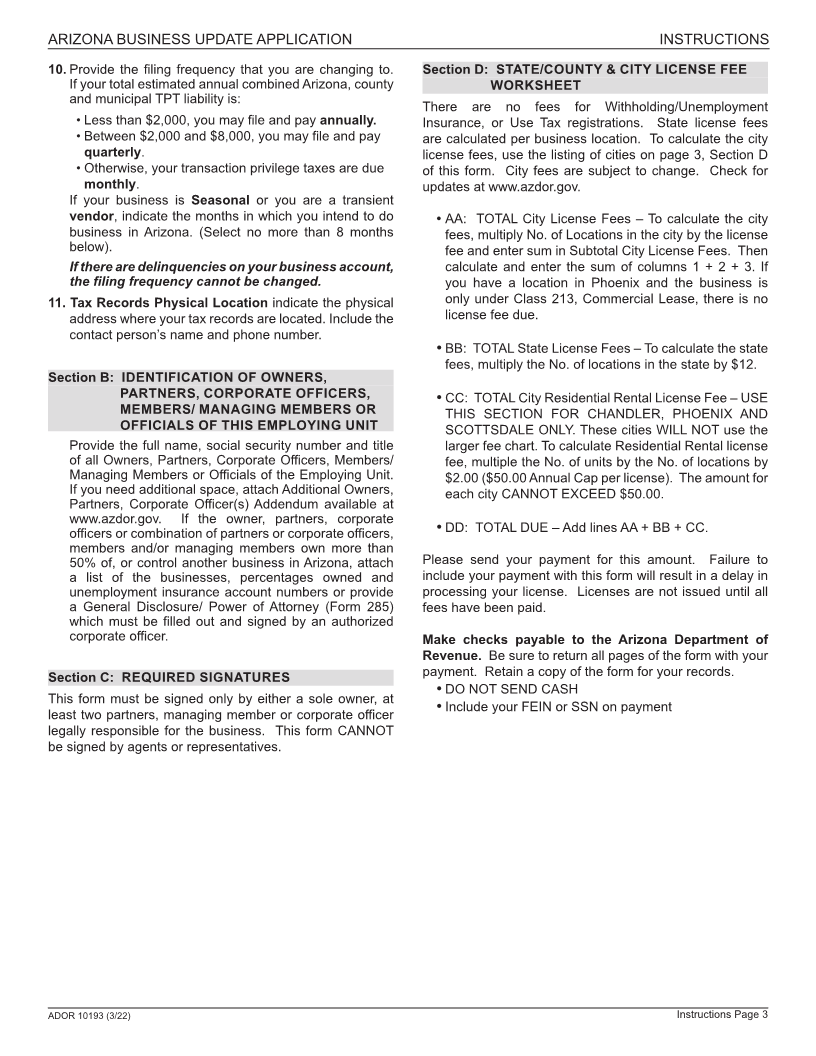

BUSINESS ACCOUNT UPDATE

INSTRUCTIONS: Please check boxes to indicate the change you You can now make

License and Registration are requesting and complete the section. Asterisk (*) changes to updates/edits to your

