Enlarge image

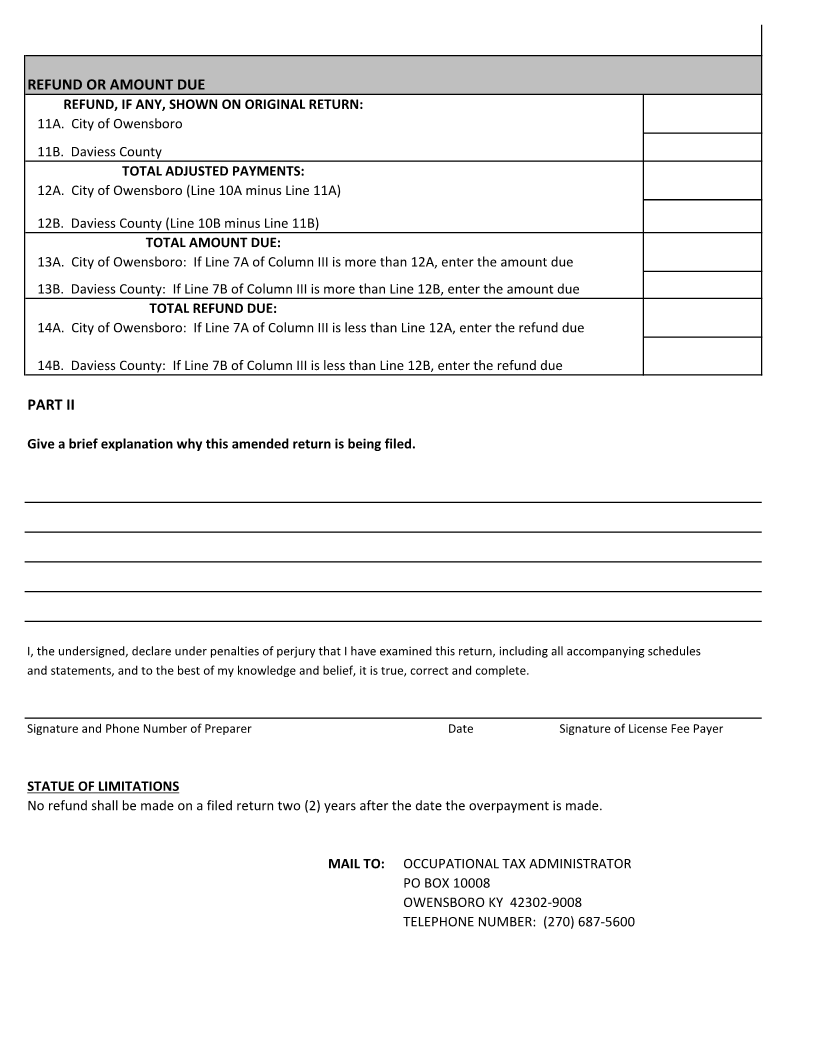

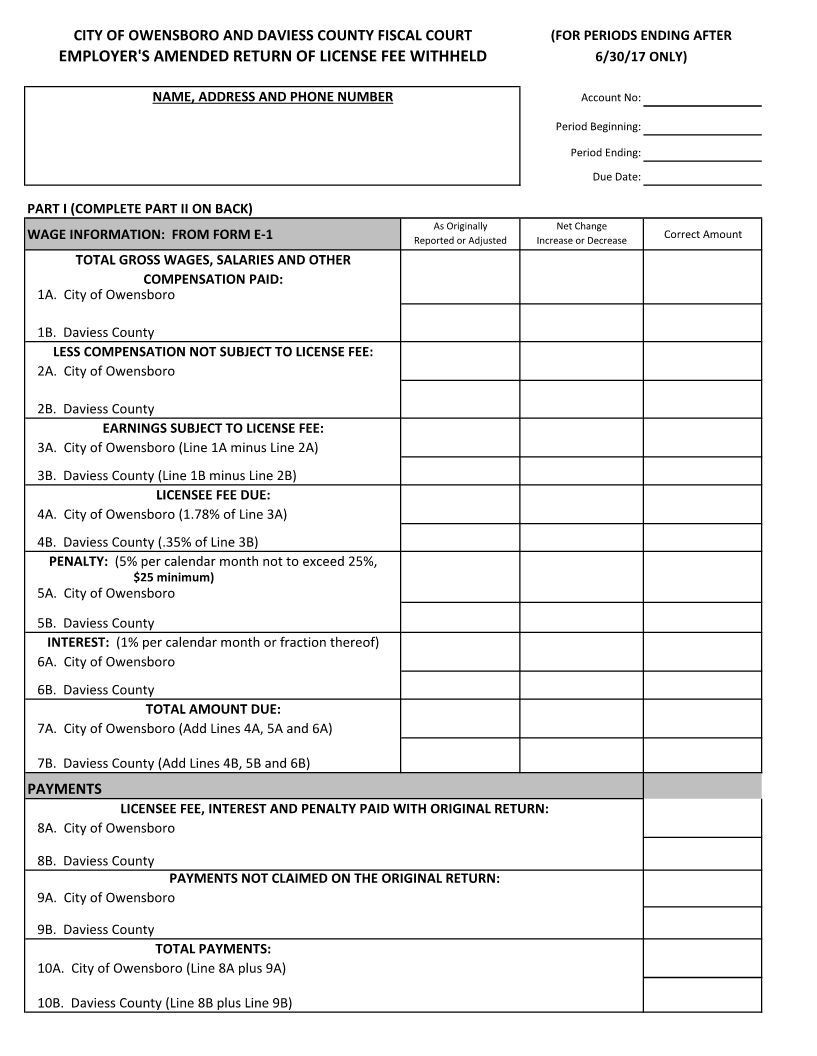

CITY OF OWENSBORO AND DAVIESS COUNTY FISCAL COURT (FOR PERIODS ENDING AFTER

EMPLOYER'S AMENDED RETURN OF LICENSE FEE WITHHELD 6/30/17 ONLY)

NAME, ADDRESS AND PHONE NUMBER Account No:

Period Beginning:

Period Ending:

Due Date:

PART I (COMPLETE PART II ON BACK)

As Originally Net Change

WAGE INFORMATION: FROM FORM E-1 Reported or Adjusted Increase or Decrease Correct Amount

TOTAL GROSS WAGES, SALARIES AND OTHER

COMPENSATION PAID:

1A. City of Owensboro

1B. Daviess County

LESS COMPENSATION NOT SUBJECT TO LICENSE FEE:

2A. City of Owensboro

2B. Daviess County

EARNINGS SUBJECT TO LICENSE FEE:

3A. City of Owensboro (Line 1A minus Line 2A)

3B. Daviess County (Line 1B minus Line 2B)

LICENSEE FEE DUE:

4A. City of Owensboro (1.78% of Line 3A)

4B. Daviess County (.35% of Line 3B)

PENALTY: (5% per calendar month not to exceed 25%,

$25 minimum)

5A. City of Owensboro

5B. Daviess County

INTEREST: (1% per calendar month or fraction thereof)

6A. City of Owensboro

6B. Daviess County

TOTAL AMOUNT DUE:

7A. City of Owensboro (Add Lines 4A, 5A and 6A)

7B. Daviess County (Add Lines 4B, 5B and 6B)

PAYMENTS

LICENSEE FEE, INTEREST AND PENALTY PAID WITH ORIGINAL RETURN:

8A. City of Owensboro

8B. Daviess County

PAYMENTS NOT CLAIMED ON THE ORIGINAL RETURN:

9A. City of Owensboro

9B. Daviess County

TOTAL PAYMENTS:

10A. City of Owensboro (Line 8A plus 9A)

10B. Daviess County (Line 8B plus Line 9B)