Enlarge image

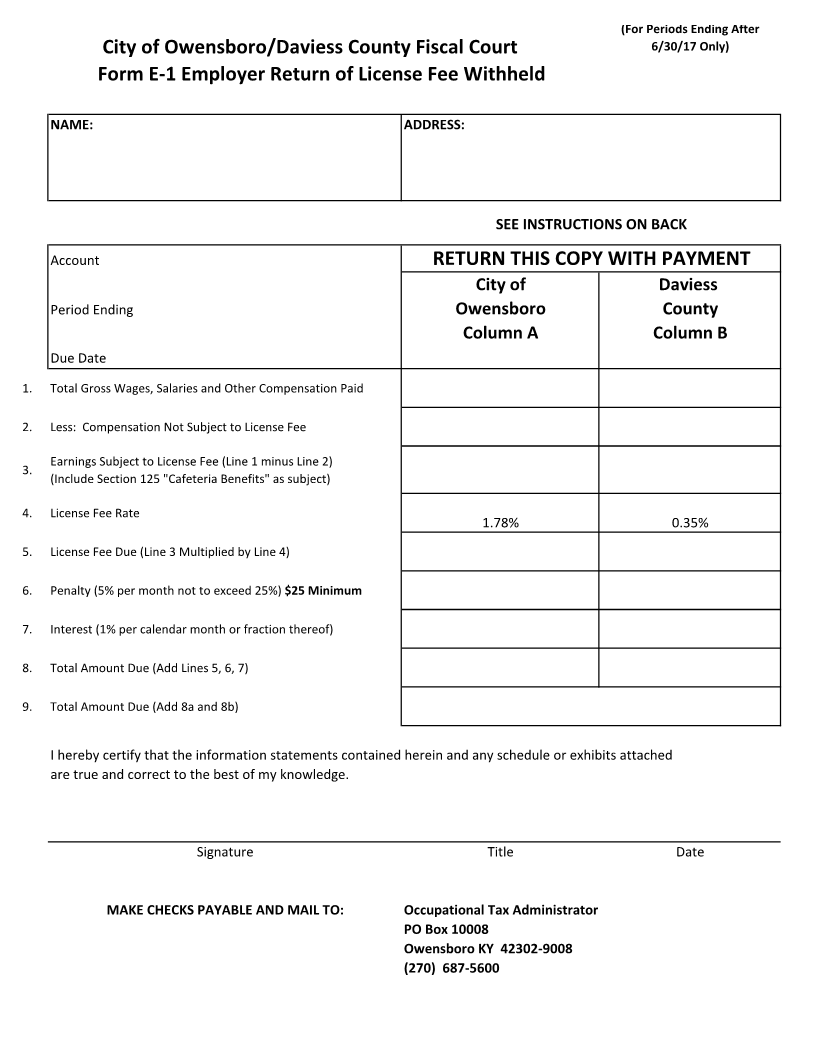

(For Periods Ending After

City of Owensboro/Daviess County Fiscal Court 6/30/17 Only)

Form E-1 Employer Return of License Fee Withheld

NAME: ADDRESS:

SEE INSTRUCTIONS ON BACK

Account RETURN THIS COPY WITH PAYMENT

City of Daviess

Period Ending Owensboro County

Column A Column B

Due Date

1. Total Gross Wages, Salaries and Other Compensation Paid

2. Less: Compensation Not Subject to License Fee

Earnings Subject to License Fee (Line 1 minus Line 2)

3.

(Include Section 125 "Cafeteria Benefits" as subject)

4. License Fee Rate

1.78% 0.35%

5. License Fee Due (Line 3 Multiplied by Line 4)

6. Penalty (5% per month not to exceed 25%) $25 Minimum

7. Interest (1% per calendar month or fraction thereof)

8. Total Amount Due (Add Lines 5, 6, 7)

9. Total Amount Due (Add 8a and 8b)

I hereby certify that the information statements contained herein and any schedule or exhibits attached

are true and correct to the best of my knowledge.

Signature Title Date

MAKE CHECKS PAYABLE AND MAIL TO: Occupational Tax Administrator

PO Box 10008

Owensboro KY 42302-9008

(270) 687-5600