Enlarge image

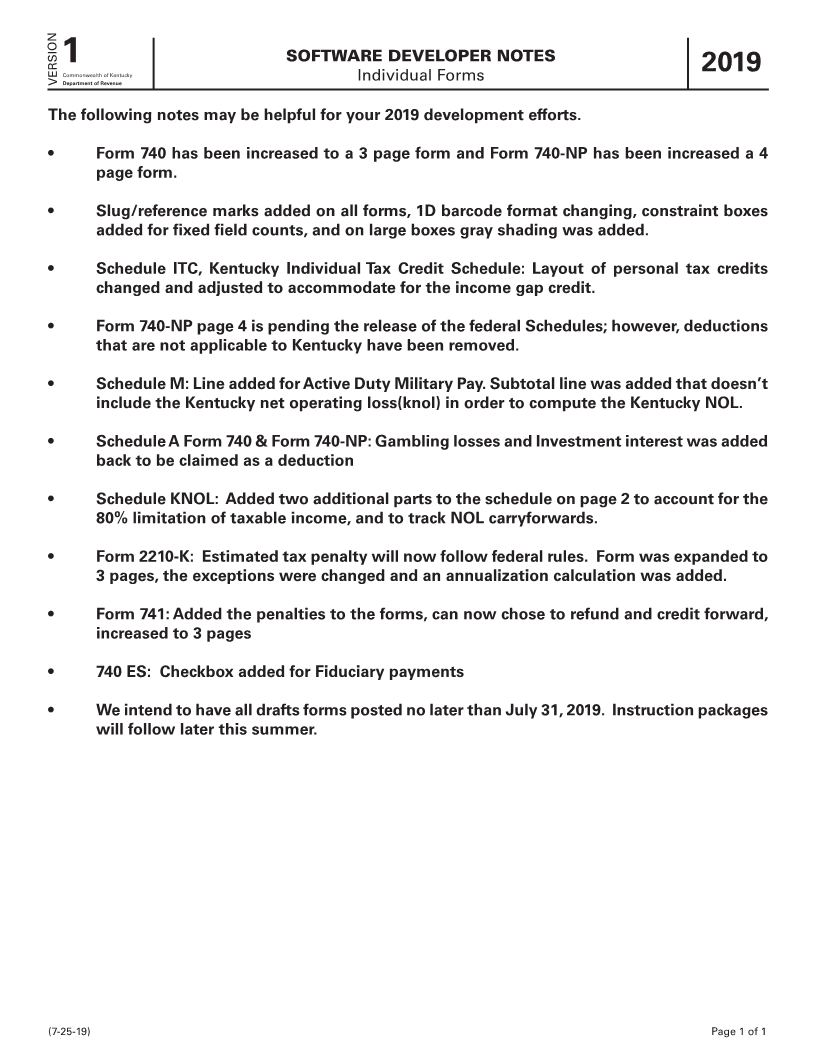

1 SOFTWARE DEVELOPER NOTES

Commonwealth of Kentucky Individual Forms 2019

VERSION Department of Revenue

The following notes may be helpful for your 2019 development efforts.

• Form 740 has been increased to a 3 page form and Form 740-NP has been increased a 4

page form.

• Slug/reference marks added on all forms, 1D barcode format changing, constraint boxes

added for fixed field counts, and on large boxes gray shading was added.

• Schedule ITC, Kentucky Individual Tax Credit Schedule: Layout of personal tax credits

changed and adjusted to accommodate for the income gap credit.

• Form 740-NP page 4 is pending the release of the federal Schedules; however, deductions

that are not applicable to Kentucky have been removed.

• Schedule M: Line added for Active Duty Military Pay. Subtotal line was added that doesn’t

include the Kentucky net operating loss(knol) in order to compute the Kentucky NOL.

• Schedule A Form 740 & Form 740-NP: Gambling losses and Investment interest was added

back to be claimed as a deduction

• Schedule KNOL: Added two additional parts to the schedule on page 2 to account for the

80% limitation of taxable income, and to track NOL carryforwards.

• Form 2210-K: Estimated tax penalty will now follow federal rules. Form was expanded to

3 pages, the exceptions were changed and an annualization calculation was added.

• Form 741: Added the penalties to the forms, can now chose to refund and credit forward,

increased to 3 pages

• 740 ES: Checkbox added for Fiduciary payments

• We intend to have all drafts forms posted no later than July 31, 2019. Instruction packages

will follow later this summer.

(7-25-19) Page 1 of 1