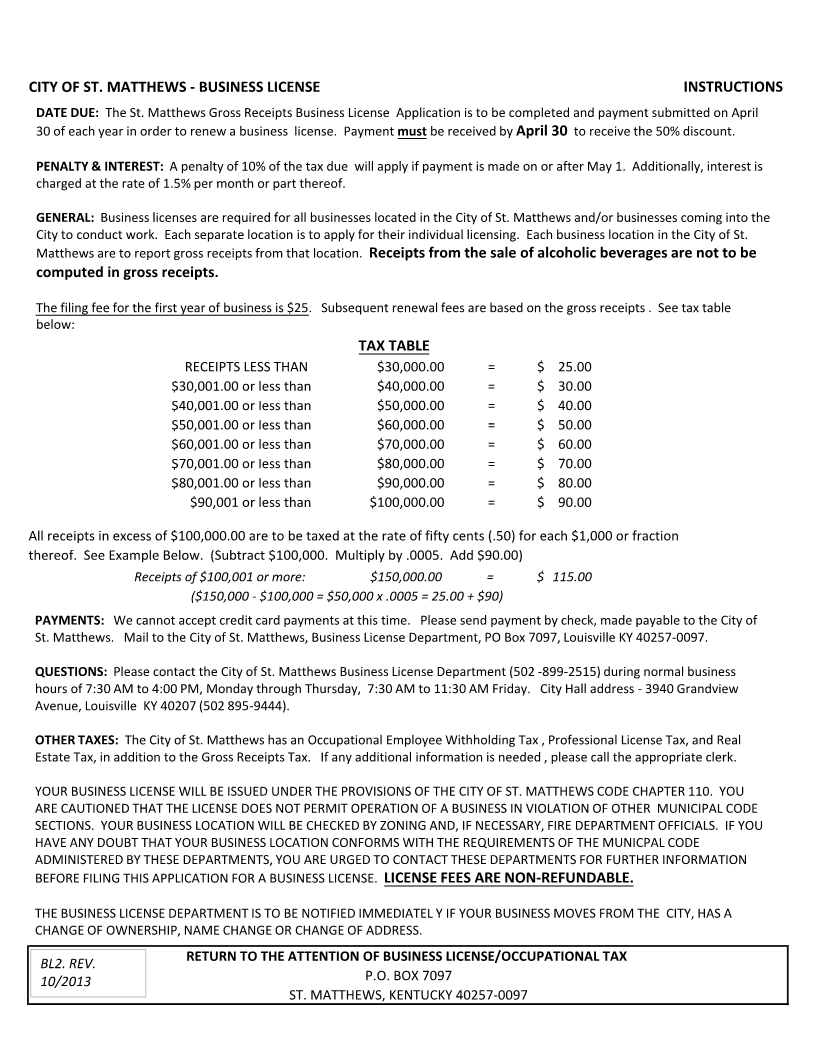

Enlarge image

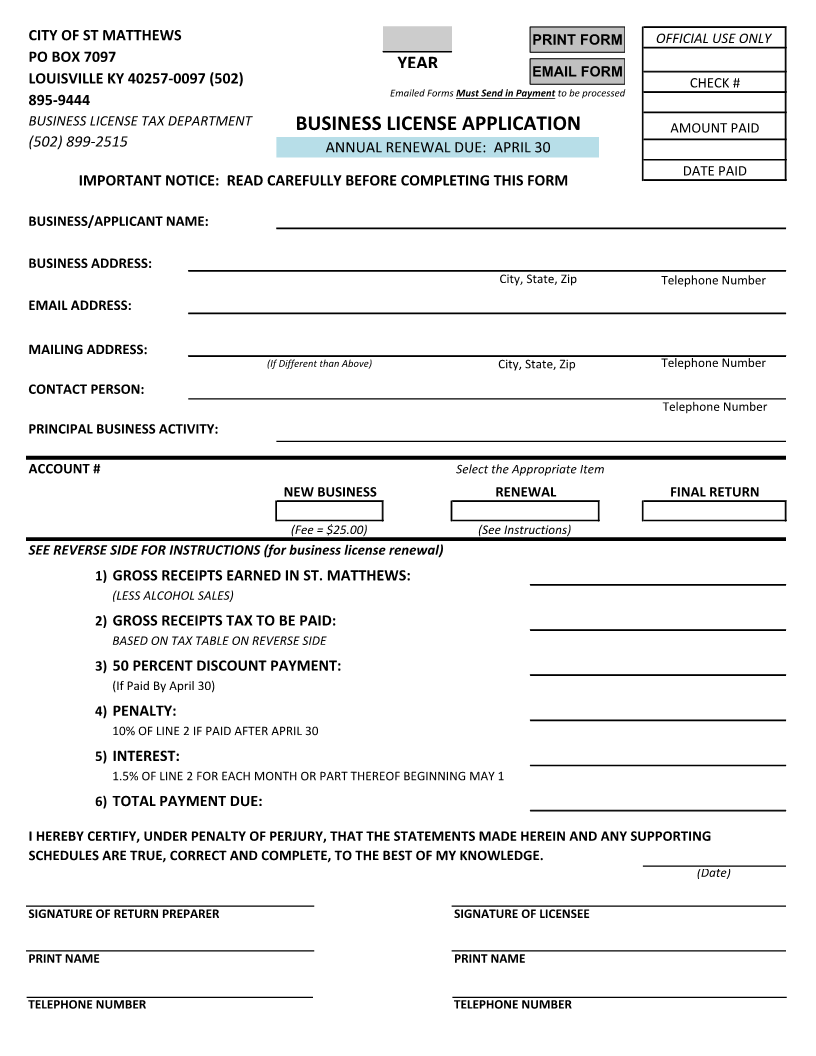

CITY OF ST MATTHEWS PRINT FORM OFFICIAL USE ONLY

PO BOX 7097

YEAR EMAIL FORM

LOUISVILLE KY 40257-0097 (502) CHECK #

Emailed Forms Must Send in Payment to be processed

895-9444

BUSINESS LICENSE TAX DEPARTMENT BUSINESS LICENSE APPLICATION

AMOUNT PAID

(502) 899-2515 ANNUAL RENEWAL DUE: APRIL 30

DATE PAID

IMPORTANT NOTICE: READ CAREFULLY BEFORE COMPLETING THIS FORM

BUSINESS/APPLICANT NAME:

BUSINESS ADDRESS:

City, State, Zip Telephone Number

EMAIL ADDRESS:

MAILING ADDRESS:

(If Different than Above) City, State, Zip Telephone Number

CONTACT PERSON:

Telephone Number

PRINCIPAL BUSINESS ACTIVITY:

ACCOUNT # Select the Appropriate Item

NEW BUSINESS RENEWAL FINAL RETURN

(Fee = $25.00) (See Instructions)

SEE REVERSE SIDE FOR INSTRUCTIONS (for business license renewal)

1) GROSS RECEIPTS EARNED IN ST. MATTHEWS:

(LESS ALCOHOL SALES)

2) GROSS RECEIPTS TAX TO BE PAID:

BASED ON TAX TABLE ON REVERSE SIDE

3) 50 PERCENT DISCOUNT PAYMENT:

(If Paid By April 30)

4) PENALTY:

10% OF LINE 2 IF PAID AFTER APRIL 30

5) INTEREST:

1.5% OF LINE 2 FOR EACH MONTH OR PART THEREOF BEGINNING MAY 1

6) TOTAL PAYMENT DUE:

I HEREBY CERTIFY, UNDER PENALTY OF PERJURY, THAT THE STATEMENTS MADE HEREIN AND ANY SUPPORTING

SCHEDULES ARE TRUE, CORRECT AND COMPLETE, TO THE BEST OF MY KNOWLEDGE.

(Date)

SIGNATURE OF RETURN PREPARER SIGNATURE OF LICENSEE

PRINT NAME PRINT NAME

TELEPHONE NUMBER TELEPHONE NUMBER