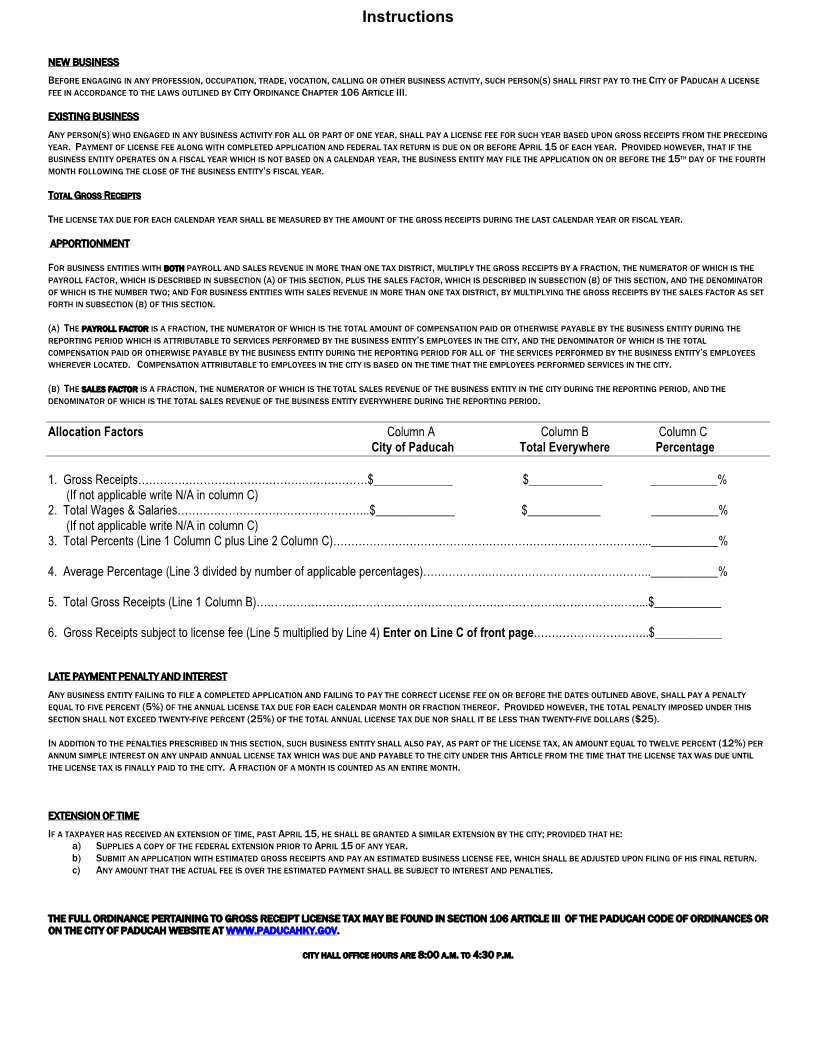

Enlarge image

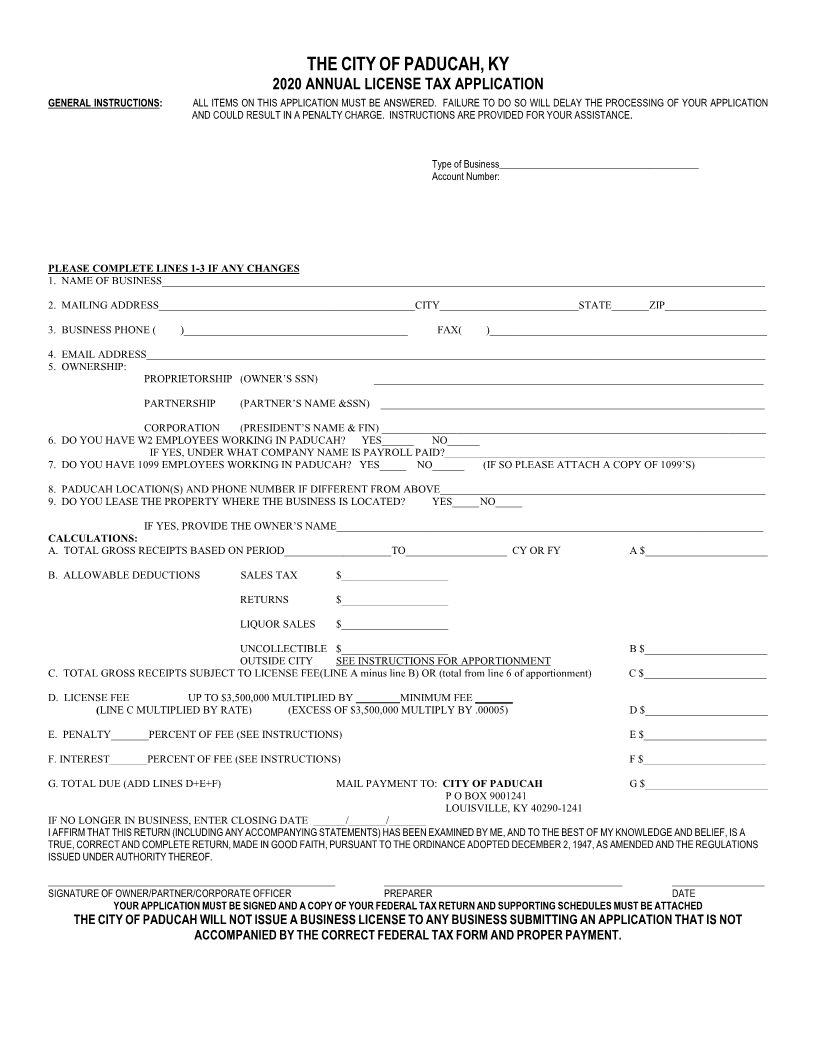

THECITYOFPADUCAH,KY

2020 ANNUAL LICENSE TAX APPLICATION

GENERAL INSTRUCTIONS: ALL ITEMS ON THIS APPLICATION MUST BE ANSWERED. FAILURE TO DO SO WILL DELAY THE PROCESSING OF YOUR APPLICATION

AND COULD RESULT IN A PENALTY CHARGE. INSTRUCTIONS ARE PROVIDED FOR YOUR ASSISTANCE.

Type of Business_________________________________________

Account Number:

PLEASE COMPLETE LINES 1-3 IF ANY CHANGES

1. NAME OF BUSINESS_________________________________________________________________________________________________________________

2. MAILING ADDRESS________________________________________________CITY__________________________STATE_______ZIP___________________

3. BUSINESS PHONE ( )__________________________________________ FAX( )____________________________________________________

4. EMAIL ADDRESS____________________________________________________________________________________________________________________

5. OWNERSHIP:

PROPRIETORSHIP (OWNER’S SSN) _________________________________________________________________________

PARTNERSHIP (PARTNER’S NAME &SSN) ________________________________________________________________________

CORPORATION (PRESIDENT’S NAME & FIN) ________________________________________________________________________

6. DO YOU HAVE W2 EMPLOYEES WORKING IN PADUCAH? YES______ NO______

IF YES, UNDER WHAT COMPANY NAME IS PAYROLL PAID?____________________________________________________________

7. DO YOU HAVE 1099 EMPLOYEES WORKING IN PADUCAH? YES_____ NO______ (IF SO PLEASE ATTACH A COPY OF 1099’S)

8. PADUCAH LOCATION(S) AND PHONE NUMBER IF DIFFERENT FROM ABOVE_____________________________________________________________

9. DO YOU LEASE THE PROPERTY WHERE THE BUSINESS IS LOCATED? YES_____ NO_____

IF YES, PROVIDE THE OWNER’S NAME________________________________________________________________________________

CALCULATIONS:

A. TOTAL GROSS RECEIPTS BASED ON PERIOD____________________TO___________________ CY OR FY A $_______________________

B. ALLOWABLE DEDUCTIONS SALES TAX $____________________

RETURNS $____________________

LIQUOR SALES $____________________

UNCOLLECTIBLE $____________________ B $_______________________

OUTSIDE CITY SEE INSTRUCTIONS FOR APPORTIONMENT

C. TOTAL GROSS RECEIPTS SUBJECT TO LICENSE FEE(LINE A minus line B) OR (total from line 6 of apportionment) C $_______________________

D. LICENSE FEE UP TO $3,500,000 MULTIPLIED BY MINIMUM FEE _______

(LINE C MULTIPLIED BY RATE) (EXCESS OF $3,500,000 MULTIPLY BY .00005) D $_______________________

E. PENALTY_______PERCENT OF FEE (SEE INSTRUCTIONS) E $_______________________

F. INTEREST_______PERCENT OF FEE (SEE INSTRUCTIONS) F $_______________________

G. TOTAL DUE (ADD LINES D+E+F) MAIL PAYMENT TO: CITY OF PADUCAH G $_______________________

P O BOX 9001241

LOUISVILLE, KY 40290-1241

IF NO LONGER IN BUSINESS, ENTER CLOSING DATE ______/_______/_______

IAFFIRMTHATTHISRETURN(INCLUDINGANYACCOMPANYINGSTATEMENTS)HASBEENEXAMINEDBYME,ANDTOTHEBESTOFMYKNOWLEDGEANDBELIEF,ISA

TRUE,CORRECTANDCOMPLETERETURN,MADEINGOODFAITH,PURSUANTTOTHEORDINANCEADOPTEDDECEMBER2,1947,ASAMENDEDANDTHEREGULATIONS

ISSUEDUNDERAUTHORITYTHEREOF.

___________________________________________________________ _________________________________________________ ___________________

SIGNATUREOFOWNER/PARTNER/CORPORATEOFFICER PREPARER DATE

YOURAPPLICATIONMUSTBESIGNEDANDACOPYOFYOURFEDERALTAXRETURNANDSUPPORTINGSCHEDULESMUSTBEATTACHED

THECITYOFPADUCAHWILLNOTISSUEABUSINESSLICENSETOANYBUSINESSSUBMITTINGANAPPLICATIONTHATISNOT

ACCOMPANIEDBYTHECORRECTFEDERALTAXFORMANDPROPERPAYMENT.