Enlarge image

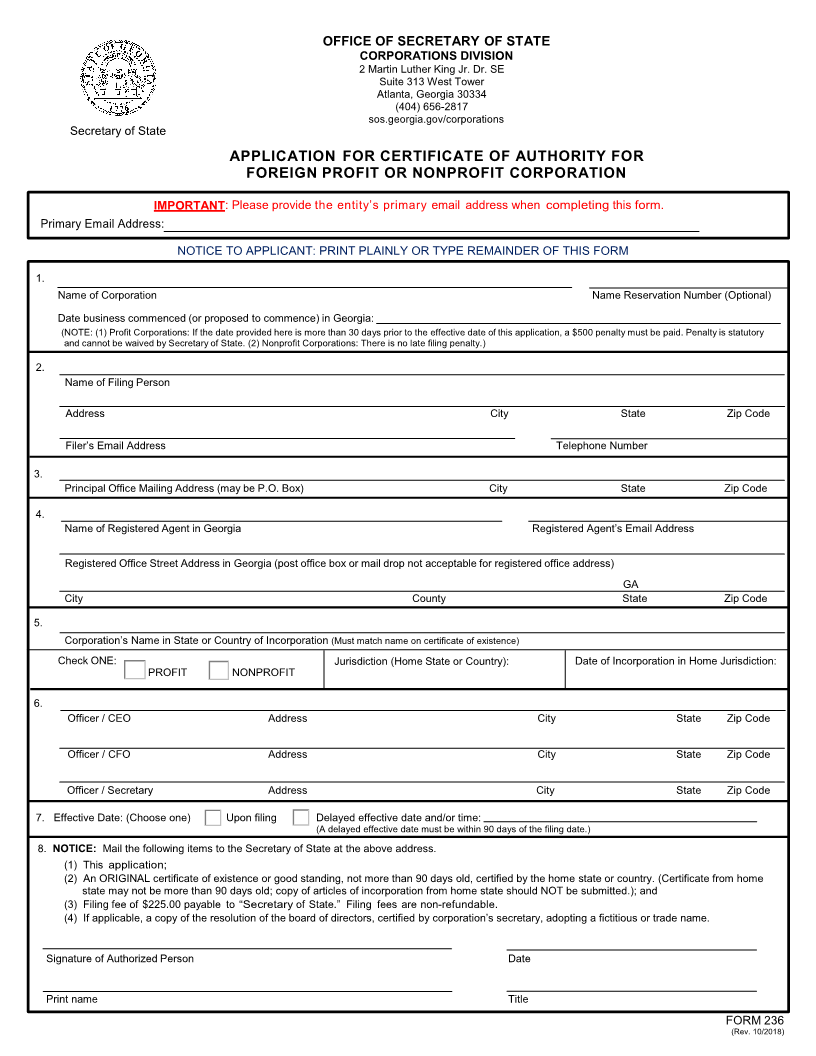

OFFICE OF SECRETARY OF STATE

CORPORATIONS DIVISION

2 Martin Luther King Jr. Dr. SE

Suite 313 West Tower

Atlanta, Georgia 30334

(404) 656-2817

sos.georgia.gov/corporations

Secretary of State

APPLICATION FOR CERTIFICATE OF AUTHORITY FOR

FOREIGN PROFIT OR NONPROFIT CORPORATION

IMPORTANT: Please provide the entity’s primary email address when completing this form.

Primary Email Address:

NOTICE TO APPLICANT: PRINT PLAINLY OR TYPE REMAINDER OF THIS FORM

1.

Name of Corporation Name Reservation Number (Optional)

Date business commenced (or proposed to commence) in Georgia:

(NOTE: (1) Profit Corporations: If the date provided here is more than 30 days prior to the effective date of this application, a $500 penalty must be paid. Penalty is statutory

and cannot be waived by Secretary of State. (2) Nonprofit Corporations: There is no late filing penalty.)

2.

Name of Filing Person

Address City State Zip Code

Filer’s Email Address Telephone Number

3.

Principal Office Mailing Address (may be P.O. Box) City State Zip Code

4.

Name of Registered Agent in Georgia Registered Agent’s Email Address

Registered Office Street Address in Georgia (post office box or mail drop not acceptable for registered office address)

GA

City County State Zip Code

5.

Corporation’s Name in State or Country of Incorporation (Must match name on certificate of existence)

Check ONE: Jurisdiction (Home State or Country): Date of Incorporation in Home Jurisdiction:

PROFIT NONPROFIT

6.

Officer / CEO Address City State Zip Code

Officer / CFO Address City State Zip Code

Officer / Secretary Address City State Zip Code

7. Effective Date: (Choose one) Upon filing Delayed effective date and/or time:

(A delayed effective date must be within 90 days of the filing date.)

8. NOTICE: Mail the following items to the Secretary of State at the above address.

(1) This application;

(2) An ORIGINAL certificate of existence or good standing, not more than 90 days old, certified by the home state or country. (Certificate from home

state may not be more than 90 days old; copy of articles of incorporation from home state should NOT be submitted.); and

(3) Filing fee of $225.00 payable to “Secretary of State.” Filing fees are non-refundable.

(4) If applicable, a copy of the resolution of the board of directors, certified by corporation’s secretary, adopting a fictitious or trade name.

Signature of Authorized Person Date

Print name Title

FORM 236

(Rev. 10/2018)