Enlarge image

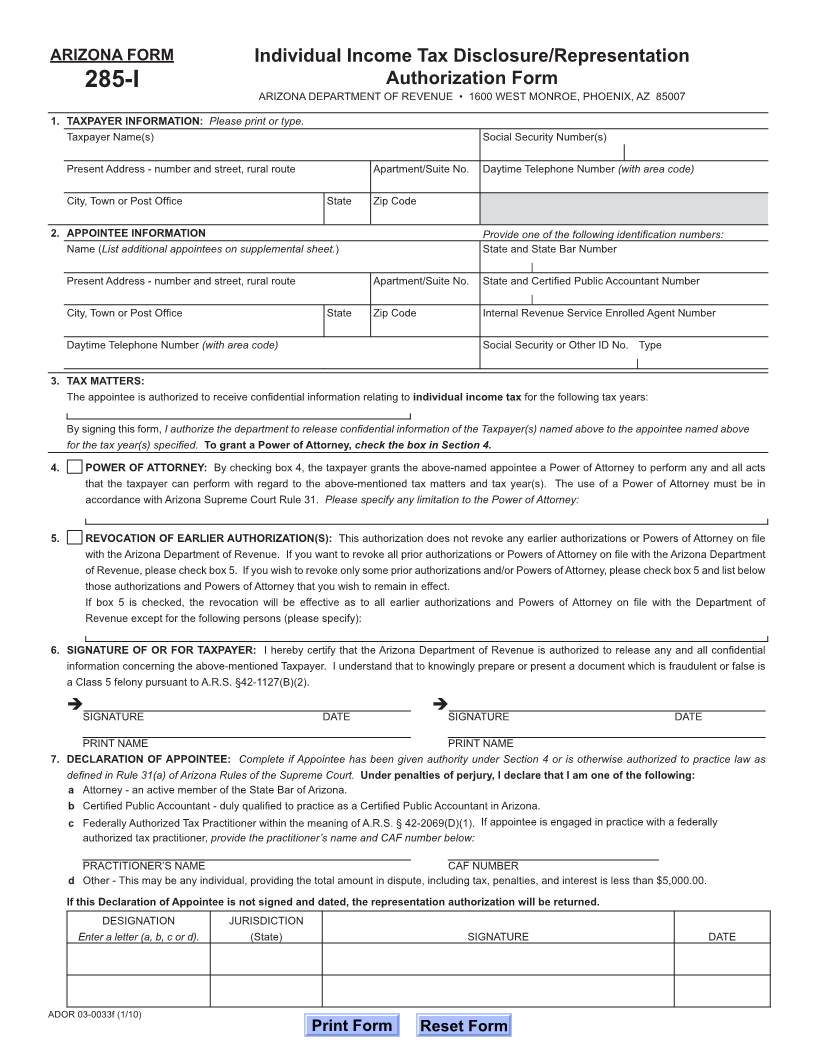

ARIZONA FORM Individual Income Tax Disclosure/Representation

285-I Authorization Form

ARIZONA DEPARTMENT OF REVENUE • 1600 WEST MONROE, PHOENIX, AZ 85007

1. TAXPAYER INFORMATION: Please print or type.

Taxpayer Name(s) Social Security Number(s)

Present Address - number and street, rural route Apartment/Suite No. Daytime Telephone Number (with area code)

City, Town or Post Offi ce State Zip Code

2. APPOINTEE INFORMATION Provide one of the following identifi cation numbers:

Name (List additional appointees on supplemental sheet.) State and State Bar Number

|

Present Address - number and street, rural route Apartment/Suite No. State and Certifi ed Public Accountant Number

|

City, Town or Post Offi ce State Zip Code Internal Revenue Service Enrolled Agent Number

Daytime Telephone Number (with area code) Social Security or Other ID No. Type

|

3. TAX MATTERS:

The appointee is authorized to receive confi dential information relating to individual income tax for the following tax years:

By signing this form, I authorize the department to release confi dential information of the Taxpayer(s) named above to the appointee named above

for the tax year(s) specifi ed. To grant a Power of Attorney, check the box in Section 4.

4. POWER OF ATTORNEY: By checking box 4, the taxpayer grants the above-named appointee a Power of Attorney to perform any and all acts

that the taxpayer can perform with regard to the above-mentioned tax matters and tax year(s). The use of a Power of Attorney must be in

accordance with Arizona Supreme Court Rule 31. Please specify any limitation to the Powerof Attorney:

5. REVOCATION OF EARLIER AUTHORIZATION(S): This authorization does not revoke any earlier authorizations or Powers of Attorney on fi le

with the Arizona Department of Revenue. If you want to revoke all prior authorizations or Powers of Attorney on fi le with the Arizona Department

of Revenue, please check box 5. If you wish to revoke only some prior authorizations and/or Powers of Attorney, please check box 5 and list below

those authorizations and Powers of Attorney that you wish to remain in effect.

If box 5 is checked, the revocation will be effective as to all earlier authorizations and Powers of Attorney on fi le with the Department of

Revenue except for the following persons (please specify):

6. SIGNATURE OF OR FOR TAXPAYER: I hereby certify that the Arizona Department of Revenue is authorized to release any and all confi dential

information concerning the above-mentioned Taxpayer. I understand that to knowingly prepare or present a document which is fraudulent or false is

a Class 5 felony pursuant to A.R.S. §42-1127(B)(2).

Î Î

SIGNATURE DATE SIGNATURE DATE

PRINT NAME PRINT NAME

7. DECLARATION OF APPOINTEE: Complete if Appointee has been given authority under Section 4 or is otherwise authorized to practice law as

defi ned in Rule 31(a) of Arizona Rules of the Supreme Court. Under penalties of perjury, I declare that I am one of the following:

a Attorney - an active member of the State Bar of Arizona.

b Certifi ed Public Accountant - duly qualifi ed to practice as a Certifi ed Public Accountant in Arizona.

c Federally Authorized Tax Practitioner within the meaning of A.R.S. § 42-2069(D)(1). If appointee is engaged in practice with a federally

authorized tax practitioner, provide the practitioner’s name and CAF number below:

PRACTITIONER’S NAME CAF NUMBER

d Other - This may be any individual, providing the total amount in dispute, including tax, penalties, and interest is less than $5,000.00.

If this Declaration of Appointee is not signed and dated, the representation authorization will be returned.

DESIGNATION JURISDICTION

Enter a letter (a, b, c or d). (State) SIGNATURE DATE

ADOR 03-0033f (1/10)

Print Form Reset Form