Enlarge image

General Disclosure/Representation Arizona Form

Authorization Form 285C

supplemental sheet, as applicable, containing the names of

Phone Numbers

each member of the consolidated/combined group for which

For information or help, call one of the numbers listed: the signator of Form 285C is a principal corporate officer and

Phoenix (602) 255-3381 to which this Form 285C applies.

From area codes 520 and 928, toll-free (800) 352-4090 Foreign Address -

Tax forms, instructions, and other tax information If the Taxpayer has a foreign address, enter the information in

the following order: city, province or state, and country.

If you need tax forms, instructions, and other tax information,

Follow the country’s practice for entering the postal code. Do

go to the department’s website at www.azdor.gov.

not abbreviate the country name.

Purpose of Form For income tax purposes:

Form 285C enables an individual to certify to the Department • Each individual signing this form must enter his or her

that he or she is authorized, pursuant to Arizona Revised Social Security Number (SSN) or Individual Tax

Statute (A.R.S.) § 42-2003(A) to receive and discuss the Identification Number (ITIN).

confidential information of the corporation, group of • A corporation, partnership, LLC, trust or estate must

consolidated or combined corporations, partnership, LLC, enter its employer identification number (EIN).

estate, trust, or other organization, association, or group

For withholding tax purposes:

thereof (“Taxpayer”).

An individual, corporation, partnership, LLC, trust, or estate

For more information or guidance for completing this form, must enter the EIN.

see General Tax Procedure (GTP) 18-1, Procedure for

Submitting an Authorization for Disclosure of Confidential For transaction privilege tax (TPT) purposes:

Information and Powers of Attorney. If the Taxpayer has only one license that is covered by this

Important Tips - Form 285C, enter that specific TPT license number.

• Review the instructions and GTP 18-1 before completing If the Taxpayer has more than one license number, include a

the form. separate sheet identifying the license number and location for

• Inspect the form and verify you have entered all of the each license that is covered by this Form 285C.

required information. NOTE: If a Taxpayer wants all of its business locations

• Retain a copy for your files. covered by this Form 285C, include the EIN of the business

(or the SSN or ITIN associated with the business if the

How to File business does not have an EIN).

If an Arizona Department of Revenue (ADOR) employee

Section 2 - Signator Information

requests that you submit this form, please send the completed

form directly to the address that the employee provides, with For an Identification Number, please provide a SSN or ITIN,

attention to the employee. Certified Public Accountant (CPA) number, State Bar number,

Alternative Preparer Tax Identification Number, or other

Otherwise, ADOR offers three convenient options to submit

government issued ID number that is unique to the Appointee

your form.

(for example: a passport or driver’s license number).

1. Email the completed form to: POA@azdor.gov.

Section 3 - Tax Periods

2. Fax the completed form to: (602) 716-6008.

3. Mail an original or photocopy of the completed form to: Please specify the tax year(s) or tax period(s) during which the

Signator is/was authorized, pursuant to A.R.S. § 42-2003(A),

Arizona Department of Revenue

to receive and discuss Taxpayer’s confidential information.

ATTN: Power of Attorney

PO Box 29086 Section 4 - Certification

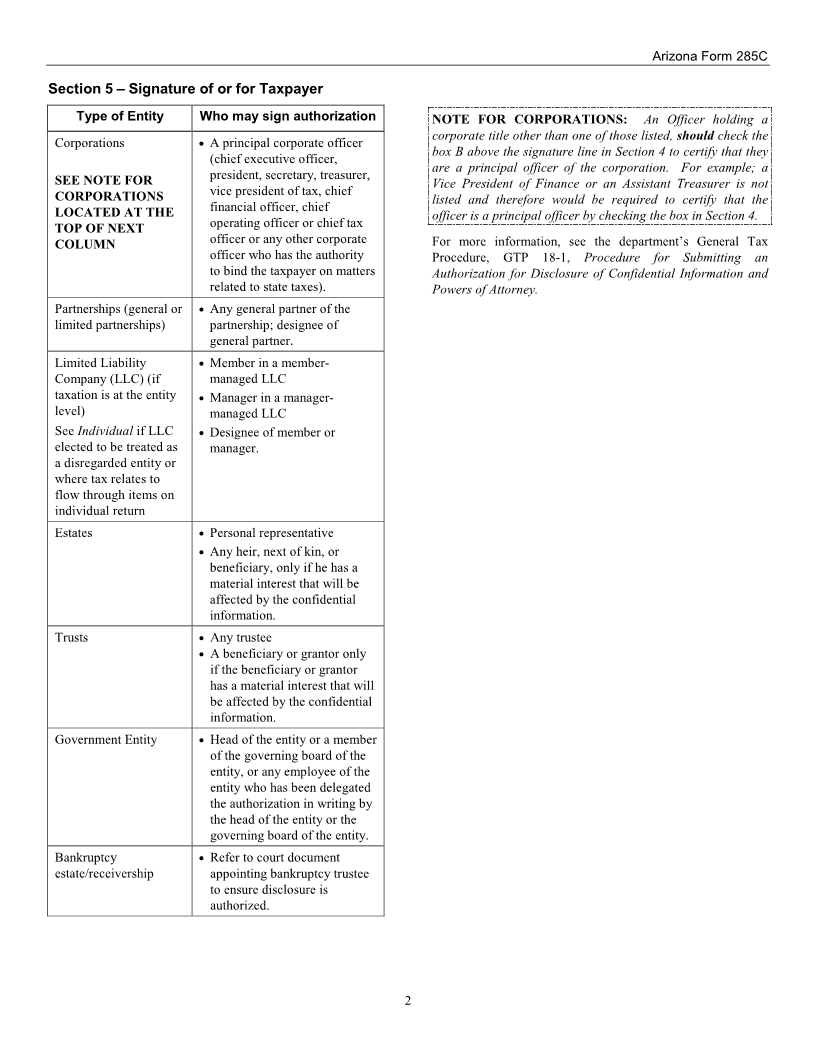

Phoenix, AZ 85038-9086 The Signator is required to:

Line-by-Line Instructions 1. Indicate, by checking box A, that he or she is

authorized, pursuant to A.R.S. § 42-2003(A), to receive

Section 1 - Taxpayer Information and discuss confidential information in Section 1.

Enter Taxpayer’s name, current address, and daytime 2. Indicate, by checking box B, that he or she is an officer of

telephone number on the lines provided. If more space is the company and he or she is also a principal officer,

needed, attach an additional page. pursuant to A.R.S. § 42-2003(A)(2), who has the

If Taxpayer is a consolidated or combined group of authority to bind the taxpayer on matters related to the

corporations, Taxpayer must attach a federal Form 851 or a state taxes.