- 2 -

Enlarge image

|

UC-247 (10/06)UC-247 (8/99)

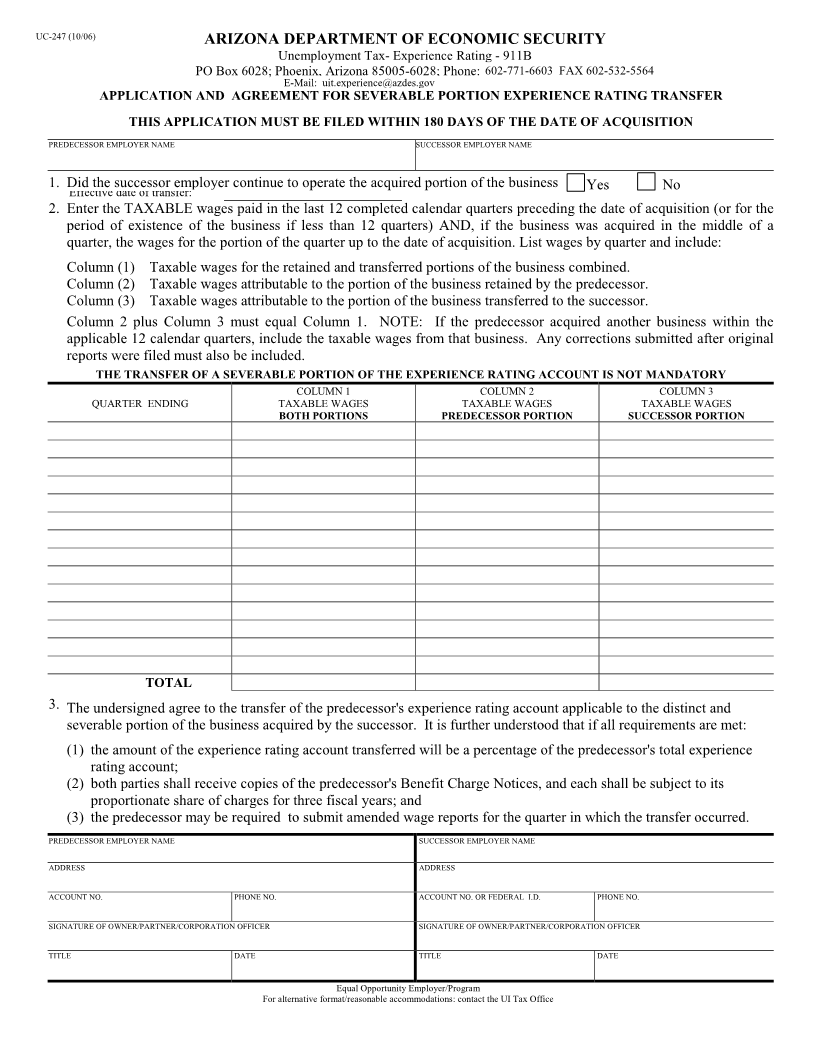

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Unemployment Tax- Experience Rating - 911B

PO Box 6028; Phoenix, Arizona 85005-6028; Phone: 602-248-9101 Ext. 5501602-771-6603 FAX 602-532-5564

E-Mail: uit.experience@azdes.gov

APPLICATION AND AGREEMENT FOR SEVERABLE PORTION EXPERIENCE RATING TRANSFER

THIS APPLICATION MUST BE FILED WITHIN 180 DAYS OF THE DATE OF ACQUISITION

PREDECESSOR EMPLOYER NAME SUCCESSOR EMPLOYER NAME

1. Did the successor employer continue to operate the acquired portion of the business ! Yes ! No

Effective date of transfer:

2. Enter the TAXABLE wages paid in the last 12 completed calendar quarters preceding the date of acquisition (or for the

period of existence of the business if less than 12 quarters) AND, if the business was acquired in the middle of a

quarter, the wages for the portion of the quarter up to the date of acquisition. List wages by quarter and include:

Column (1) Taxable wages for the retained and transferred portions of the business combined.

Column (2) Taxable wages attributable to the portion of the business retained by the predecessor.

Column (3) Taxable wages attributable to the portion of the business transferred to the successor.

Column 2 plus Column 3 must equal Column 1. NOTE: If the predecessor acquired another business within the

applicable 12 calendar quarters, include the taxable wages from that business. Any corrections submitted after original

reports were filed must also be included.

THE TRANSFER OF A SEVERABLE PORTION OF THE EXPERIENCE RATING ACCOUNT IS NOT MANDATORY

COLUMN 1 COLUMN 2 COLUMN 3

QUARTER ENDING TAXABLE WAGES TAXABLE WAGES TAXABLE WAGES

BOTH PORTIONS PREDECESSOR PORTION SUCCESSOR PORTION

TOTAL

3. The undersigned agree to the transfer of the predecessor's experience rating account applicable to the distinct and

severable portion of the business acquired by the successor. It is further understood that if all requirements are met:

(1) the amount of the experience rating account transferred will be a percentage of the predecessor's total experience

rating account;

(2) both parties shall receive copies of the predecessor's Benefit Charge Notices, and each shall be subject to its

proportionate share of charges for three fiscal years; and

(3) the predecessor may be required to submit amended wage reports for the quarter in which the transfer occurred.

PREDECESSOR EMPLOYER NAME SUCCESSOR EMPLOYER NAME

ADDRESS ADDRESS

ACCOUNT NO. PHONE NO. ACCOUNT NO. OR FEDERAL I.D. PHONE NO.

SIGNATURE OF OWNER/PARTNER/CORPORATION OFFICER SIGNATURE OF OWNER/PARTNER/CORPORATION OFFICER

TITLE DATE TITLE DATE

Equal Opportunity Employer/Program

For alternative format/reasonable accommodations: contact the UI Tax Office

|