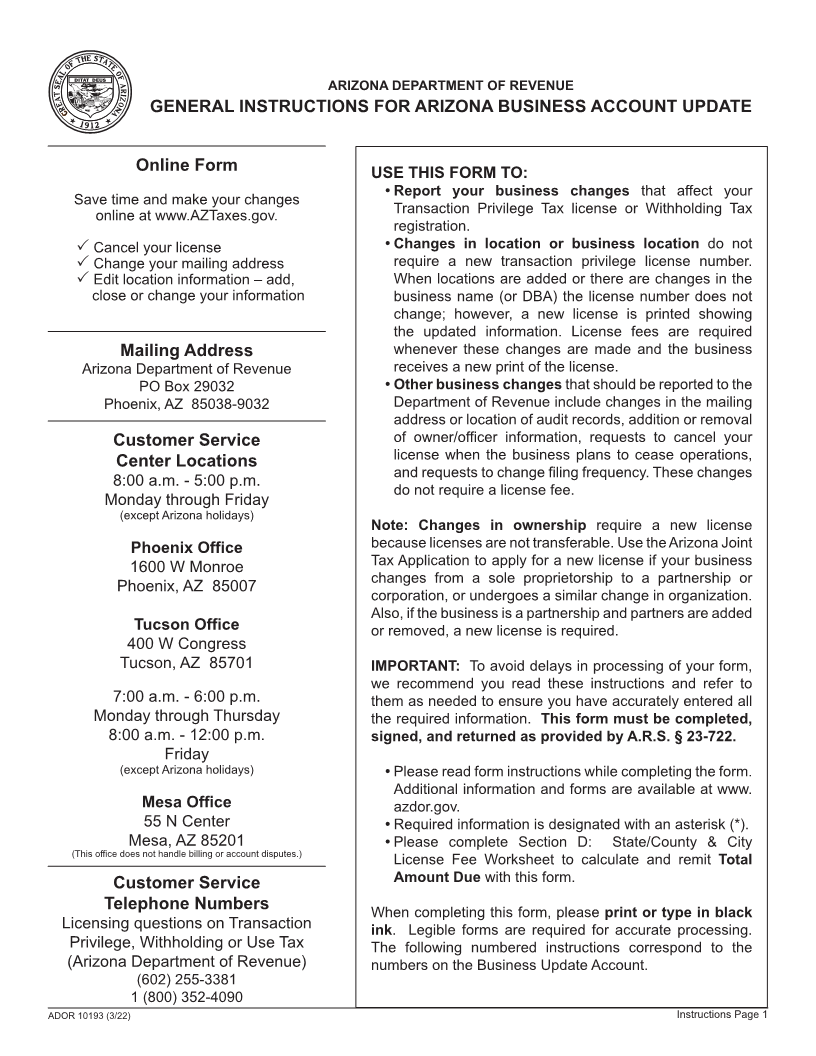

ARIZONA DEPARTMENT OF REVENUE Transaction Privilege Tax Licenses are subject to a fee of $12 per

PO BOX 29032 Business Account at

Phoenix, AZ 85038-9032 location for the state fee and any applicable city fees (see page 3). www.AZTaxes.gov. It is

(602) 255- 3381 There are no fees for changes to Corporate Account, Use Tax fast and secure.

1 (800) 352-4090 or Withholding Registrations.

BONDING REQUIREMENT: A taxpayer in the contracting business MUST maintain a bond for a minimum of 2 years. When requesting change(s) to the Physical Location,

Legal Name and/or Business Name, “Doing Business As”, within the first 2 years, a Bond Rider to match the change(s) requested MUST be obtained prior to the request and

submitted with this Business Account Update Form.

