Enlarge image

Disclosure Arizona Form

Authorization Form 285B

Phone Numbers If Taxpayer is a consolidated or combined group of corporations,

Taxpayer must attach a federal Form 851 or a supplemental sheet,

For information or help, call one of the numbers listed: as applicable, containing the names of each member of the

Phoenix (602) 255-3381 consolidated/combined group for which the signator of Form

From area codes 520 and 928, toll-free (800) 352-4090 285B is a principal corporate officer and to which this Form

Tax forms, instructions, and other tax information 285B applies.

If you need tax forms, instructions, and other tax information, Foreign Address -

go to the department’s website at www.azdor.gov. If the taxpayer has a foreign address, enter the information in

the following order: city, province or state, and country.

Purpose of Form Follow the country’s practice for entering the postal code. Do

not abbreviate the country name.

Form 285B enables any individual, sole proprietorship,

corporation, group of consolidated/combined corporations, For income tax purposes:

partnership, LLC, estate, trust, governmental agency, or other • Each individual signing this form must enter his or her

organization, association, or group thereof (“Taxpayer”) to Social Security Number (SSN) or Individual Tax

designate a person (“Appointee”) to whom the Arizona Identification Number (ITIN).

Department of Revenue can release confidential information, • A corporation, partnership, LLC, trust or estate must enter

pursuant to A.R.S. § 42-2003. its employer identification number (EIN).

The disclosure of such confidential information may be necessary For withholding tax purposes:

to fully discuss tax issues with, or respond to tax questions by An individual, corporation, partnership, LLC, trust, or estate

such Appointee. For more information or guidance for must enter the EIN.

completing this form, see General Tax Procedure (GTP) 15-2,

Procedure for Submitting an Authorization for Disclosure of For transaction privilege tax (TPT) purposes:

Confidential Information and Powers of Attorney. If the taxpayer has only one license that is covered by this

Form 285B, enter that specific TPT license number.

Important Tips -

If the taxpayer has more than one license number, include a

• Review the instructions and GTP 15-2 before completing

separate sheet identifying the license number and location for

the form.

each license that is covered by this Form 285B.

• Inspect the form and verify you have entered all of the

required information. NOTE: If a taxpayer wants all of its business locations

• Retain a copy for your files. covered by this Form 285B, include the EIN of the business (or

the SSN or ITIN associated with the business if the business

How to File does not have an EIN).

If an Arizona Department of Revenue (ADOR) employee

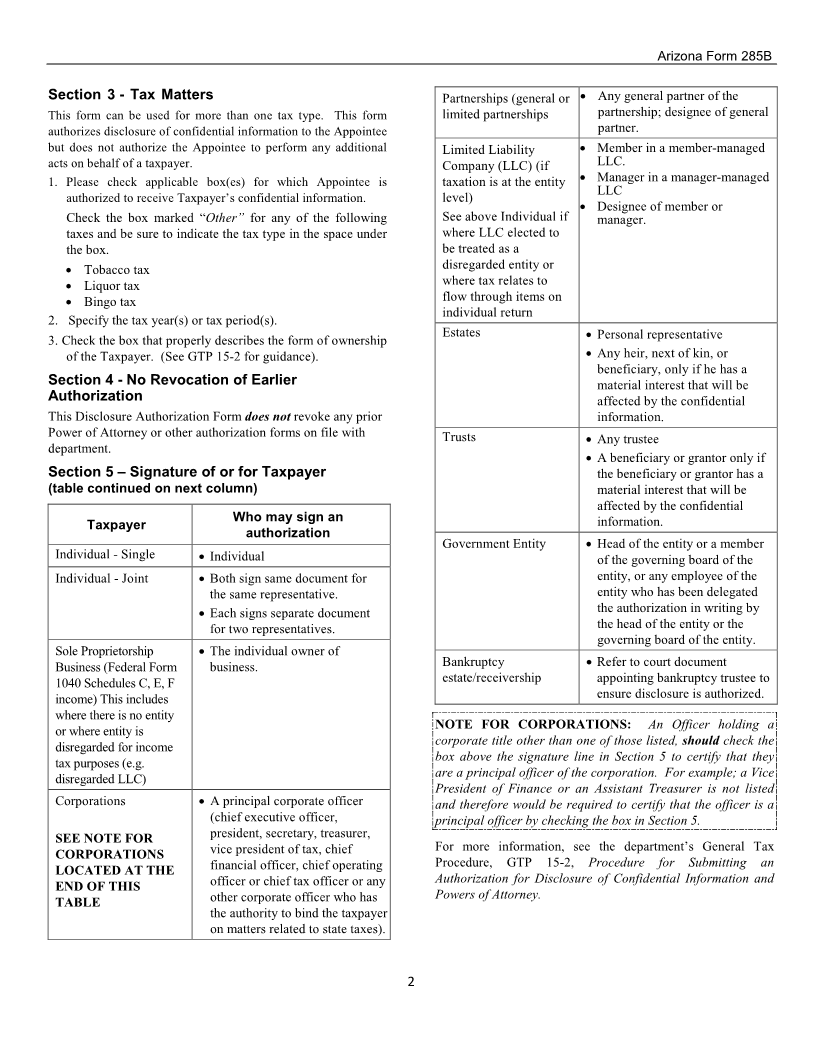

Section 2 - Appointee Information

requests that you submit this form, please send the completed

form directly to the address that the employee provides, with The Appointee must be an individual. Enter the first and last

attention to the employee. name and current address of the person taxpayer is appointing to

be to receive Taxpayer’s confidential information. If the

Otherwise, ADOR offers three convenient options to submit Appointee has a foreign address, enter the information in the

your form. following order: city, province or state, and country. Follow the

1. Email the completed form to: POA@azdor.gov. country’s practice for entering the postal code. Do not abbreviate

2. Fax the completed form to: (602) 716-6008. the country name.

3. Mail the original or photocopy of the completed form to: Enter the ID number of the individual (Appointee). This may

Arizona Department of Revenue be an SSN, ITIN, Certified Public Account (CPA) number,

ATTN: Power of Attorney State Bar number, Alternative Preparer Tax Identification

PO Box 29086 Number, or other government issued ID number that is unique

Phoenix, AZ 85038-9086 to the Appointee (for example: a passport or driver’s license

number). If the taxpayer wants to name more than one

Appointee, please attach an additional sheet that contains the

Line-by-Line Instructions

required information for each Appointee.

Section 1 - Taxpayer Information

NOTE: The number used must be different for each individual

Enter Taxpayer’s name, current address, and daytime telephone Appointee designated. For identification purposes, the

number on the lines provided. If more space is needed, attach an Appointee will be required to provide that number when

additional page. contacting the Department.