Enlarge image

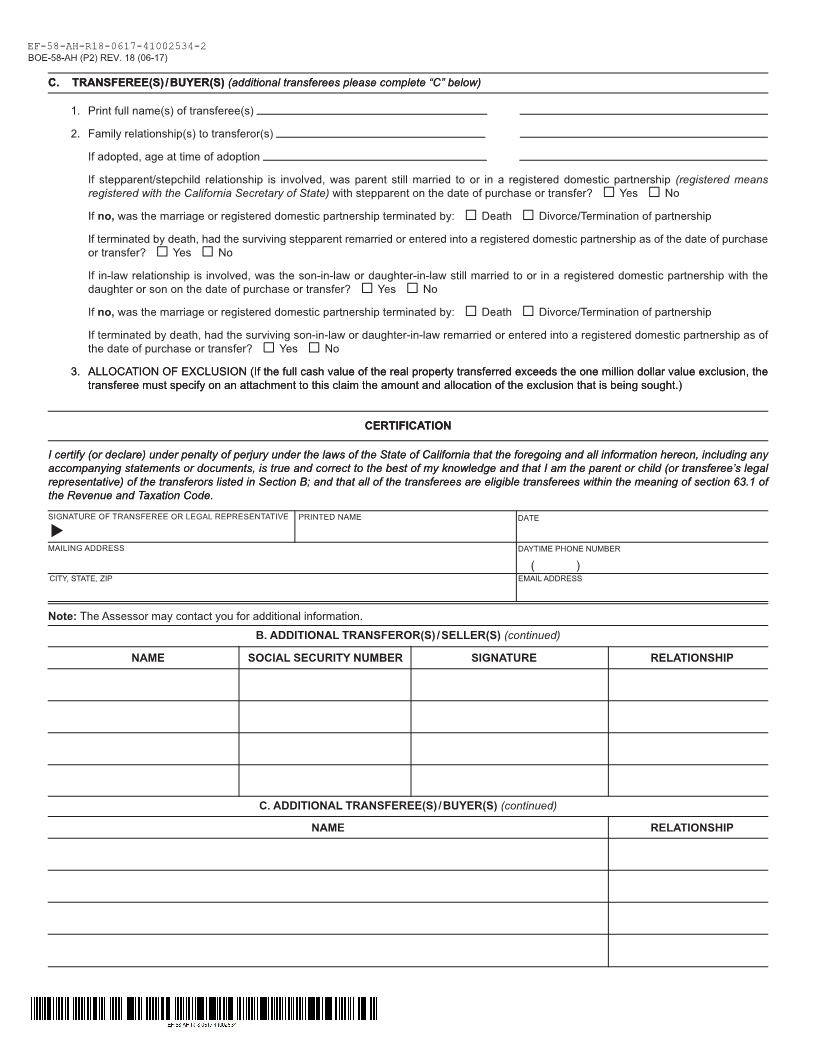

MARK CHURCH

EF-58-AH-R18-0617-41002534-1 Assessor - County Clerk - Recorder

BOE-58-AH (P1) REV. 1 8(0 -16 7) 555 County Center

Redwood City, CA 94063

CLAIM FOR REASSESSMENT EXCLUSION FOR P 650.363.4500 F 650.599.7435

TRANSFER BETWEEN PARENT AND CHILD email assessor@smcacre.org

web www.smcacre.org

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address.)

A. PROPERTY

ASSESSOR’S PARCEL NUMBER

PROPERTY ADDRESS CITY

RECORDER’S DOCUMENT NUMBER DATE OF PURCHASE OR TRANSFER

PROBATE NUMBER (if applicable) DATE OF DEATH (if applicable) DATE OF DECREE OF DISTRIBUTION (if applicable)

The disclosure of social security numbers is mandatory as required by Revenue and Taxation Code section 63.1. [See Title 42 United

States Code, section 405(c)(2)(C)(i) which authorizes the use of social security numbers for identification purposes in the administration of any

tax.] A foreign national who cannot obtain a social security number may provide a tax identification number issued by the Internal Revenue

Service. The numbers are used by the Assessor and the state to monitor the exclusion limit.

B. TRANSFEROR(S)/SELLER(S) (additional transferors please complete “B” on the reverse)

1. Print full name(s) of transferor(s)

2. Social security number(s)

3. Family relationship(s) to transferee(s)

If adopted, age at time of adoption

4. Was this property the transferor’s principal residence? Yes No

If yes, please check which of the following exemptions was granted or was eligible to be granted on this property:

Homeowners’ Exemption Disabled Veterans’ Exemption

5. Have there been other WUDQVIHUs that qualified for this exclusion? Yes No

If yes, please attach a list of all previous transfers that qualified for this exclusion. (This list should include for each property: the County,

Assessor’s parcel number, address, date of transfer, names of all the transferees/buyers, and family relationship. Transferor’s principal

residence must be identified.)

6. Was only a partial interest in the property transferred? Yes No If yes, percentage transferred %

7. Was this property owned in joint tenancy? Yes No

8. If the transfer was through the medium of a will and/or trust, you must attach a full and complete copy of the will and/or trust and all

amendments.

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true and correct to the best of my knowledge and that I am the parent or child (or transferor’s legal

representative) of the transferees listed in Section C. I knowingly am granting this exclusion and will not file a claim to transfer the base year

value of my principal residence under Revenue and Taxation Code section 69.5.

SIGNATUREt OF TRANSFEROR OR LEGAL REPRESENTATIVEPRINTED NAME DATE

SIGNATUREt OF TRANSFEROR OR LEGAL REPRESENTATIVEPRINTED NAME DATE

MAILING ADDRESS DAYTIME PHONE NUMBER

( )

CITY, STATE, ZIP EMAIL ADDRESS

(Please complete applicable information on reverse side.)

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION