Enlarge image

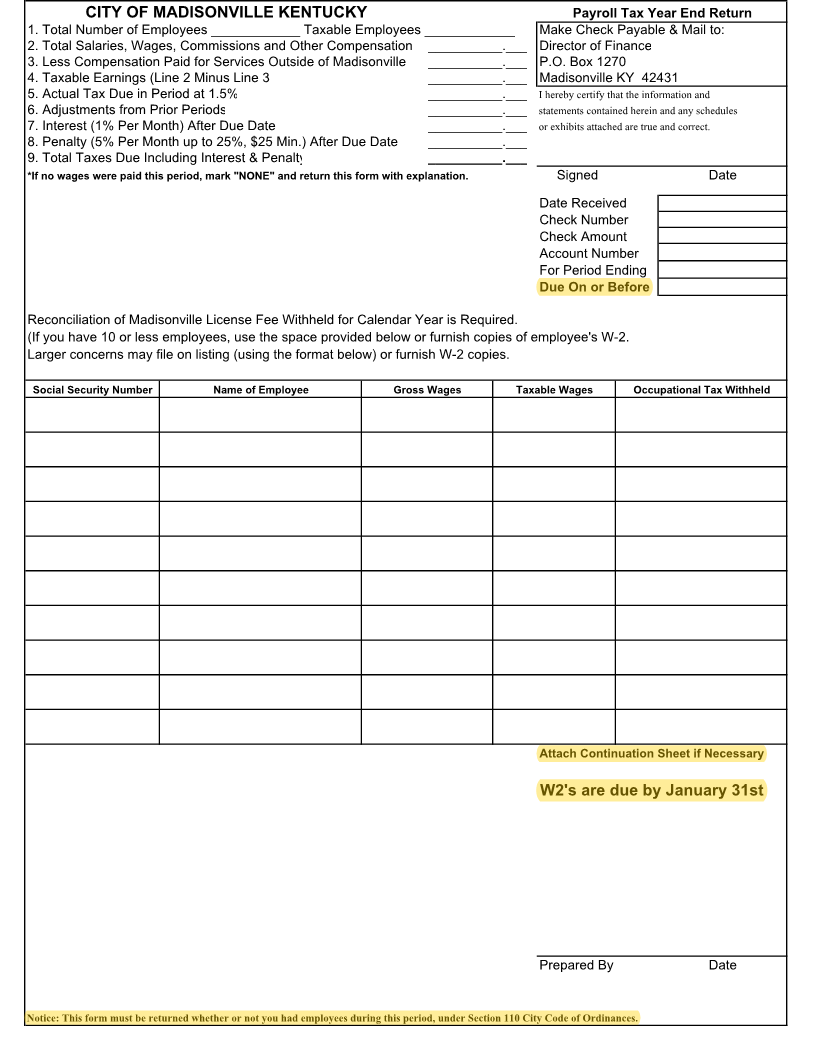

CITY OF MADISONVILLE KENTUCKY Payroll Tax Year End Return 1.Total Number of Employees ____________ Taxable Employees _____________ Make Check Payable & Mail to: 2.Total Salaries, Wages, Commissions and Other Compensation __________.___ Director of Finance 3.Less Compensation Paid for Services Outside of Madisonville __________.___ P.O. Box 1270 4.Taxable Earnings (Line 2 Minus Line 3 __________.___ Madisonville KY 42431 5.Actual Tax Due in Period at 1.5% __________.___ I hereby certify that the information and 6.Adjustments from Prior Periods __________.___ statements contained herein and any schedules 7.Interest (1% Per Month) After Due Date __________.___ or exhibits attached are true and correct. 8.Penalty (5% Per Month up to 25%, $25 Min.) After Due Date __________.___ 9.Total Taxes Due Including Interest & Penalty __________.___ *If no wages were paid this period, mark "NONE" and return this form with explanation. Signed Date Date Received Check Number Check Amount Account Number For Period Ending Due On or Before Reconciliation of Madisonville License Fee Withheld for Calendar Year is Required. (If you have 10 or less employees, use the space provided below or furnish copies of employee's W-2. Larger concerns may file on listing (using the format below) or furnish W-2 copies. Social Security Number Name of Employee Gross Wages Taxable Wages Occupational Tax Withheld Attach Continuation Sheet if Necessary W2's are due by January 31st PreparedBy Date Notice: This form must be returned whether or not you had employees during this period, under Section 110 City Code of Ordinances.