Enlarge image

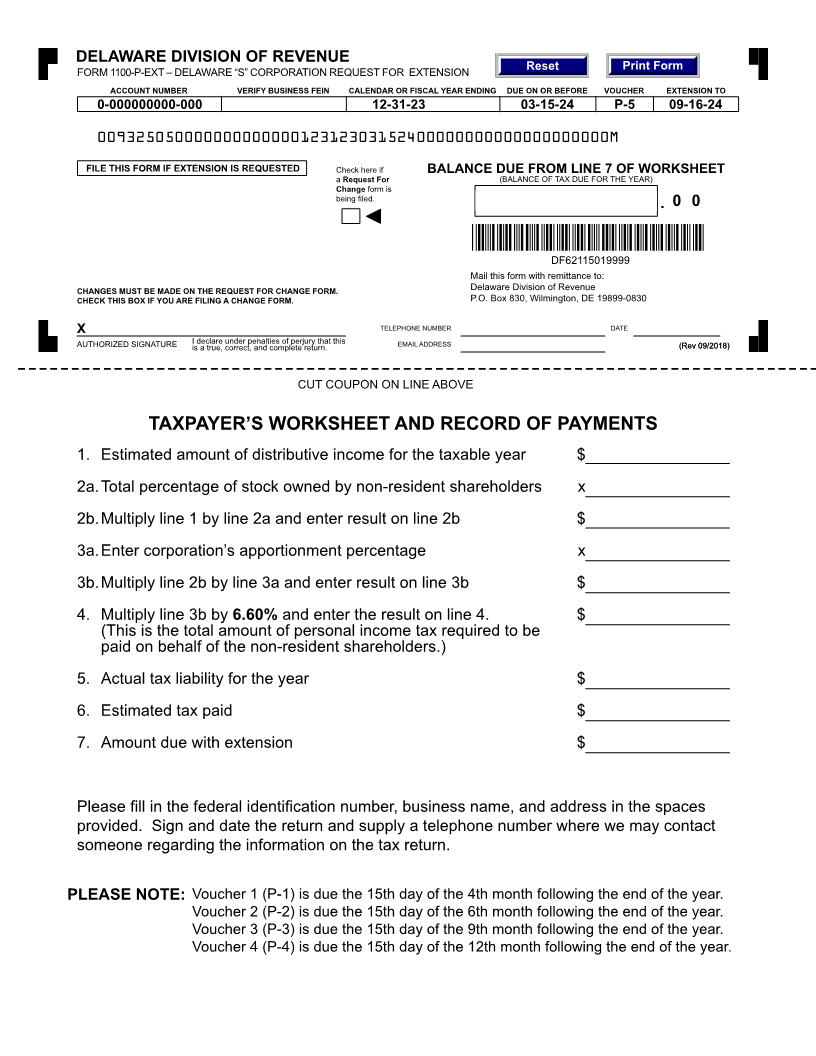

DELAWARE DIVISION OF REVENUE Reset Print Form

FORM 1100-P-EXT – DELAWARE “S” CORPORATION REQUEST FOR EXTENSION

ACCOUNT NUMBER VERIFY BUSINESS FEIN CALENDAR OR FISCAL YEAR ENDING DUE ON OR BEFORE VOUCHER EXTENSION TO

0-000000000-000 12-31-23 03-15-24 P-5 09-16-24

00932505000000000000012312303152400000000000000000000M

Check here if

FILE THIS FORMa RequestBALANCE(BALANCE OF TAX DUE FOR THE YEAR) EXTENSIONIF DUE FROMIS REQUESTEDLINE OF7 WORKSHEETFor

Change form is

being filed.

. 0 0

*DF62115019999*

DF62115019999

Mail this form with remittance to:

CHANGES MUST BE MADE ON THE REQUEST FOR CHANGE FORM. Delaware Division of Revenue

CHECK THIS BOX IF YOU ARE FILING A CHANGE FORM. P.O. Box 830, Wilmington, DE 19899-0830

X TELEPHONE NUMBER DATE MM DD YY

AUTHORIZED SIGNATURE Iisdeclarea true, correct,under penaltiesand completeof perjuryreturn.that this EMAIL ADDRESS (Rev(Rev 09/2018)09/2018)

CUT COUPON ON LINE ABOVE

TAXPAYER’S WORKSHEET AND RECORD OF PAYMENTS

1. Estimated amount of distributive income for the taxable year $

2a. Total percentage of stock owned by non-resident shareholders x

2b. Multiply line 1 by line 2a and enter result on line 2b $

3a. Enter corporation’s apportionment percentage x

3b. Multiply line 2b by line 3a and enter result on line 3b $

4. Multiply line 3b by 6.60% and enter the result on line 4. $

(This is the total amount of personal income tax required to be

paid on behalf of the non-resident shareholders.)

5. Actual tax liability for the year $

6. Estimated tax paid $

7. Amount due with extension $

Please fill in the federal identification number, business name, and address in the spaces

provided. Sign and date the return and supply a telephone number where we may contact

someone regarding the information on the tax return.

PLEASE NOTE: Voucher 1 (P-1) is due the 15th day of the 4th month following the end of the year.

Voucher 2 (P-2) is due the 15th day of the 6th month following the end of the year.

Voucher 3 (P-3) is due the 15th day of the 9th month following the end of the year.

Voucher 4 (P-4) is due the 15th day of the 12th month following the end of the year.