Enlarge image

UC-522-FF (12-18) ARIZONA DEPARTMENT OF ECONOMIC SECURITY Page 1 of 2

Employer Engagement Administration

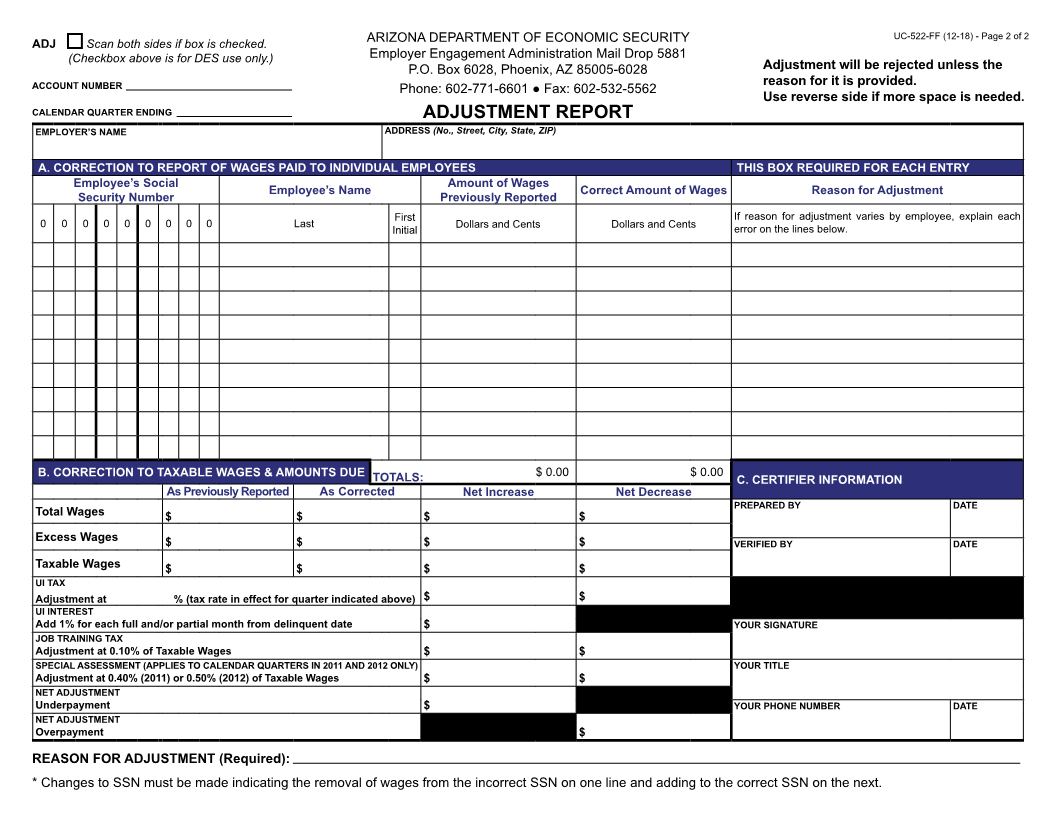

ADJUSTMENT REPORT

Use this form if you need to make corrections to a previously submitted Unemployment Tax and Wage Report

(UC-018).

INSTRUCTIONS:

Section A:

Document the Social Security Number, Name and Wage Information of each worker for which wages must be

corrected.

VERY IMPORTANT: Provide the reason for the adjustment (if more space is needed, continue the expla-

nation on the reverse side of the form after printing it). Your adjustment report will be rejected without

this information.

If only changes to Social Security Numbers are being made, you do not need to complete section.

Section B:

Do not complete this section if only making corrections to Social Security Numbers, not wages.

Section C:

Unsigned requests will be rejected.

If you have questions about completing this form or adjusting wage reports, contact the UI Tax Section at:

Arizona Department of Economic Security

Unemployment Tax – Mail Drop 5881

Accounting Unit

P.O. Box 6028

Phoenix, AZ 85005-6028

Telephone: (602) 771-6601

Fax: (602) 532-5562

Email: UITAccounting@azdes.gov

For faster processing, please submit your Adjustment Report via email at the email address above.

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the

Americans with Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of

1975, and Title II of the Genetic Information Nondiscrimination Act (GINA) of 2008; the Department prohibits discrimination in

admissions, programs, services, activities, or employment based on race, color, religion, sex, national origin, age, disability,

genetics and retaliation. To request this document in alternative format or for further information about this policy, Contact

the UI Tax Office at 602-771-6606; TTY/TDD Services: 7-1-1. • Free language assistance for DES services is available upon

request. Ayuda gratuita con traducciones relacionadas con los servicios del DES esta disponible a solicitud del cliente.