Enlarge image

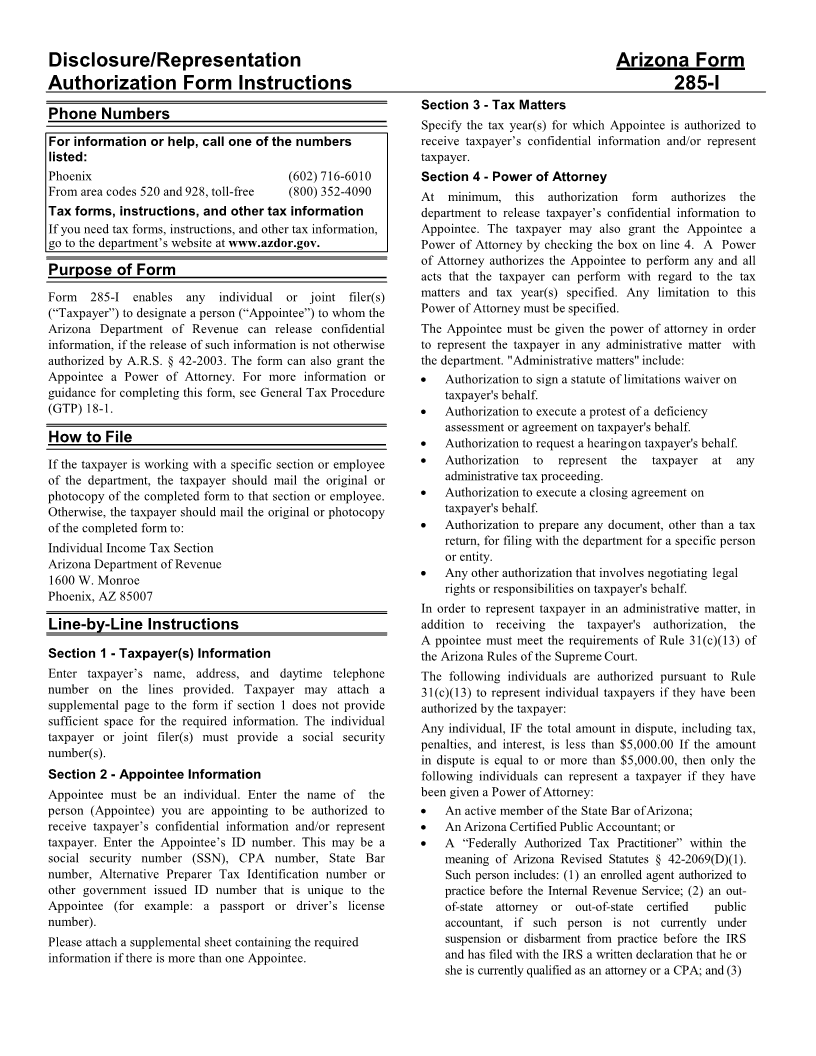

Disclosure/Representation Arizona Form

Authorization Form Instructions 285-I

Section 3 - Tax Matters

Phone Numbers Specify the tax year(s) for which Appointee is authorized to

For information or help, call one of the numbers receive taxpayer’s confidential information and/or represent

listed: taxpayer.

Phoenix (602) 716-6010 Section 4 - Power of Attorney

From area codes 520 and 928, toll-free (800) 352-4090 At minimum, this authorization form authorizes the

Tax forms, instructions, and other tax information department to release taxpayer’s confidential information to

If you need tax forms, instructions, and other tax information, Appointee. The taxpayer may also grant the Appointee a

go to the department’s website at www.azdor.gov. Power of Attorney by checking the box on line 4. A Power

of Attorney authorizes the Appointee to perform any and all

Purpose of Form acts that the taxpayer can perform with regard to the tax

Form 285-I enables any individual or joint filer(s) matters and tax year(s) specified. Any limitation to this

(“Taxpayer”) to designate a person (“Appointee”) to whom the Power of Attorney must be specified.

Arizona Department of Revenue can release confidential The Appointee must be given the power of attorney in order

information, if the release of such information is not otherwise to represent the taxpayer in any administrative matter with

authorized by A.R.S. § 42-2003. The form can also grant the the department. "Administrative matters" include:

Appointee a Power of Attorney. For more information or • Authorization to sign a statute of limitations waiver on

guidance for completing this form, see General Tax Procedure taxpayer's behalf.

(GTP) 18-1. • Authorization to execute a protest of a deficiency

assessment or agreement on taxpayer's behalf.

How to File • Authorization to request a hearing on taxpayer's behalf.

If the taxpayer is working with a specific section or employee • Authorization to represent the taxpayer at any

of the department, the taxpayer should mail the original or administrative tax proceeding.

photocopy of the completed form to that section or employee. • Authorization to execute a closing agreement on

Otherwise, the taxpayer should mail the original or photocopy taxpayer's behalf.

of the completed form to: • Authorization to prepare any document, other than a tax

return, for filing with the department for a specific person

Individual Income Tax Section

or entity.

Arizona Department of Revenue

• Any other authorization that involves negotiating legal

1600 W. Monroe

rights or responsibilities on taxpayer's behalf.

Phoenix, AZ 85007

In order to represent taxpayer in an administrative matter, in

Line-by-Line Instructions addition to receiving the taxpayer's authorization, the

A ppointee must meet the requirements of Rule 31(c)(13) of

Section 1 - Taxpayer(s) Information the Arizona Rules of the Supreme Court.

Enter taxpayer’s name, address, and daytime telephone The following individuals are authorized pursuant to Rule

number on the lines provided. Taxpayer may attach a 31(c)(13) to represent individual taxpayers if they have been

supplemental page to the form if section 1 does not provide authorized by the taxpayer:

sufficient space for the required information. The individual

Any individual, IF the total amount in dispute, including tax,

taxpayer or joint filer(s) must provide a social security

penalties, and interest, is less than $5,000.00 If the amount

number(s).

in dispute is equal to or more than $5,000.00, then only the

Section 2 - Appointee Information following individuals can represent a taxpayer if they have

Appointee must be an individual. Enter the name of the been given a Power of Attorney:

person (Appointee) you are appointing to be authorized to • An active member of the State Bar of Arizona;

receive taxpayer’s confidential information and/or represent • An Arizona Certified Public Accountant; or

taxpayer. Enter the Appointee’s ID number. This may be a • A “Federally Authorized Tax Practitioner” within the

social security number (SSN), CPA number, State Bar meaning of Arizona Revised Statutes § 42-2069(D)(1).

number, Alternative Preparer Tax Identification number or Such person includes: (1) an enrolled agent authorized to

other government issued ID number that is unique to the practice before the Internal Revenue Service; (2) an out-

Appointee (for example: a passport or driver’s license of-state attorney or out-of-state certified public

number). accountant, if such person is not currently under

Please attach a supplemental sheet containing the required suspension or disbarment from practice before the IRS

information if there is more than one Appointee. and has filed with the IRS a written declaration that he or

she is currently qualified as an attorney or a CPA; and (3)