Enlarge image

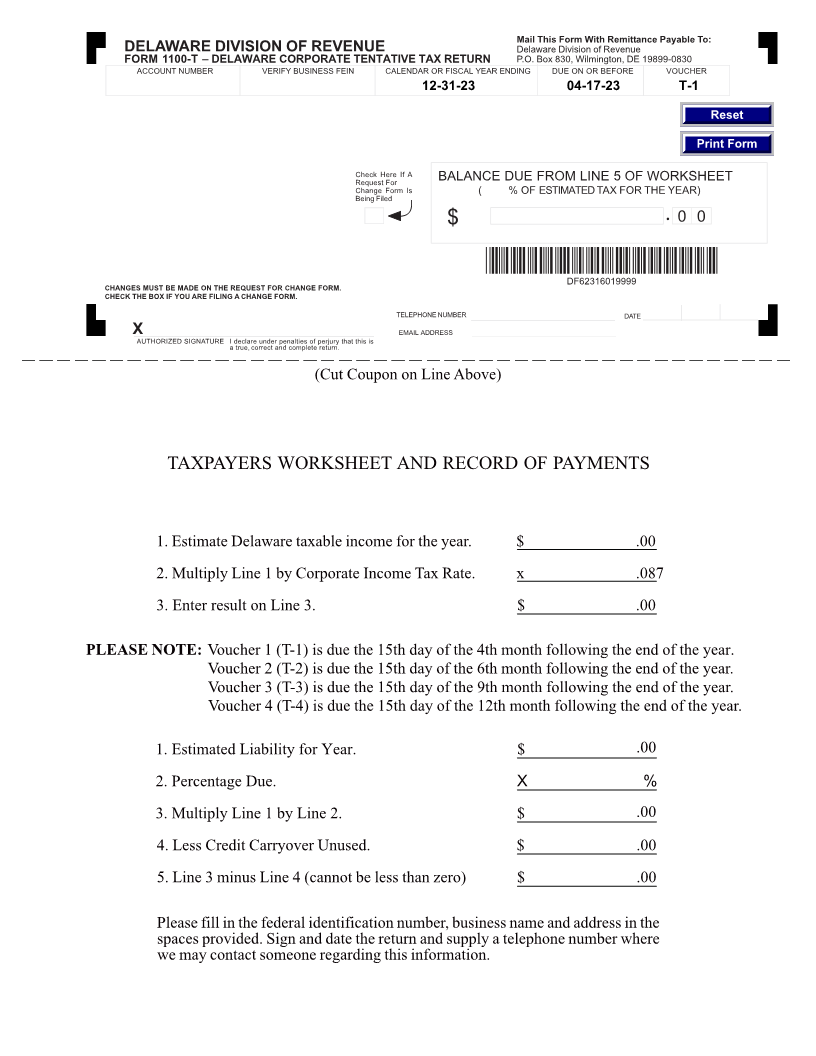

Mail This Form With Remittance Payable To:

DELAWARE DIVISION OF REVENUE Delaware Division of Revenue

FORM 1100-T – DELAWARE CORPORATE TENTATIVE TAX RETURN P.O. Box 830, Wilmington, DE 19899-0830

ACCOUNT NUMBER VERIFY BUSINESS FEIN CALENDAR OR FISCAL YEAR ENDING DUE ON OR BEFORE VOUCHER

0-000000000-000 12-31-23 04-17-23 T-1

Reset

003801010000000000000123123041723000000000000000000001

Print Form

Check Here If A BALANCE DUE FROM LINE 5 OF WORKSHEET

Request For

Change Form Is ( % OF ESTIMATED TAX FOR THE YEAR)

Being Filed

$ . 0 0

*DF62316019999*

CHANGES MUST BE MADE ON THE REQUEST FOR CHANGE FORM. DF62316019999

CHECK THE BOX IF YOU ARE FILING A CHANGE FORM.

TELEPHONE NUMBER DATE

X EMAIL ADDRESS

AUTHORIZED SIGNATURE Iadeclaretrue, correctunderandpenaltiescompleteof perjuryreturn.that this is

(Cut Coupon on Line Above)

TAXPAYERS WORKSHEET AND RECORD OF PAYMENTS

1. Estimate Delaware taxable income for the year. $ .00

2. Multiply Line 1 by Corporate Income Tax Rate. x .087

3. Enter result on Line 3. $ .00

PLEASE NOTE: Voucher 1 (T-1) is due the 15th day of the 4th month following the end of the year.

Voucher 2 (T-2) is due the 15th day of the 6th month following the end of the year.

Voucher 3 (T-3) is due the 15th day of the 9th month following the end of the year.

Voucher 4 (T-4) is due the 15th day of the 12th month following the end of the year.

1. Estimated Liability for Year. $ 0.00

2. Percentage Due. X %

3. Multiply Line 1 by Line 2. $ 0.00

4. Less Credit Carryover Unused. $ .00

5. Line 3 minus Line 4 (cannot be less than zero) $ 0 .00

Please fill in the federal identification number, business name and address in the

spaces provided. Sign and date the return and supply a telephone number where

we may contact someone regarding this information.