Enlarge image

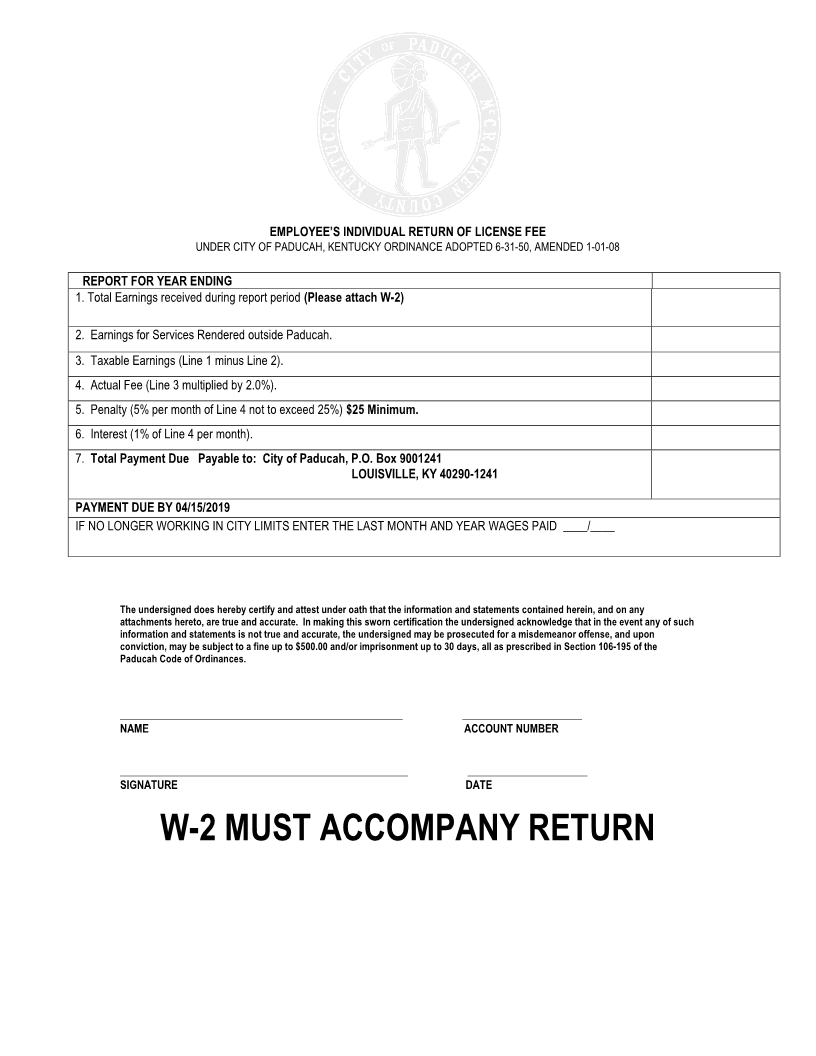

EMPLOYEE’S INDIVIDUAL RETURN OF LICENSE FEE

UNDER CITY OF PADUCAH, KENTUCKY ORDINANCE ADOPTED 6-31-50, AMENDED 1-01-08

REPORT FOR YEAR ENDING

1. Total Earnings received during report period (Please attach W-2)

2. Earnings for Services Rendered outside Paducah.

3. Taxable Earnings (Line 1 minus Line 2).

4. Actual Fee (Line 3 multiplied by 2.0%).

5. Penalty (5% per month of Line 4 not to exceed 25%) $25 Minimum.

6. Interest (1% of Line 4 per month).

7. Total Payment Due Payable to: City of Paducah, P.O. Box 9001241

LOUISVILLE, KY 40290-1241

PAYMENT DUE BY 04/15/2019

IF NO LONGER WORKING IN CITY LIMITS ENTER THE LAST MONTH AND YEAR WAGES PAID ____/____

The undersigned does hereby certify and attest under oath that the information and statements contained herein, and on any

attachments hereto, are true and accurate. In making this sworn certification the undersigned acknowledge that in the event any of such

information and statements is not true and accurate, the undersigned may be prosecuted for a misdemeanor offense, and upon

conviction, may be subject to a fine up to $500.00 and/or imprisonment up to 30 days, all as prescribed in Section 106-195 of the

Paducah Code of Ordinances.

____________________________________________________ ______________________

NAME ACCOUNT NUMBER

_____________________________________________________ ______________________

SIGNATURE DATE

W-2 MUST ACCOMPANY RETURN