Enlarge image

Arizona Form

2022 Withholding Tax Information Authorization 821

For information or help, call one of these numbers: Section 2 - Appointee Information

Phoenix (602) 255-3381 Enter the name of your appointee. For an appointee ID, please

From area codes 520 and 928, toll-free (800) 352-4090 provide the appointee’s Social Security Number, CPA number,

Tax forms, instructions, and other tax information State Bar number, Alternative Preparer Tax Identification Number,

If you need tax forms, instructions, and other tax information, go to EIN, or other ID number.

the department’s website atwww.azdor.gov. Section 3 - Authorization

Withholding Tax Procedures and Rulings The appointee may only be authorized to inspect and/or receive

These instructions may refer to the department’s withholding tax Arizona withholding tax information. Enter the years or periods for

procedures and rulings for more information. To view or print which the authorization is granted.

these, go to our website and click on Reports & Legal Research then Any tax year(s) or period(s) that have ended as of the date a

click on Legal Research and select a Document Type and Category withholding tax information authorization is signed may be listed.

from the drop down menus. The number of future tax years or periods that will be accepted is

Publications limited to tax years or periods that end no later than four years after

To view or print the department’s publications, go to our website the date the withholding tax information authorization is signed.

and click on Reports & Legal Research. Then click on Publications. A general reference to “all years” or “all periods” will be accepted

as applying only to tax years (periods) ending prior to the date the

General Instructions withholding tax information authorization is signed. A general

reference to “all future years” will be subject to the four-year

Purpose of Form

limitation.

A taxpayer may use Form 821 to authorize any individual,

corporation, firm, organization, or partnership to inspect and/or Section 4 - Retention/Revocation of Withholding Tax

receive confidential Arizona withholding tax information for the Information Authorization

years or periods listed on the form. A new withholding tax information authorization will revoke a prior

If a taxpayer wants an individual to inspect and/or receive withholding tax information authorization if it is granted by the

information for tax types other than withholding, or to perform other taxpayer to another appointee for the same years or periods covered

acts on the taxpayer’s behalf, the taxpayer may not use Form 821. by this document.

The taxpayer must use Arizona Form 285, General If there is any existing withholding tax information authorization

Disclosure/Representation Authorization Form, or other you do not want to revoke, check the box in this section, and include

comparable form. Only an individual may be designated as a a copy of the withholding tax information authorization.

representative under a General Disclosure/Representation A taxpayer may revoke a withholding tax information authorization

Authorization Form. without authorizing a new appointee by filing a statement of

Filing Instructions revocation with the department. The statement of revocation must

If an Arizona Department of Revenue employee requests that you indicate that the authority of the previous withholding tax

submit this form, please submit the completed form to that employee information authorization is revoked and must be signed by the

at the address provided by that employee. taxpayer. Also, the name and address of each appointee whose

Otherwise, the department offers three options to submit this form: authority is revoked must be listed (or a copy of the withholding tax

information authorization to be revoked must be included and

• Email the completed form to: POA@azdor.gov

marked “revoked”).

• Fax the completed form to: (602) 716-6088

• Mail the original or copy of the completed form to: The filing of a Form 821 will not revoke any Arizona Form 285,

Arizona Department of Revenue or other power of attorney that is in effect.

ATTENTION: Power of Attorney Section 5 - Signature of or for Taxpayer

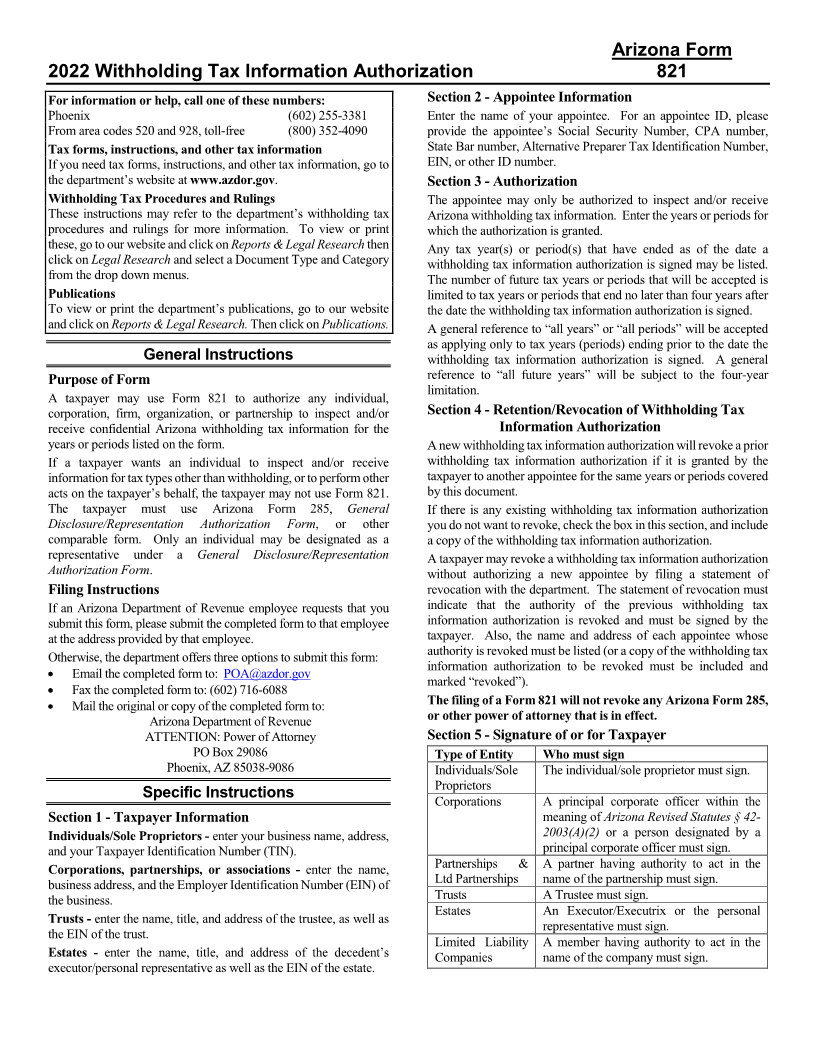

PO Box 29086 Type of Entity Who must sign

Phoenix, AZ 85038-9086 Individuals/Sole The individual/sole proprietor must sign.

Proprietors

Specific Instructions Corporations A principal corporate officer within the

Section 1 - Taxpayer Information meaning ofArizona Revised Statutes § 42-

Individuals/Sole Proprietors - enter your business name, address, 2003(A)(2) or a person designated by a

and your Taxpayer Identification Number (TIN). principal corporate officer must sign.

Corporations, partnerships, or associations - enter the name, Partnerships & A partner having authority to act in the

business address, and the Employer Identification Number (EIN) of Ltd Partnerships name of the partnership must sign.

Trusts A Trustee must sign.

the business.

Estates An Executor/Executrix or the personal

Trusts - enter the name, title, and address of the trustee, as well as

representative must sign.

the EIN of the trust. Limited Liability A member having authority to act in the

Estates - enter the name, title, and address of the decedent’s Companies name of the company must sign.

executor/personal representative as well as the EIN of the estate.