Enlarge image

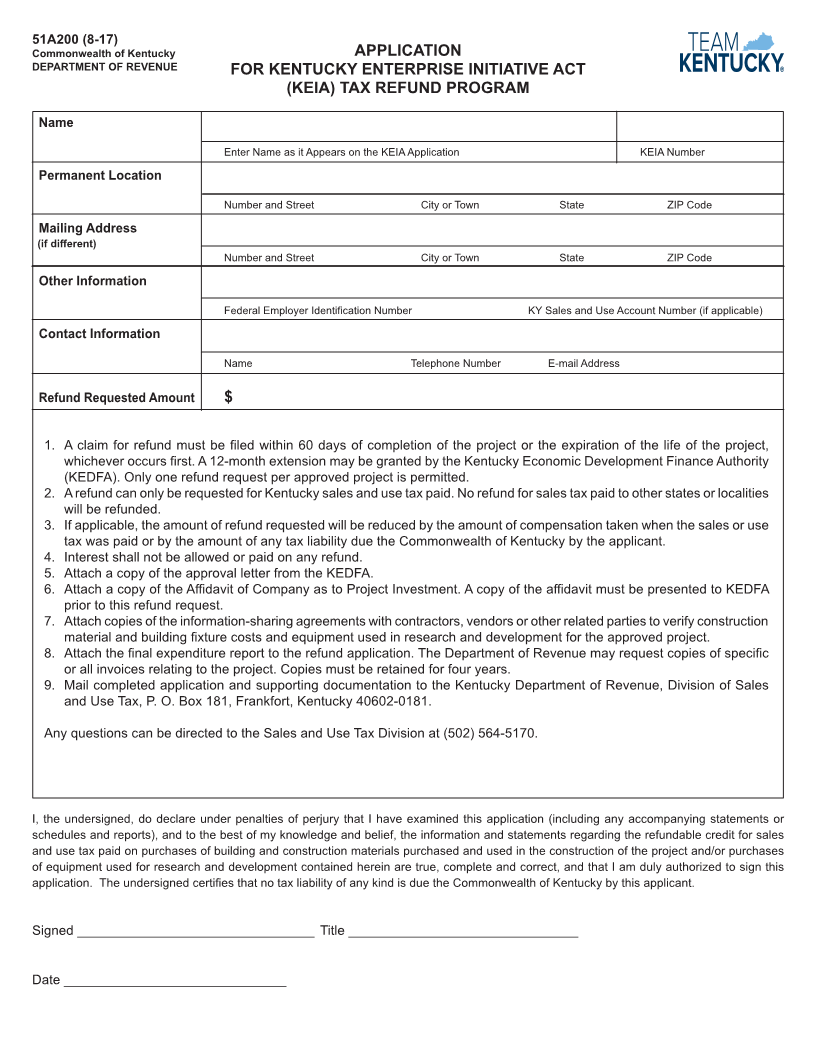

51A200 (8-17) Commonwealth of Kentucky APPLICATION DEPARTMENT OF REVENUE FOR KENTUCKY ENTERPRISE INITIATIVE ACT (KEIA) TAX REFUND PROGRAM Name Enter Name as it Appears on the KEIA Application KEIA Number Permanent Location Number and Street City or Town State ZIP Code Mailing Address (if different) Number and Street City or Town State ZIP Code Other Information Federal Employer Identification Number KY Sales and Use Account Number (if applicable) Contact Information Name Telephone Number E-mail Address Refund Requested Amount $ 1. A claim for refund must be filed within 60 days of completion of the project or the expiration of the life of the project, whichever occurs first. A 12-month extension may be granted by the Kentucky Economic Development Finance Authority (KEDFA). Only one refund request per approved project is permitted. 2. A refund can only be requested for Kentucky sales and use tax paid. No refund for sales tax paid to other states or localities will be refunded. 3. If applicable, the amount of refund requested will be reduced by the amount of compensation taken when the sales or use tax was paid or by the amount of any tax liability due the Commonwealth of Kentucky by the applicant. 4. Interest shall not be allowed or paid on any refund. 5. Attach a copy of the approval letter from the KEDFA. 6. Attach a copy of the Affidavit of Company as to Project Investment. A copy of the affidavit must be presented to KEDFA prior to this refund request. 7. Attach copies of the information-sharing agreements with contractors, vendors or other related parties to verify construction material and building fixture costs and equipment used in research and development for the approved project. 8. Attach the final expenditure report to the refund application. The Department of Revenue may request copies of specific or all invoices relating to the project. Copies must be retained for four years. 9. Mail completed application and supporting documentation to the Kentucky Department of Revenue, Division of Sales and Use Tax, P. O. Box 181, Frankfort, Kentucky 40602-0181. Any questions can be directed to the Sales and Use Tax Division at (502) 564-5170. I, the undersigned, do declare under penalties of perjury that I have examined this application (including any accompanying statements or schedules and reports), and to the best of my knowledge and belief, the information and statements regarding the refundable credit for sales and use tax paid on purchases of building and construction materials purchased and used in the construction of the project and/or purchases of equipment used for research and development contained herein are true, complete and correct, and that I am duly authorized to sign this application. The undersigned certifies that no tax liability of any kind is due the Commonwealth of Kentucky by this applicant. Signed ________________________________ Title _______________________________ Date ______________________________