Enlarge image

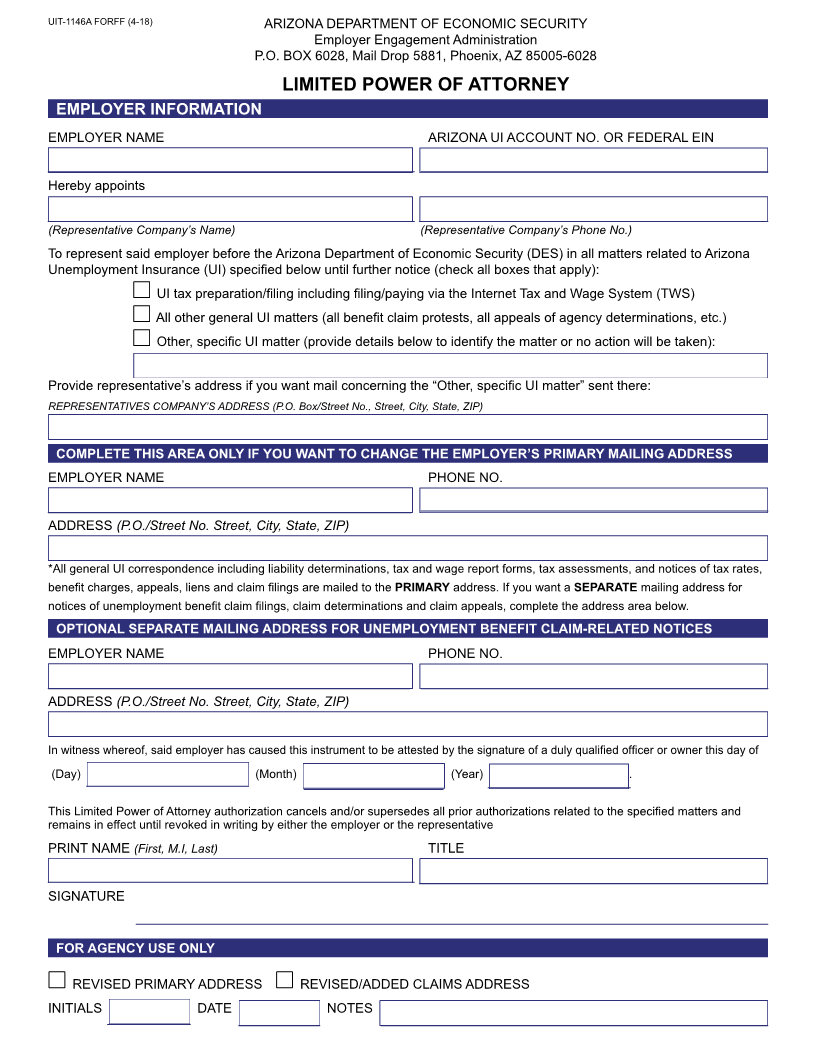

UIT-1146A FORFF (4-18) ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Employer Engagement Administration

LIMITED POWER OF ATTORNEY

The Limited Power of Attorney form is used by employers to authorize a third party to represent them before the Arizona

Department of Economic Security (DES) in the Unemployment Insurance (UI) matters specified on the form. Such

authorization also permits DES to provide the representative with any confidential information concerning the employer’s

Arizona UI account that is related to those matters.

Specify which matters the authorization applies to by checking the appropriate checkbox(es) on the form. If you want

the authorization limited to a specific matter, such as a specific DES decision under appeal, check the “Other, specific UI

matter” checkbox and briefly describe the matter in the space below to identify it specifically. Provide the representative’s

address immediately below that if you want to have all correspondence related to the “Other, specific UI matter” mailed to

that address.

If you want to change the primary mailing address for general DES correspondence related to the employer’s UI account,

complete the area of the form provided for that purpose. You may also specify a separate mailing address for unemployment

benefit claim-related notices by completing the area of the form provided for that purpose. Such a separate address is

sometimes advisable, to enable the timely protesting of claims. Protests must be returned or postmarked within 10 business

days after the date on the claim filing notice (Notice to Employer – UB-110) to be considered timely.

Submit the completed form with the original signature of a duly qualified officer or owner of the employer’s business to the

UI Tax Employer Registration Unit at the address below. Questions about the use or completion of the form should also be

directed to the Employer Registration Unit.

ADES - UI Tax Section

Employer Registration Unit

P.O. Box 6028 - Mail Drop 5881

Phoenix, Arizona 85005-6028

Telephone – (602) 771-6602

Fax – (602) 532-5539

Email – UITStatusClerical@azdes.gov

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the

Americans with Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of

1975, and Title II of the Genetic Information Nondiscrimination Act (GINA) of 2008; the Department prohibits discrimination in

admissions, programs, services, activities, or employment based on race, color, religion, sex, national origin, age, disability,

genetics and retaliation. The Department must make a reasonable accommodation to allow a person with a disability to take

part in a program, service, or activity. Auxiliary aids and services are available upon request to individuals with disabilities.

To request this document in alternative format or for further information about this policy, Contact the UI Tax Office at 602-

771-6606; TTY/TDD Services: 7-1-1. • Free language assistance for DES services is available upon request. • Disponible

en español en línea o en la oficina local.