Enlarge image

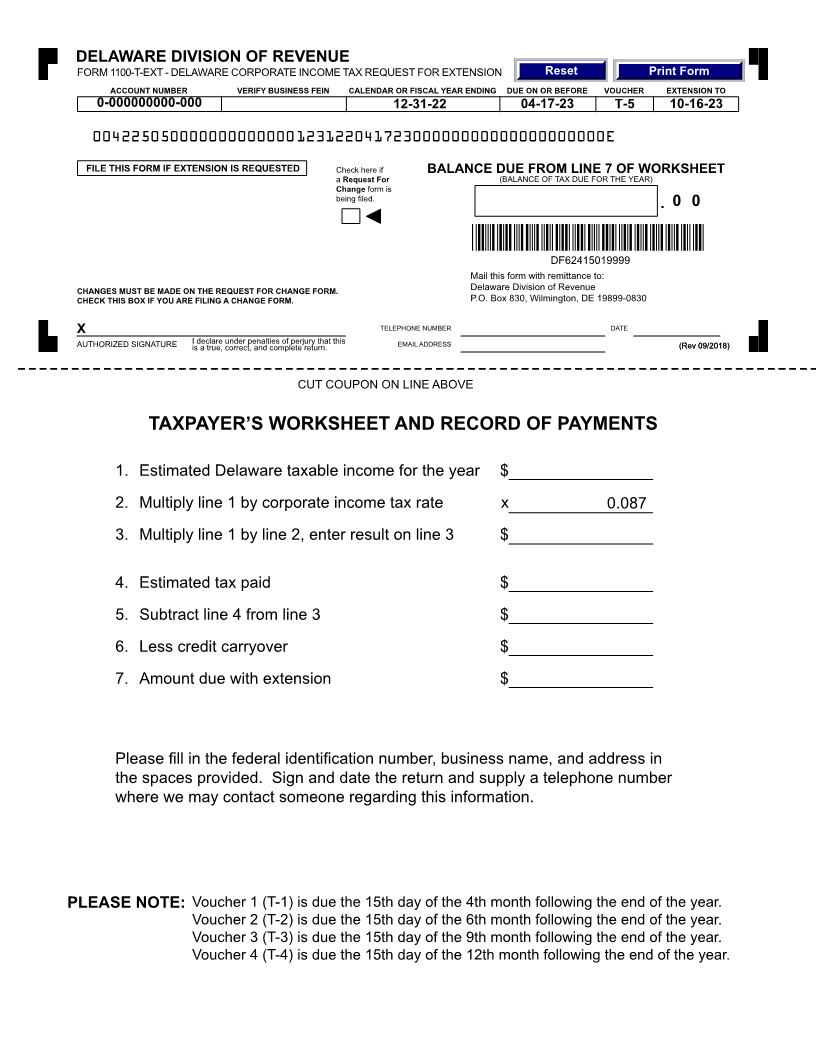

DELAWARE DIVISION OF REVENUE FORM 1100-T-EXT - DELAWARE CORPORATE INCOME TAX REQUEST FOR EXTENSION Reset Print Form ACCOUNT NUMBER VERIFY BUSINESS FEIN CALENDAR OR FISCAL YEAR ENDING DUE ON OR BEFORE VOUCHER EXTENSION TO 0-000000000-000 12-31-22 04-17-23 T-5 10-16-23 00422505000000000000012312204172300000000000000000000E Check here if FILEa RequestBALANCE(BALANCE OF TAX DUE FOR THE YEAR) DUETHISFROMFORMFor LINEIF EXTENSIONOF7 WORKSHEETIS REQUESTED Change form is being filed. . 0 0 *DF62415019999* DF62415019999 Mail this form with remittance to: CHANGES MUST BE MADE ON THE REQUEST FOR CHANGE FORM. Delaware Division of Revenue CHECK THIS BOX IF YOU ARE FILING A CHANGE FORM. P.O. Box 830, Wilmington, DE 19899-0830 X TELEPHONE NUMBER DATE MM DD YY AUTHORIZED SIGNATURE Iisdeclarea true, correct,under penaltiesand completeof perjuryreturn.that this EMAIL ADDRESS (Rev(Rev 09/2018)09/2018) CUT COUPON ON LINE ABOVE TAXPAYER’S WORKSHEET AND RECORD OF PAYMENTS 1. Estimated Delaware taxable income for the year $ 2. Multiply line 1 by corporate income tax rate x 0.087 3. Multiply line 1 by line 2, enter result on line 3 $ 4. Estimated tax paid $ 5. Subtract line 4 from line 3 $ 6. Less credit carryover $ 7. Amount due with extension $ Please fill in the federal identification number, business name, and address in the spaces provided. Sign and date the return and supply a telephone number where we may contact someone regarding this information. PLEASE NOTE: Voucher 1 (T-1) is due the 15th day of the 4th month following the end of the year. Voucher 2 (T-2) is due the 15th day of the 6th month following the end of the year. Voucher 3 (T-3) is due the 15th day of the 9th month following the end of the year. Voucher 4 (T-4) is due the 15th day of the 12th month following the end of the year.