Enlarge image

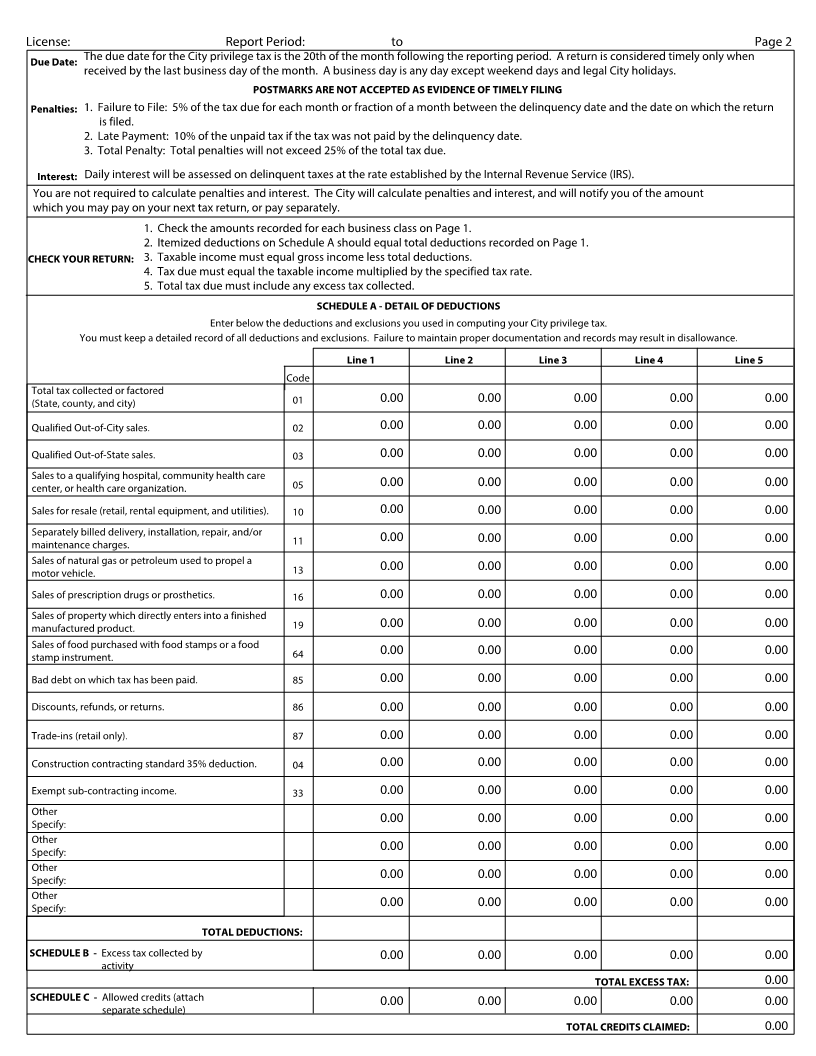

CITY OF APACHE JUNCTION PRIVILEGE (SALES) TAX RETURN

City of Apache Junction

Tax & Licensing Division License Due Date

300 E. Superstition Blvd.

Apache Junction, AZ 85119

Phone: (480) 474-5051 Period Begins Period Ends

Fax: (480) 982-8004

Cancel License Date:

Business Name Reason:

Street or PO Box

No income this period. Sign and

Suite or Apartment date below.

City State Zip

Address change: Enter new

address to the left.

State Tax License

Column 1 Column 2 Column 3 Column 4 Column 5

Less (-) Deductions Equals (=) Net (X) Tax Equals (=) Tax

Business Description Line Business Gross Income From Schedule A Taxable Income Rate Amount

Class

1 000 0.00

2 000 0.00

3 000 0.00

4 000 0.00

5 000 0.00

6 SUBTOTAL (Add lines 1 thru 5 in Column 5) Equals (=)

7 TOTAL FROM ADDITIONAL PAGES (if any) Plus (+) 0.00

8 SUBTOTAL (Add Lines 6 and 7) Equals (=)

9 EXCESS CITY TAX COLLECTED (From Schedule B on Page 2) Plus (+)

10 GRAND TOTAL (Add Lines 8 and 9) Equals (=)

11 PENALTIES AND INTEREST (See instructions) Plus (+) 0.00

12 TOTAL LIABILITY (Add Lines 10 and 11) Equals (=)

13 ENTER CREDIT BALANCE (From Schedule C on Page 2) Minus (-) 0.00

14 NET AMOUNT DUE (Subtract Line 13 from Line 12) Equals (=)

15 ENTER AMOUNT PAID (Payable to the City of Apache Junction) 0.00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief it is true, correct, and complete. Declaration of preparer (other than the taxpayer) is based on all information available.

DO NOT WRITE IN THIS AREA

TAXPAYER PREPARER

Print Name: Print Name:

Signature: Signature:

Date: Date:

A SIGNATURE IS REQUIRED TO MAKE THIS A VALID RETURN

THIS FORM MUST BE RETURNED TO THE CITY EVEN IF THERE IS NO TAX DUE

AJ Form 100 (February 2008)