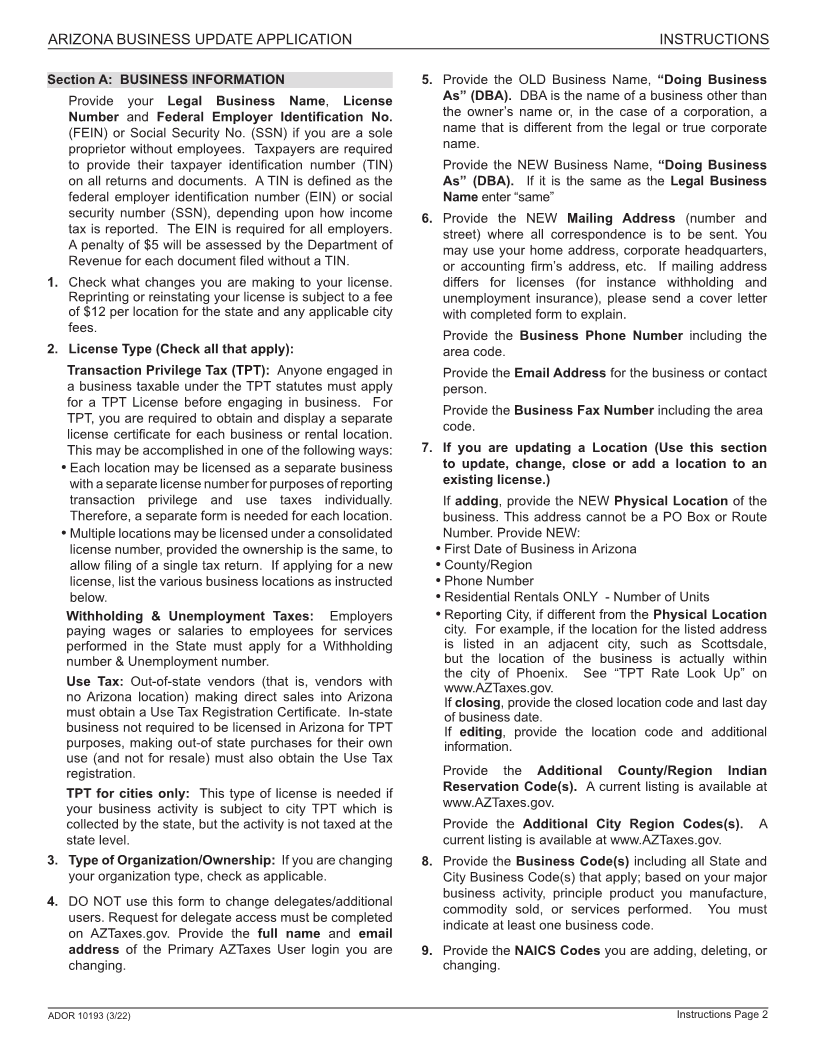

SECTION A: Business Information

Legal Business Name

License Number Federal Employer Identification Number or Social Security Number, required if sole proprietor with no employees

CORRECTION TO: Federal Employer Identification Number Social Security Number

1. CHANGE(S) TO LICENSE

*Reprint License *Reinstate License Effective Date: M M D D Y Y Y Y Cancel License Effective Date:

(Date required for Withholding Only) M M D D Y Y Y Y

2. LICENSE TYPE – Check all that apply:

Transaction Privilege Tax License Use Tax TPT for Cities ONLY Withholding/Unemployment Tax Registration (if hiring employees)

3. TYPE OF ORGANIZATION/OWNERSHIP Use this section to correct organization/owner type. If the ownership changes require a new Employer Identification

Number (EIN), a Joint Tax Application is required. DO NOT USE THIS FORM TO CHANGE THE EIN. Acceptable organization/ownership types:

CURRENT TYPE

Individual/Sole Proprietorship Subchapter S Corporation Government Joint Venture

Corporation Association Estate Receivership

Partnership Limited Liability Company Trust Limited Liability Partnership

NEW TYPE

Individual/Sole Proprietorship Subchapter S Corporation Government Joint Venture

Corporation Association Estate Receivership

Partnership Limited Liability Company Trust Limited Liability Partnership

4. AZTAXES PRIMARY USER: You must enroll to file and pay on www.AZTaxes.gov. DO NOT use this form to change delegates/additional users.

Primary User: Maintains the entire online account and provides access to delegate users. There can only be one Primary User for each account.

The Arizona Department of Revenue recommends that this be an officer/owner of the business.

Remove Username: Effective date:

Delegate User: Is given specific authority for business account functions by the Primary User. This type of user can be a CPA, Paid Preparer,

office managers, additional officer/owner of the company, etc. Please contact primary user for changes to delegate access.

Name of Primary User Email Address - Your email will become your AZTaxes username

5. OLD Business Name, “Doing Business As” or Trade Name at this NEW Business Name, “Doing Business As” or Trade Name at this Physical

Physical Location Location

6. NEW Mailing Address – number and street City State ZIP Code

County/Region Country

Business Phone Number (with area code) Email Address Fax Number (with area code)

7.*LOCATION Add: Close Loc Code: Edit Loc Code:

First Day of Business: MM D D Y Y Y Y Last Day of Business: MM D D Y Y Y Y

NEW Physical Location of Business or Commercial/Residential Rental City State ZIP Code

Number and street (Do not use PO Box, PMB or route numbers)

County/Region Residential Rental Only – Number of Units Reporting City - See “TPT Rate Look Up” on AZTaxes.gov

Additional County/Region Indian Reservation: See “TPT Rate Look Up” on AZTaxes.gov Additional City Region(s): See “TPT Rate Look Up” on AZTaxes.gov

8. *BUSINESS CODE: Include all State and City that apply - See “TPT Rate Look Up” on AZTaxes.gov. If you need more space, attach Additional

Business Location(s) Addendum Available at www.azdor.gov

ADOR 10193 (3/22) Continued on page 2