Enlarge image

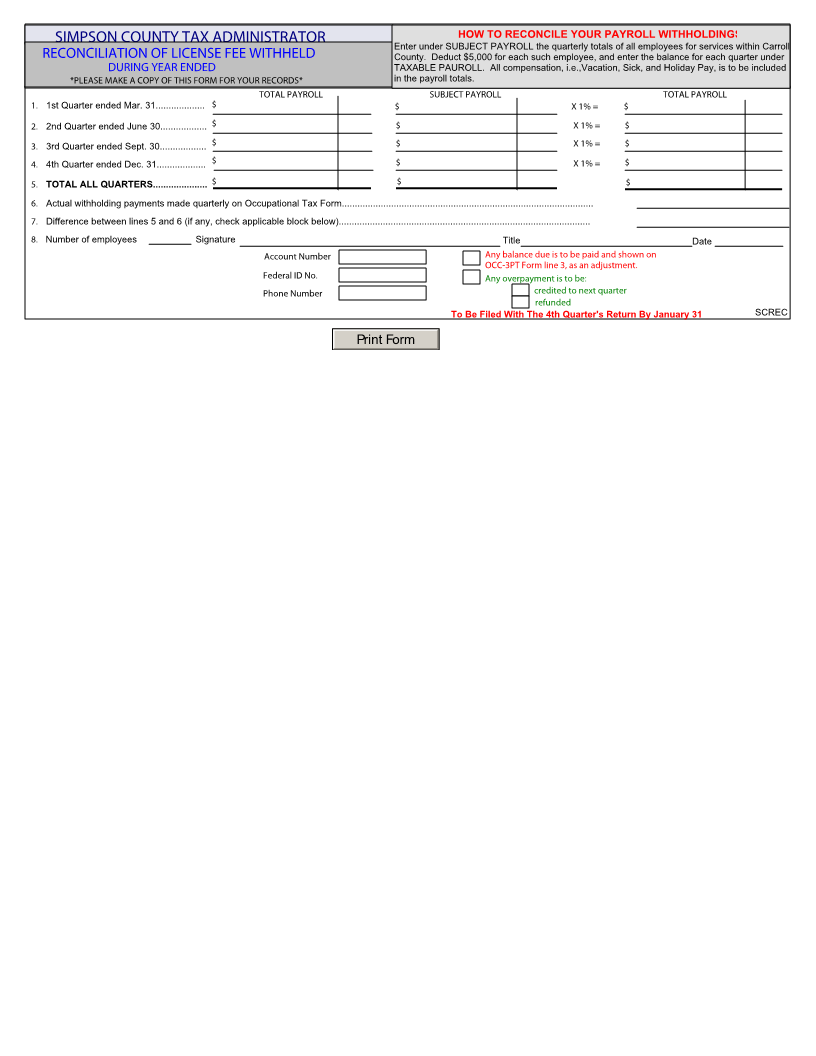

SIMPSON COUNTY TAX ADMINISTRATOR HOW TO RECONCILE YOUR PAYROLL WITHHOLDINGS

Enter under SUBJECT PAYROLL the quarterly totals of all employees for services within Carroll

RECONCILIATION OF LICENSE FEE WITHHELD County. Deduct $5,000 for each such employee, and enter the balance for each quarter under

DURING YEAR ENDED TAXABLE PAUROLL. All compensation, i.e.,Vacation, Sick, and Holiday Pay, is to be included

*PLEASE MAKE A COPY OF THIS FORM FOR YOUR RECORDS* in the payroll totals.

TOTAL PAYROLL SUBJECT PAYROLL TOTAL PAYROLL

1. 1st Quarter ended Mar. 31................... $ $ X 1% = $

2. 2nd Quarter ended June 30.................. $ $ X 1% = $

3. 3rd Quarter ended Sept. 30.................. $ $ X 1% = $

4. 4th Quarter ended Dec. 31................... $ $ X 1% = $

5. TOTAL ALL QUARTERS..................... $ $ $

6. Actual withholding payments made quarterly on Occupational Tax Form.................................................................................................

7. Difference between lines 5 and 6 (if any, check applicable block below).................................................................................................

8. Number of employees Signature Title Date

Account Number Any balance due is to be paid and shown on

OCC-3PT Form line 3, as an adjustment.

Federal ID No. Any overpayment is to be:

Phone Number credited to next quarter

refunded

To Be Filed With The 4th Quarter's Return By January 31 SCREC

Print Form