Enlarge image

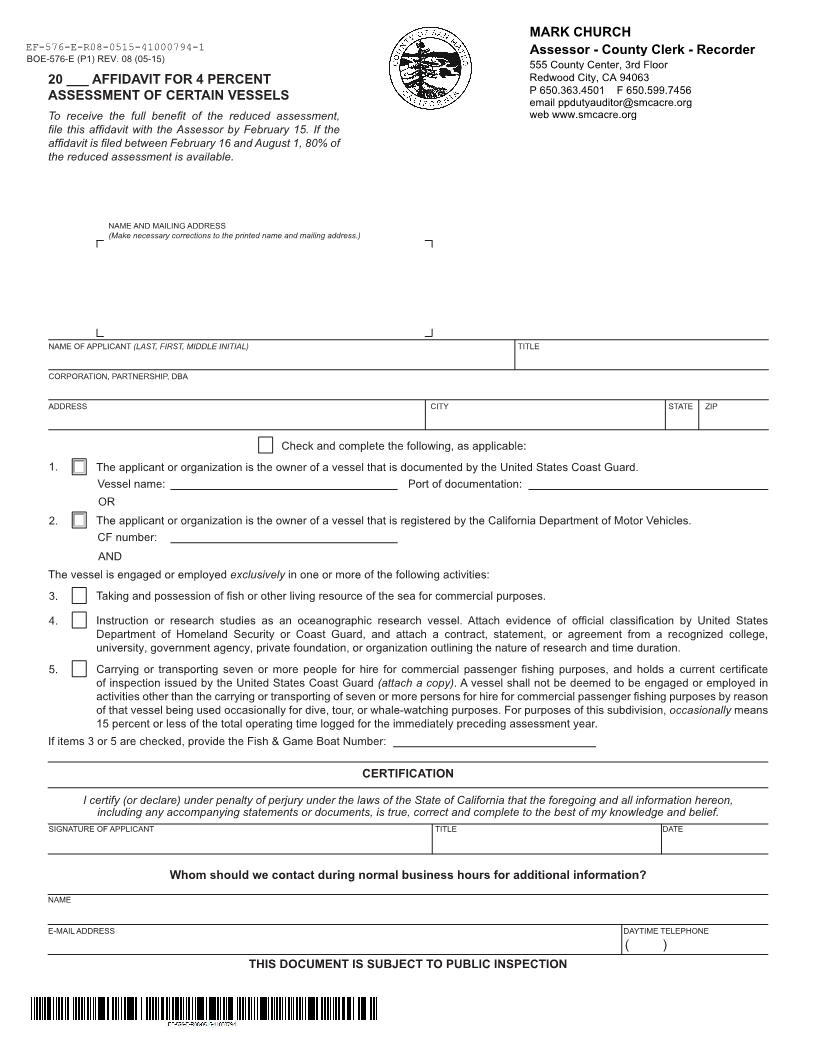

MARK CHURCH

EF-576-E-R08-0515-41000794-1 Assessor - County Clerk - Recorder

BOE-576-E (P1) REV. 0 8(0 -5 15) 555 County Center, 3rd Floor

20 ___ AFFIDAVIT FOR 4 PERCENT Redwood City, CA 94063

P 650.363.4501 F 650.599.7456

ASSESSMENT OF CERTAIN VESSELS email ppdutyauditor@smcacre.org

To receive the full benefit of the reduced assessment, web www.smcacre.org

file this affidavit with the Assessor by February 15. If the

affidavit is filed between February 16 and August 1, 80% of

the reduced assessment is available.

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address.)

NAME OF APPLICANT (LAST, FIRST, MIDDLE INITIAL) TITLE

CORPORATION, PARTNERSHIP, DBA

ADDRESS CITY STATE ZIP

Check and complete the following, as applicable:

P

1. The applicant or organization is the owner of a vessel that is documented by the United States Coast Guard.

Vessel name: Port of documentation:

OR

2. The applicant or organization is the owner of a vessel that is registered by the California Department of Motor Vehicles.

CF number:

AND

The vessel is engaged or employed exclusively in one or more of the following activities:

3. Taking and possession of fish or other living resource of the sea for commercial purposes.

4. Instruction or research studies as an oceanographic research vessel. Attach evidence of official classification by United States

Department of Homeland Security or Coast Guard, and attach a contract, statement, or agreement from a recognized college,

university, government agency, private foundation, or organization outlining the nature of research and time duration.

5. Carrying or transporting seven or more people for hire for commercial passenger fishing purposes, and holds a current certificate

of inspection issued by the United States Coast Guard (attach a copy). A vessel shall not be deemed to be engaged or employed in

activities other than the carrying or transporting of seven or more persons for hire for commercial passenger fishing purposes by reason

of that vessel being used occasionally for dive, tour, or whale-watching purposes. For purposes of this subdivision, occasionally means

15 percent or less of the total operating time logged for the immediately preceding assessment year.

If items 3 or 5 are checked, provide the Fish & Game Boat Number:

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon,

including any accompanying statements or documents, is true, correct and complete to the best of my knowledge and belief.

SIGNATURE OF APPLICANT TITLE DATE

t

Whom should we contact during normal business hours for additional information?

NAME

E-MAIL ADDRESS DAYTIME TELEPHONE

( )

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION