- 4 -

Enlarge image

|

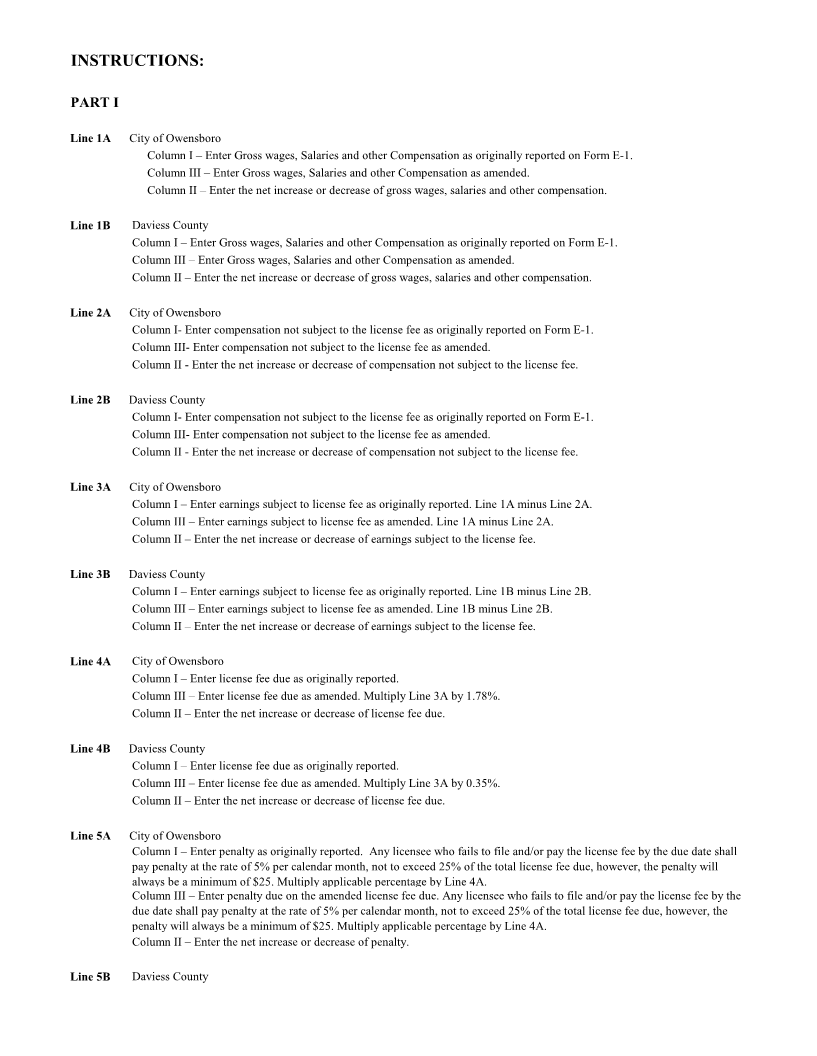

Column I – Enter penalty as originally reported. Any licensee who fails to file and/or pay the license fee by the due date shall

pay penalty at the rate of 5% per calendar month, not to exceed 25% of the total license fee due, however, the penalty will

always be a minimum of $25. Multiply applicable percentage by Line 4B.

Column III – Enter penalty due on the amended license fee due. Any licensee who fails to file and/or pay the license fee by the

due date shall pay penalty at the rate of 5% per calendar month, not to exceed 25% of the total license fee due, however, the

penalty will always be a minimum of $25. Multiply applicable percentage by Line 4B.

Column II – Enter the net increase or decrease of penalty.

Line 6A City of Owensboro

Column I – Enter interest as originally reported. Any licensee who fails to pay the license fee by the due date shall pay interest

at the rate of 1% per calendar month, or fraction thereof, of any license fee due. Multiply Line 4A by applicable percentage.

Column III – Enter interest due on the amended license fee due. Any licensee who fails to pay the license fee by the due date

shall pay interest at the rate of 1% per calendar month, or fraction thereof, of any license fee due. Multiply Line 4A by

applicable percentage.

Column II – Enter the net increase or decrease of interest.

Line 6B Daviess County

Column I – Enter interest as originally reported. Any licensee who fails to pay the license fee by the due date shall pay interest

at the rate of 1% per calendar month, or fraction thereof, of any license fee due. Multiply Line 4B by applicable percentage.

Column III – Enter interest due on the amended license fee due. Any licensee who fails to pay the license fee by the due date

shall pay interest at the rate of 1% per calendar month, or fraction thereof, of any license fee due. Multiply Line 4B by

applicable percentage.

Column II – Enter the net increase or decrease of interest.

Line 7A City of Owensboro

Column I – Enter total amount due as originally reported. Add Lines 4A, 5A and 6A.

Column III – Enter total amount due as amended. Add Lines 4A, 5A and 6A.

Column II – Enter the net increase or decrease of the total amount due.

Line 7B Daviess County

Column I – Enter total amount due as originally reported. Add Lines 4B, 5B and 6B.

Column III – Enter total amount due as amended. Add Lines 4B, 5B and 6B.

Column II – Enter the net increase or decrease of the total amount due.

Line 8A City of Owensboro – Enter the amount of license fee, interest and penalty paid with original return.

Line 8B Daviess County – Enter the amount of license fee, interest and penalty paid with the original return.

Line 9A City of Owensboro – Enter any existing payments or credits not claimed on the original return.

Line 9B Daviess County – Enter any existing payments not claimed on the original return.

Line 10A City of Owensboro – Enter total payments. Line 8A plus Line 9A.

Line 10B Daviess County – Enter total payments. Line 8B plus Line 9B.

Line 11A City of Owensboro – Enter refund, if any, shown on original return.

Line 11B Daviess County – Enter refund, if any, shown on original return.

Line 12A City of Owensboro – Enter adjusted payments. Line 10A minus Line 11A.

Line 12B Daviess County – Enter adjusted payments. Line 10B minus Line 11B.

Line 13A City of Owensboro – If Line 7A of Column III is more than Line 12A, enter the amount due.

|