Enlarge image

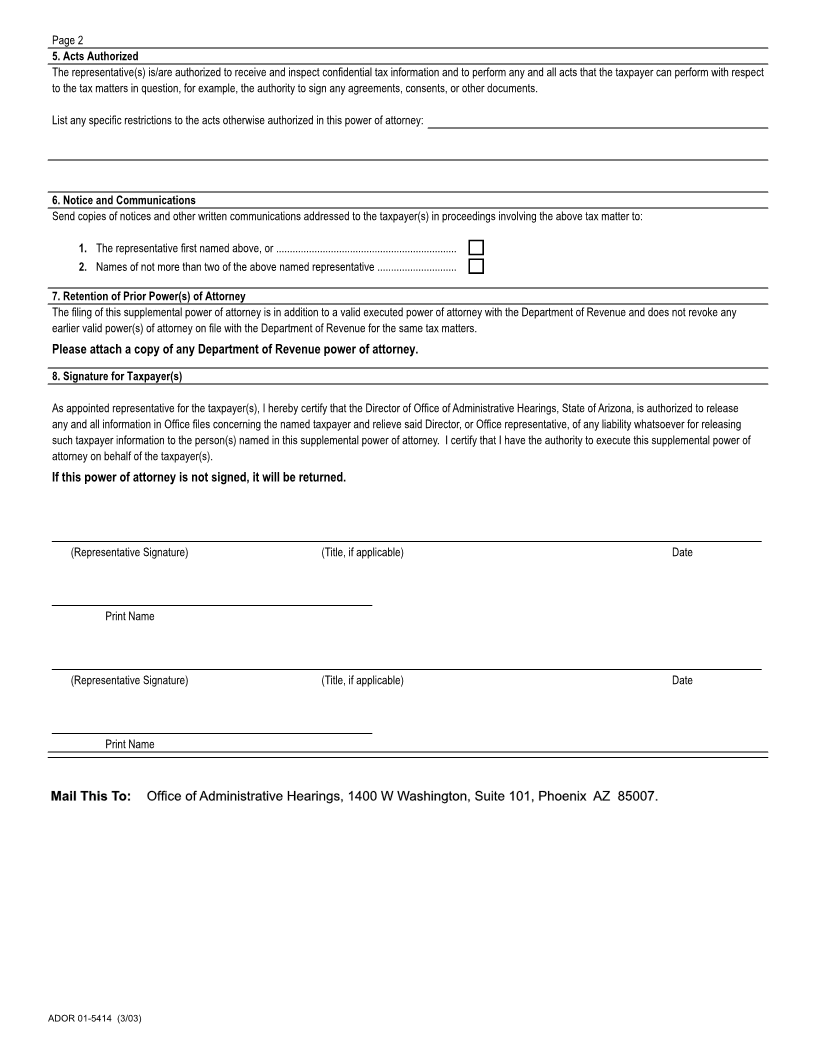

State of Arizona

Offi ce of Administrative Hearings

Supplemental Power of Attorney

Purpose of Form The Department of Revenue has transferred a contested matter to the Offi ce of Administrative Hearings

for a hearing. The Arizona statutes require written authorization before the Offi ce of Administrative Hearings can disclose

confi dential tax information to a taxpayer’s representative. This supplemental power of attorney form must be fi lled out by

the appointed representative and fi led with the Offi ce of Administrative Hearings in order that the Offi ce may deal with the

appointed representative in the matter(s) transferred to the Offi ce by the Department of Revenue.

Authority Granted This supplemental power of Attorney authorizes the individuals named herein to receive and inspect

confi dential tax information and to perform any and all acts the taxpayer(s) can perform with respect to these matters in

dealing with the Offi ce of Administrative Hearings.

1. Taxpayer Information 2. Applicable Identifi cation Number

Daytime telephone number Arizona transaction privilege tax number

Taxpayer name(s) ( )

Federal employer identifi cation number

Address Social security number

City State ZIP code

3. Representative(s)

Name and address ID number

Telephone number ( )

Fax number ( )

Name and address ID number

Telephone number ( )

Fax number ( )

4. Tax Matters

Tax type Entity/Type of return Case Number

Transaction Sole Proprietorship Partnership

Privilege Tax

Corporation

Use Sole Proprietorship Partnership

Corporation

Other

(Specify Tax

Type)

ADOR 01-5414 (3/03)