Enlarge image

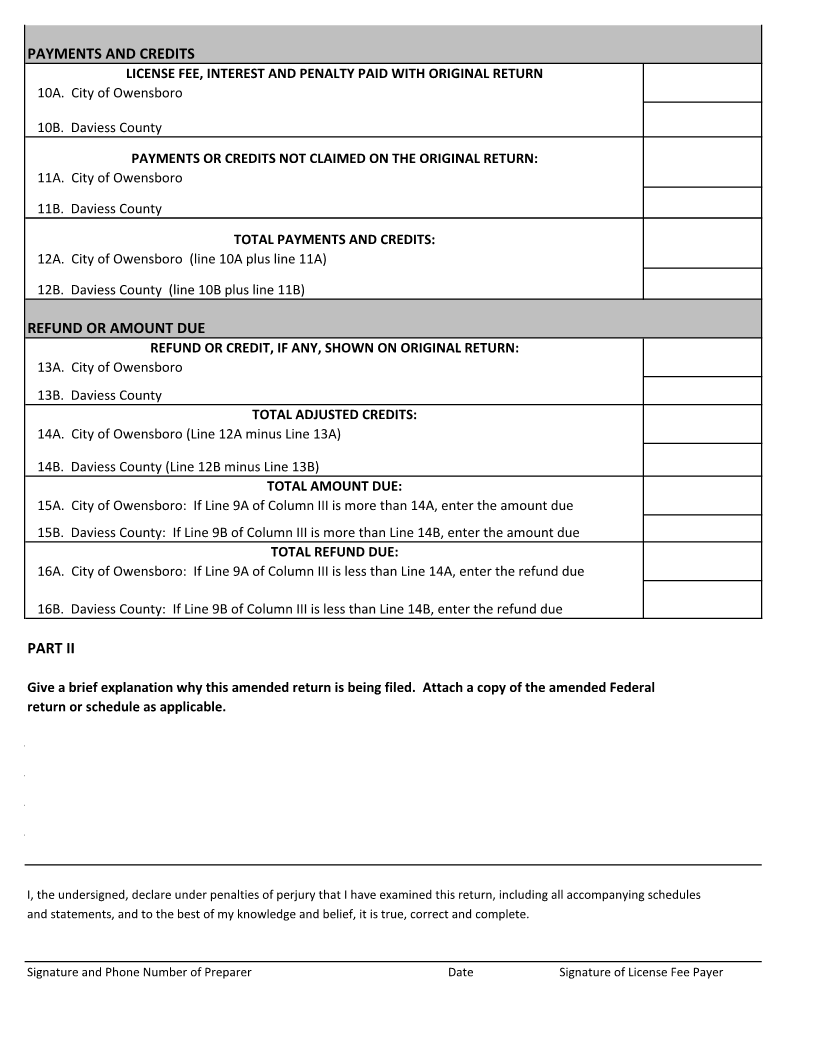

CITY OF OWENSBORO AND DAVIESS COUNTY FISCAL COURT

AMENDED NET PROFIT LICENSE FEE RETURN

Business Name Account Number

Business Address Business Telephone

Period Ending

PART I

As Originally Net Change

LICENSE FEE DUE Reported or Adjusted Increase or Decrease Correct Amount

TOTAL NET PROFIT FROM PART I:

1A. City of Owensboro

1B. Daviess County

PRE-APPORTIONMENT ADJUSTMENTS:

2A. City of Owensboro

2B. Daviess County

ADJUSTED NET PROFIT:

3A. City of Owensboro (Line 1A plus Line 2A)

3B. Daviess County (Line 1B plus Line 2B)

BUSINESS APPORTIONMENT: (PART II)

4A. City of Owensboro

4B. Daviess County

TAXABLE NET PROFIT:

5A. City of Owensboro (line 3A X line 4A)

5B. Daviess County (line 3B X line 4B)

LICENSE FEE DUE:

6A. City of Owensboro (see table A in instructions)

6B. Daviess County (see applicable table)

PENALTY: (5% per calendar month not to exceed 25%,

$25 MINIMUM)

7A. City of Owensboro

7B. Daviess County

INTEREST: (1% per calendar month or fraction thereof)

8A. City of Owensboro

8B. Daviess County

TOTAL AMOUNT DUE:

9A. City of Owensboro (Add lines 6A, 7A and 8A)

9B. Daviess County (Add lines 6B, 7B and 8B)