Enlarge image

REPORTING INSTRUCTIONS

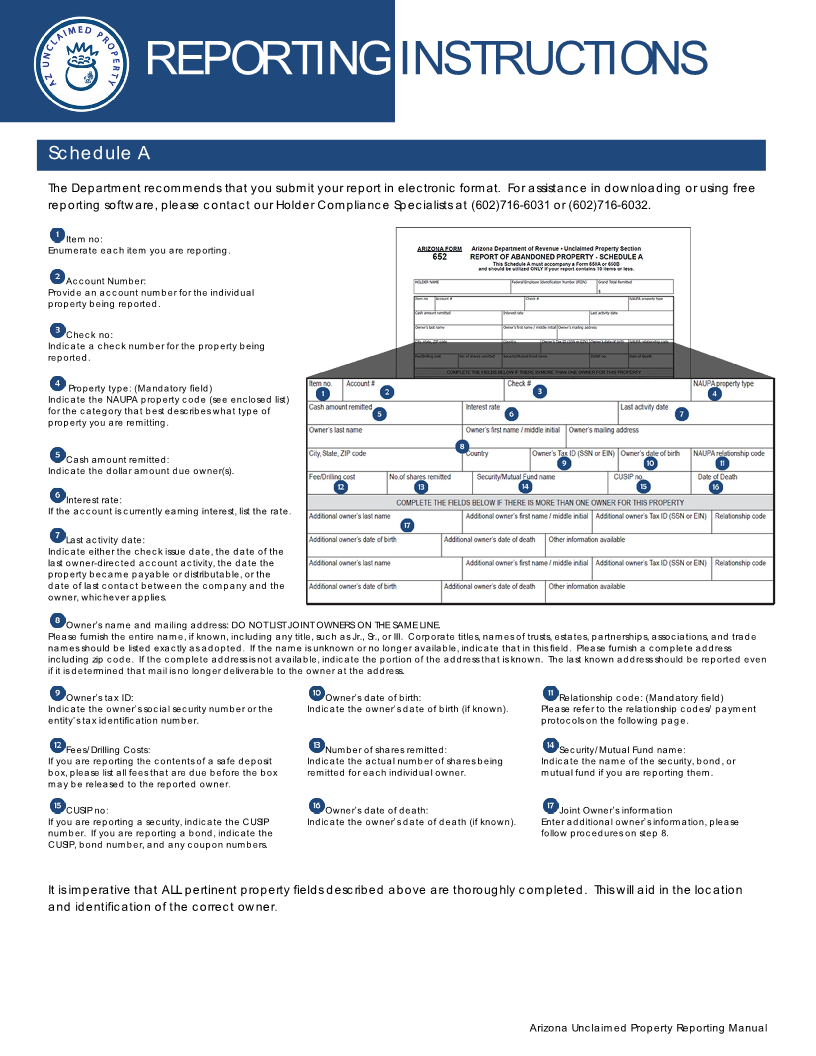

Schedule A

The Department recommends that you submit your report in electronic format. For assistance in downloading or using free

reporting software, please contact our Holder Compliance Specialists at (602)716-6031 or (602)716-6032.

Item no:

Enumerate each item you are reporting.

Account Number:

Provide an account number for the individual

property being reported.

Check no:

Indicate a check number for the property being

reported.

Property type: (Mandatory field)

Indicate the NAUPA property code (see enclosed list)

for the category that best describes what type of

property you are remitting.

Cash amount remitted:

Indicate the dollar amount due owner(s).

Interest rate:

If the account is currently earning interest, list the rate.

Last activity date:

Indicate either the check issue date, the date of the

last owner-directed account activity, the date the

property became payable or distributable, or the

date of last contact between the company and the

owner, whichever applies.

Owner’s name and mailing address: DO NOT LIST JOINT OWNERS ON THE SAME LINE.

Please furnish the entire name, if known, including any title, such as Jr., Sr., or III. Corporate titles, names of trusts, estates, partnerships, associations, and trade

names should be listed exactly as adopted. If the name is unknown or no longer available, indicate that in this field. Please furnish a complete address

including zip code. If the complete address is not available, indicate the portion of the address that is known. The last known address should be reported even

if it is determined that mail is no longer deliverable to the owner at the address.

Owner’s tax ID: Owner’s date of birth: Relationship code: (Mandatory field)

Indicate the owner’s social security number or the Indicate the owner’s date of birth (if known). Please refer to the relationship codes/ payment

entity’s tax identification number. protocols on the following page.

Fees/Drilling Costs: Number of shares remitted: Security/Mutual Fund name:

If you are reporting the contents of a safe deposit Indicate the actual number of shares being Indicate the name of the security, bond, or

box, please list all fees that are due before the box remitted for each individual owner. mutual fund if you are reporting them.

may be released to the reported owner.

CUSIP no: Owner’s date of death: Joint Owner’s information

If you are reporting a security, indicate the CUSIP Indicate the owner’s date of death (if known). Enter additional owner’s information, please

number. If you are reporting a bond, indicate the follow procedures on step 8.

CUSIP, bond number, and any coupon numbers.

It is imperative that ALL pertinent property fields described above are thoroughly completed. This will aid in the location

and identification of the correct owner.

Arizona Unclaimed Property Reporting Manual