Enlarge image

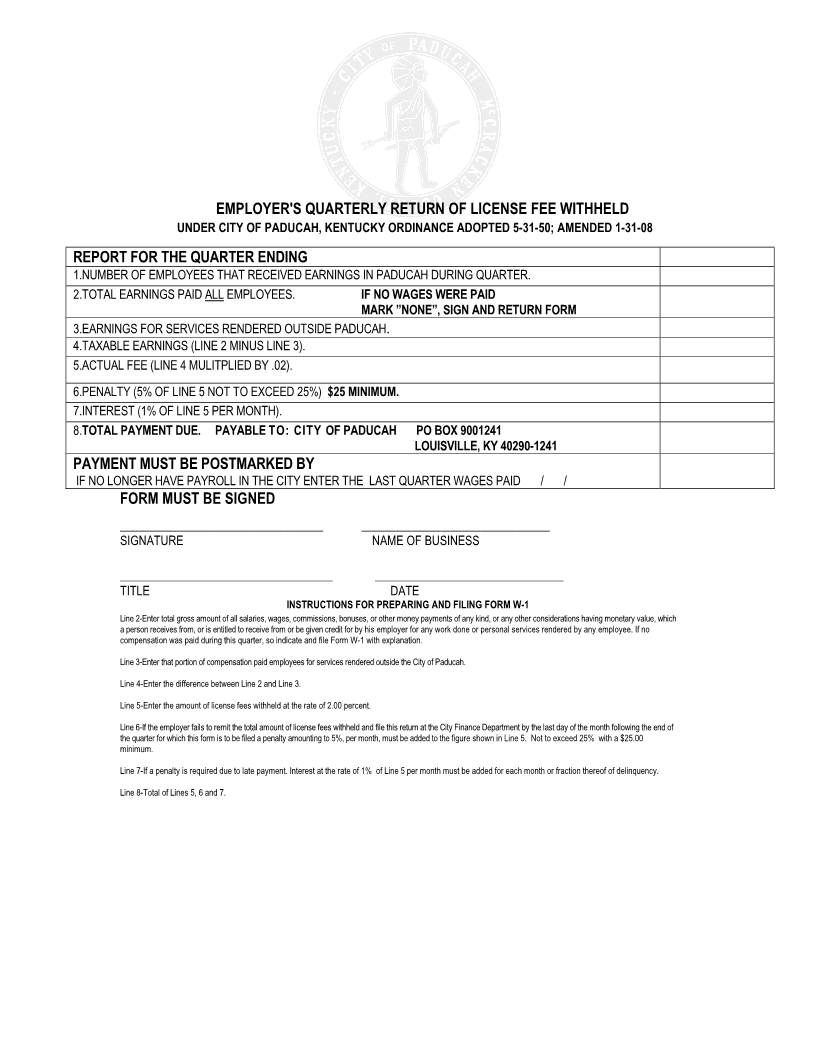

EMPLOYER'S QUARTERLY RETURN OF LICENSE FEE WITHHELD

UNDER CITY OF PADUCAH, KENTUCKY ORDINANCE ADOPTED 5-31-50; AMENDED 1-31-08

REPORT FOR THE QUARTER ENDING

1.NUMBER OF EMPLOYEES THAT RECEIVED EARNINGS IN PADUCAH DURING QUARTER.

2.TOTAL EARNINGS PAID ALL EMPLOYEES. IF NO WAGES WERE PAID

MARK ”NONE”, SIGN AND RETURN FORM

3.EARNINGS FOR SERVICES RENDERED OUTSIDE PADUCAH.

4.TAXABLE EARNINGS (LINE 2 MINUS LINE 3).

5.ACTUAL FEE (LINE 4 MULITPLIED BY .02).

6.PENALTY (5% OF LINE 5 NOT TO EXCEED 25%) $25 MINIMUM.

7.INTEREST (1% OF LINE 5 PER MONTH).

8.TOTAL PAYMENT DUE. PAYABLE TO: CITY OF PADUCAH PO BOX 9001241

LOUISVILLE, KY 40290-1241

PAYMENT MUST BE POSTMARKED BY

IF NO LONGER HAVE PAYROLL IN THE CITY ENTER THE LAST QUARTER WAGES PAID / /

FORM MUST BE SIGNED

_________________________________________ ______________________________________

SIGNATURE NAME OF BUSINESS

___________________________________ _______________________________

TITLE DATE

INSTRUCTIONS FOR PREPARING AND FILING FORM W-1

Line 2-Enter total gross amount of all salaries, wages, commissions, bonuses, or other money payments of any kind, or any other considerations having monetary value, which

a person receives from, or is entitled to receive from or be given credit for by his employer for any work done or personal services rendered by any employee. If no

compensation was paid during this quarter, so indicate and file Form W-1 with explanation.

Line 3-Enter that portion of compensation paid employees for services rendered outside the City of Paducah.

Line 4-Enter the difference between Line 2 and Line 3.

Line 5-Enter the amount of license fees withheld at the rate of 2.00 percent.

Line 6-If the employer fails to remit the total amount of license fees withheld and file this return at the City Finance Department by the last day of the month following the end of

the quarter for which this form is to be filed a penalty amounting to 5%, per month, must be added to the figure shown in Line 5. Not to exceed 25% with a $25.00

minimum.

Line 7-If a penalty is required due to late payment. Interest at the rate of 1% of Line 5 per month must be added for each month or fraction thereof of delinquency.

Line 8-Total of Lines 5, 6 and 7.